Data suggests the hype around the new Bitcoin Runes has severely dropped, something that’s not a good sign for miner revenues.

Bitcoin Halving Effect Settles In On Miner Revenue As Runes Interest Drops

A few days back, the much-anticipated Bitcoin Halving went through. Halvings are periodic events coded into the blockchain in which the BTC block rewards are cut exactly in half. They occur every four years, and the newest one was the fourth such event.

The block rewards, which the Halvings drastically affect, are one of the two main ways miners make income. Miners receive these rewards as compensation for solving blocks, which have historically also been their dominant revenue source.

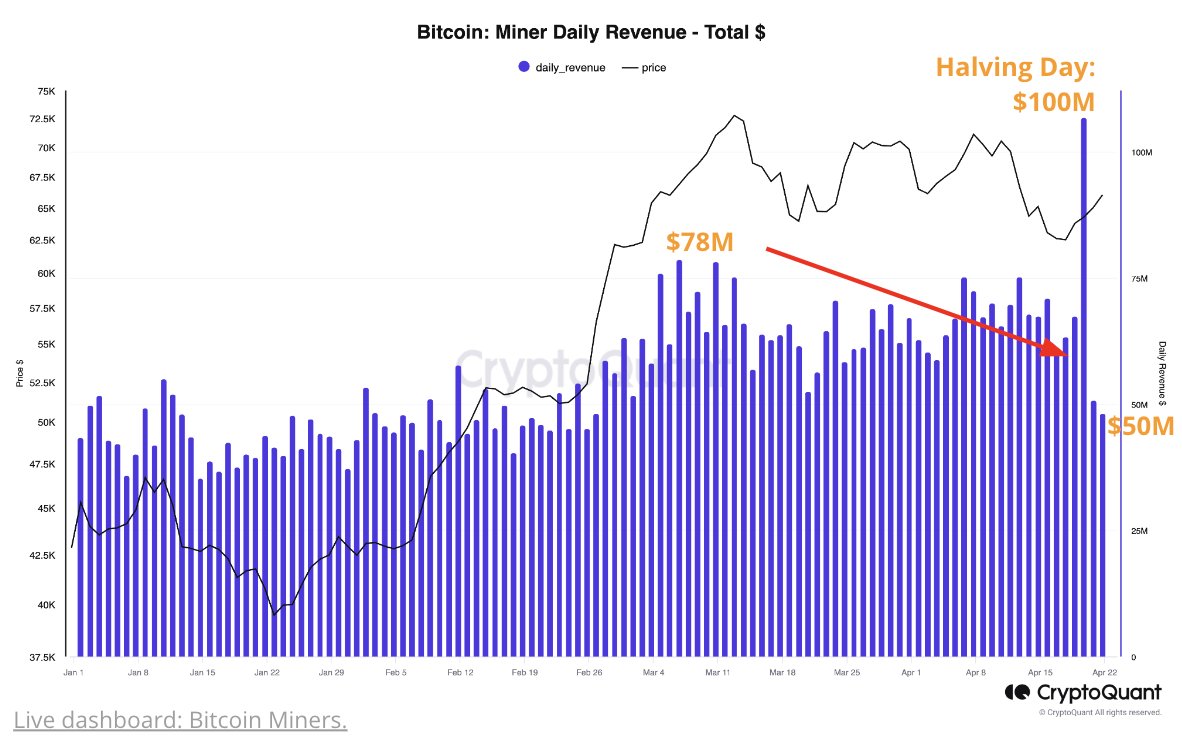

As such, the Halvings can be troublesome for this group’s financials, as their revenue undergoes a significant drop following them. However, shortly after the latest Halving, miner revenues spiked to a record $100 million.

