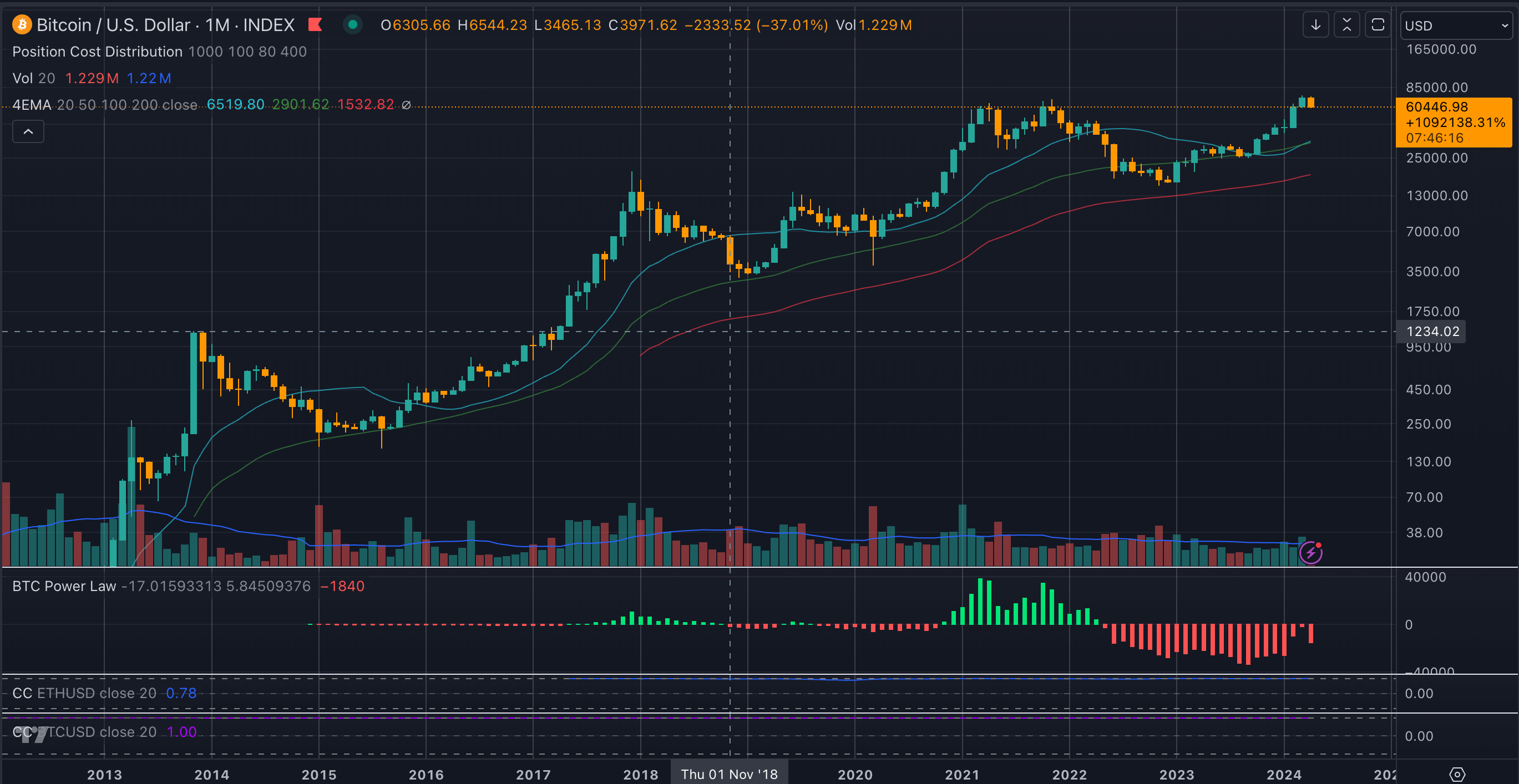

Bitcoin will close April down this evening following a drawdown of roughly 15% since the start of the month. The close of the monthly candle will mark the end of seven successive green candles and the end of a record-making streak.

