Data shows the Bitcoin network is currently observing a high amount of adoption. Here’s how other major assets like XRP and Ethereum stack up.

Bitcoin Is Observing High Daily Average Wallet Creation Right Now

In a new post on X, the on-chain analytics firm Santiment has discussed about how the average Network Growth has been like for the top assets in the sector during the past month.

The “Network Growth” here refers to an indicator that measures the total number of new addresses that are being created on a given network every day. An address is said to be generated when it makes its very first transaction.

When the value of this indicator goes up, it can be due to new investors joining the network or old ones who had sold earlier re-investing into it. Existing users creating multiple wallets to distribute their holdings for a purpose like privacy can also naturally add to this trend.

In general, all three of these can be considered to be simultaneously at play to some degree whenever the Network Growth registers a spike, so some net adoption of the cryptocurrency could be assumed to be occurring.

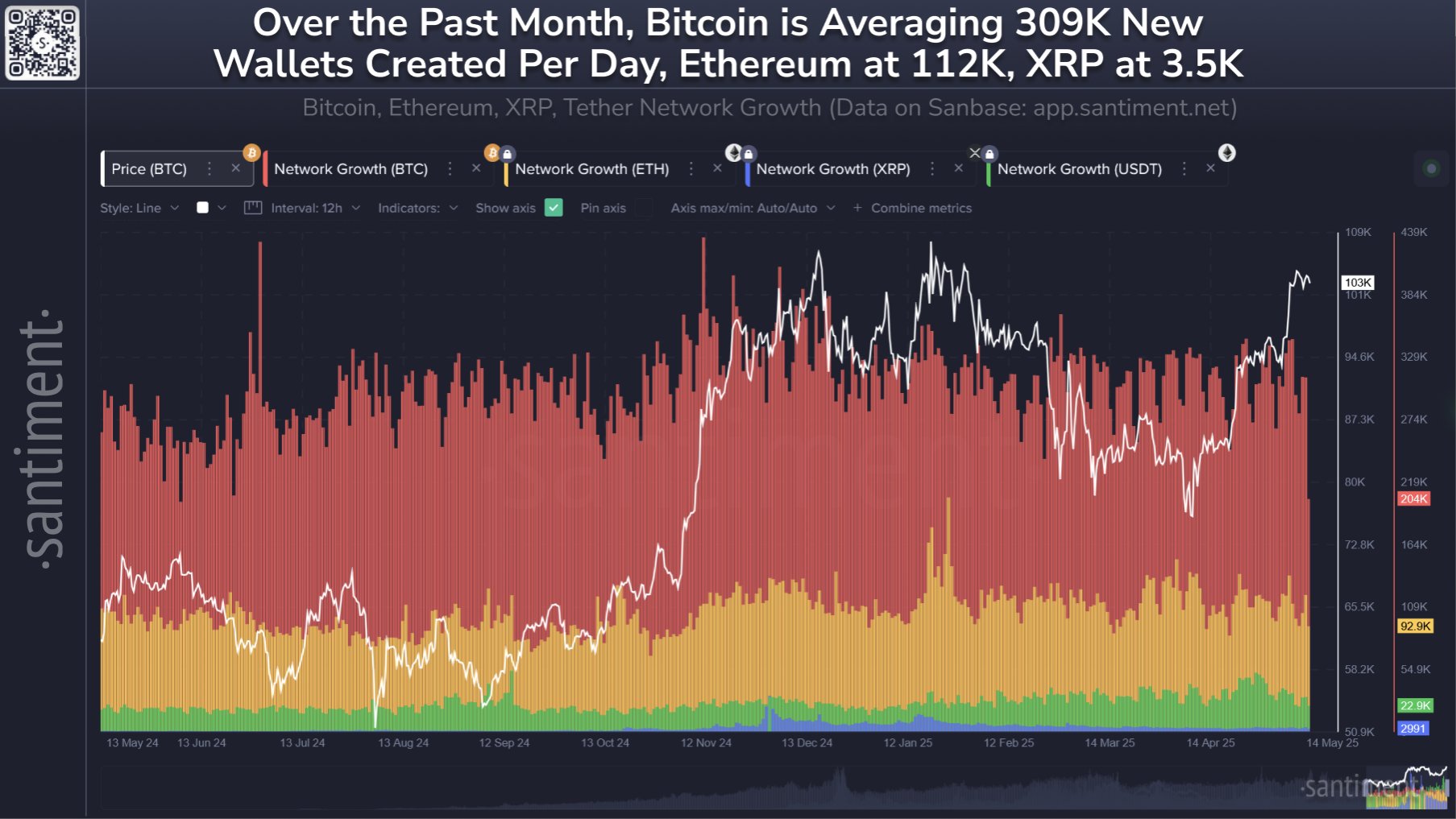

Now, here is the chart shared by the analytics firm that shows the trend in the Network Growth for the four largest cryptocurrencies by market cap: Bitcoin, Ethereum, XRP, and USDT.

As is visible in the above graph, Bitcoin has consistently remained the top coin in the sector based on this metric during the last twelve months, implying it has been attracting more user interest than the rest.

Over the past month, the daily average value of the indicator has stood at 309,000 for the cryptocurrency. Ethereum, the second largest digital asset, follows behind at 112,000, meaning the BTC network is expanding at a rate almost three times that of ETH’s.

There is again a large gap between second and third, with the stablecoin USDT witnessing an average of 36,400 addresses being created per day. Finally, there is XRP in fourth, severely lagging behind the rest with its Network Growth sitting at just 3,500.

Historically, adoption is something that has been constructive for cryptocurrency networks, as a wider userbase can provide for a more sustainable ground for futures price moves to grow on. That said, the effects of adoption are generally only visible in the long term.

Considering that the Bitcoin network has been growing at an appreciable rate for a while now, the asset’s bull run may be positioned well, at least in the context of userbase growth.

BTC Price

Bullish momentum has gone cold for Bitcoin during the past week as the asset’s price has again returned to the $102,600 mark.