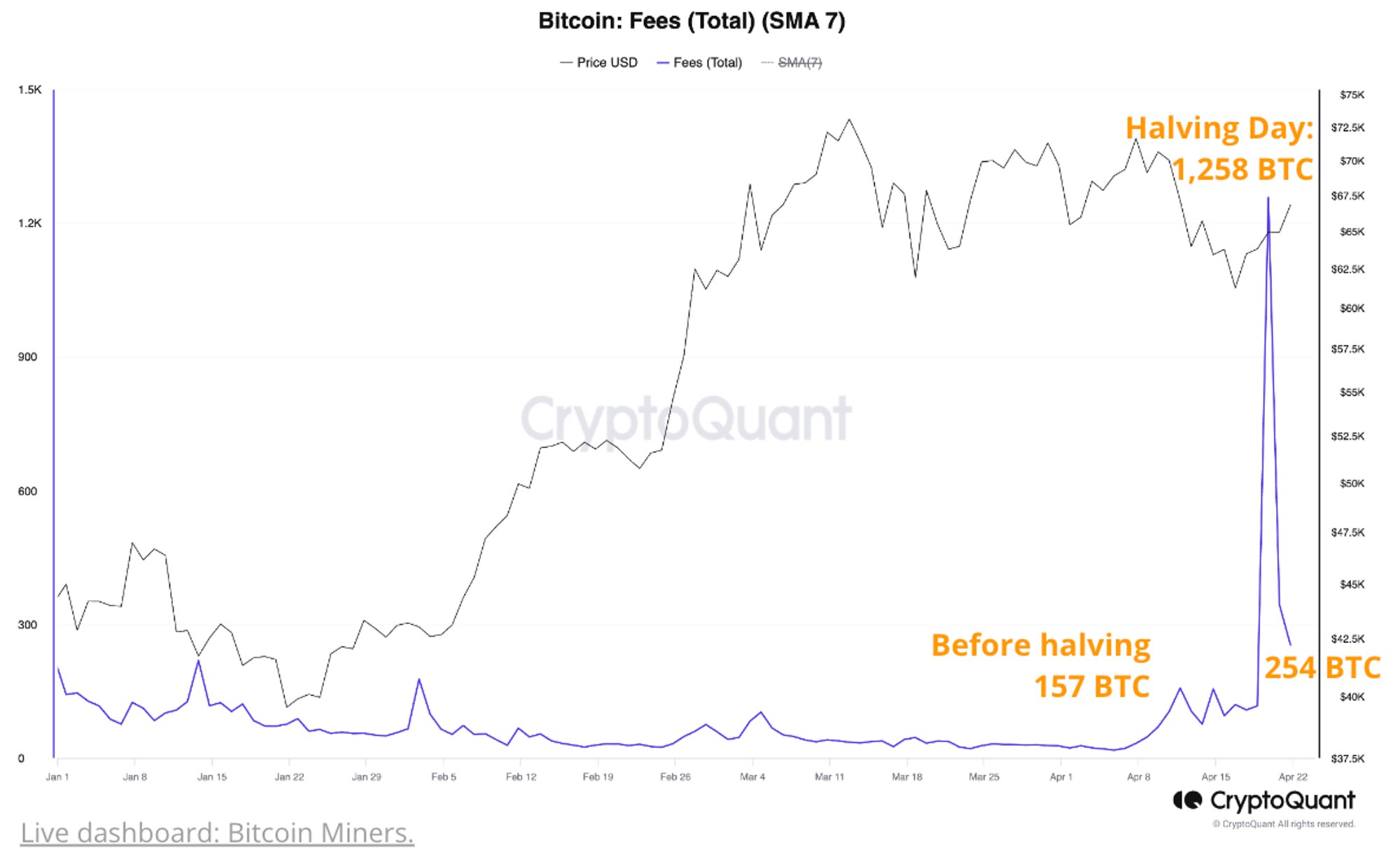

The block rewards were cut in half with the event, but at the same time, their second income stream, the transaction fees, saw an explosion, helping total revenue go up rather than down as may normally be expected.

This spike in fees is due to another major development on the network on Halving Day: the release of the Runes protocol. This protocol provides a way to mint fungible tokens on the Bitcoin blockchain.

Fungible tokens are indistinguishable from each other, just like how individual BTC satoshis (sats) are also generally exactly the same. On the other hand, unique tokens are known as non-fungible tokens (NFTs).

The Runes instantly found popularity among users, and network usage sharply increased. The transaction fee is usually tied to network activity, so it also went up when this new protocol dropped.

This is naturally because in times of high traffic, transfers can get stuck in waiting due to the network’s limited capacity to handle them, so users have no choice but to pay a high fee if they want their moves through quicker.

Data shared by the on-chain analytics firm CryptoQuant shows that the total transaction fees exploded due to the high interest the Runes received upon launch.

The chart also shows that the indicator has cooled off since this extraordinary peak. Thus, while the Runes were quite popular at release, interest in them has already waned.

As a result, Bitcoin mining revenues, which had been extremely high post-Halving, have also fallen.

Bitcoin miner revenue is now down to $50 million, half of the $100 million peak from earlier. Therefore, while the Runes had temporarily placed miners in a comfortable position, that line of support is now gone, and these chain validators are starting to come under pressure.

BTC Price

At the time of writing, Bitcoin is trading at around $63,900, down over 1% in the past seven days.