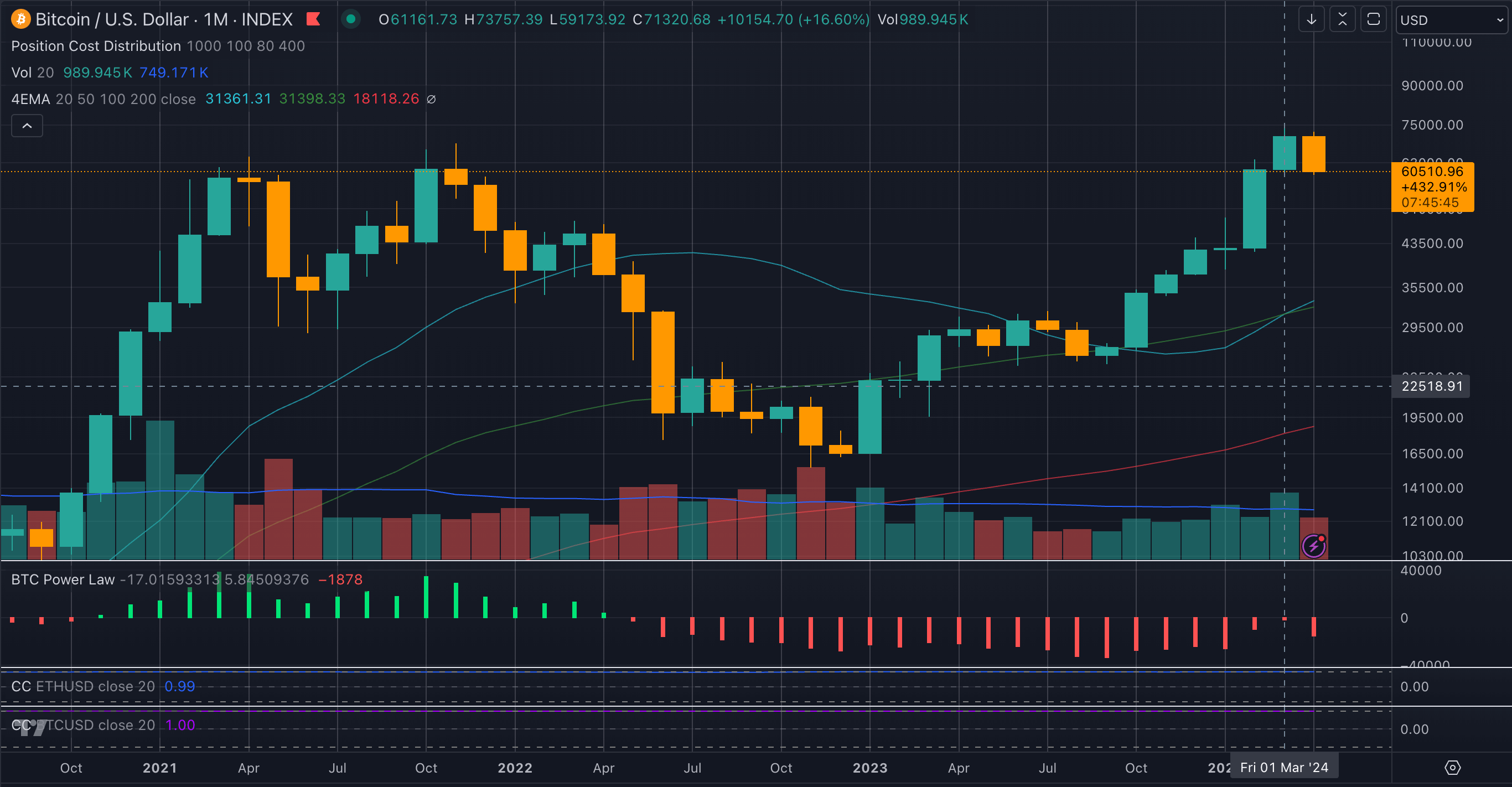

Bitcoin opened the month with a new all-time high for a monthly candle close at around $71,200. The previous high was around $60,500, set in 2021 when Bitcoin traded again as of press time.

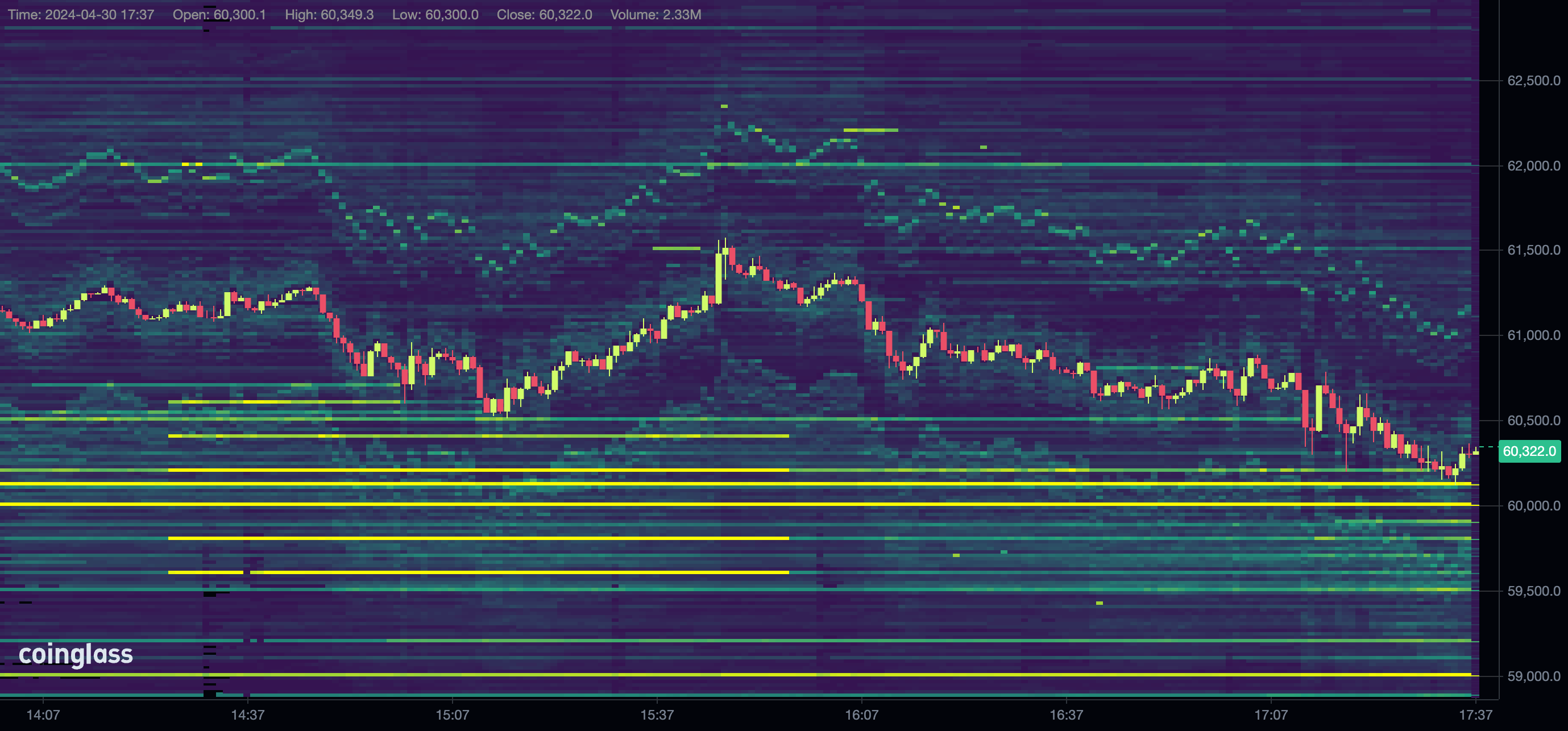

The psychological support of $60,000 is expected to be an essential marker for Bitcoin in the coming week. Sentiment is waning with the reduction of buying pressure from Bitcoin ETFs in the US and the poor opening of Hong Kong ETFs this morning.

In the past 24 hours, there have been over $300 million in crypto liquidations, with the majority coming from long positions at $257 million and just $58 million from shorts, according to Coinglass data.

Further, Binance, the most liquid exchange for Bitcoin trading, shows significant buy walls of around $60,000. Over 1,000 BTC ($60 million) of buy orders are set on the BTC-USDT pair alone, ready to absorb a dip down to that level. However, the overall liquidity within the order book appears relatively low compared to recent times in this bull run.

With Bitcoin sentiment down and no future bullish event on the horizon, price discovery is likely to be led less by optimism about future events and more by the intrinsic value of the Bitcoin network. US ETF approval and launch, the Halving, and now the Hong Kong ETFs have all been done. Bitcoin has seen a meteoric rise throughout the period, with over 90% of holders in profit. Is it time for profit-taking and Bitcoin to retest lower bounds, or will it hold strong at this key historical and psychological monthly support?

The post Bitcoin retraces back to critical monthly all-time high support level from 2021 appeared first on CryptoSlate.