On-chain data shows that Bitcoin short-term holders may have sold BTC worth almost $4.5 billion during the past four days.

Bitcoin Short-Term Holders Show Largest Profit-Taking Event Since Nov. 2021

As analyst James V. Straten explained in a post on X, the short-term holders have participated in a massive profit-taking event recently. The “short-term holders” (STHs) refer to investors who acquired their Bitcoin within the last 155 days.

The STHs are the fickle-minded participants who usually show some reaction to any FUD or FOMO that emerges in the market. In contrast, the “long-term holders” (LTHs) are the resolute investors who rarely sell, even during periods of high profits or losses.

During the last few days, Bitcoin has enjoyed some sharp bullish momentum as the cryptocurrency has now breached the $41,000 level. Given the high profits the investors would have amassed following this rally, it wouldn’t be unexpected to see the STHs give in and harvest these gains.

One way to track whether these investors are selling or not can be through the total transfer volume that they are sending toward centralized exchanges. This is natural because exchanges are what holders deposit when they want to exit the market.

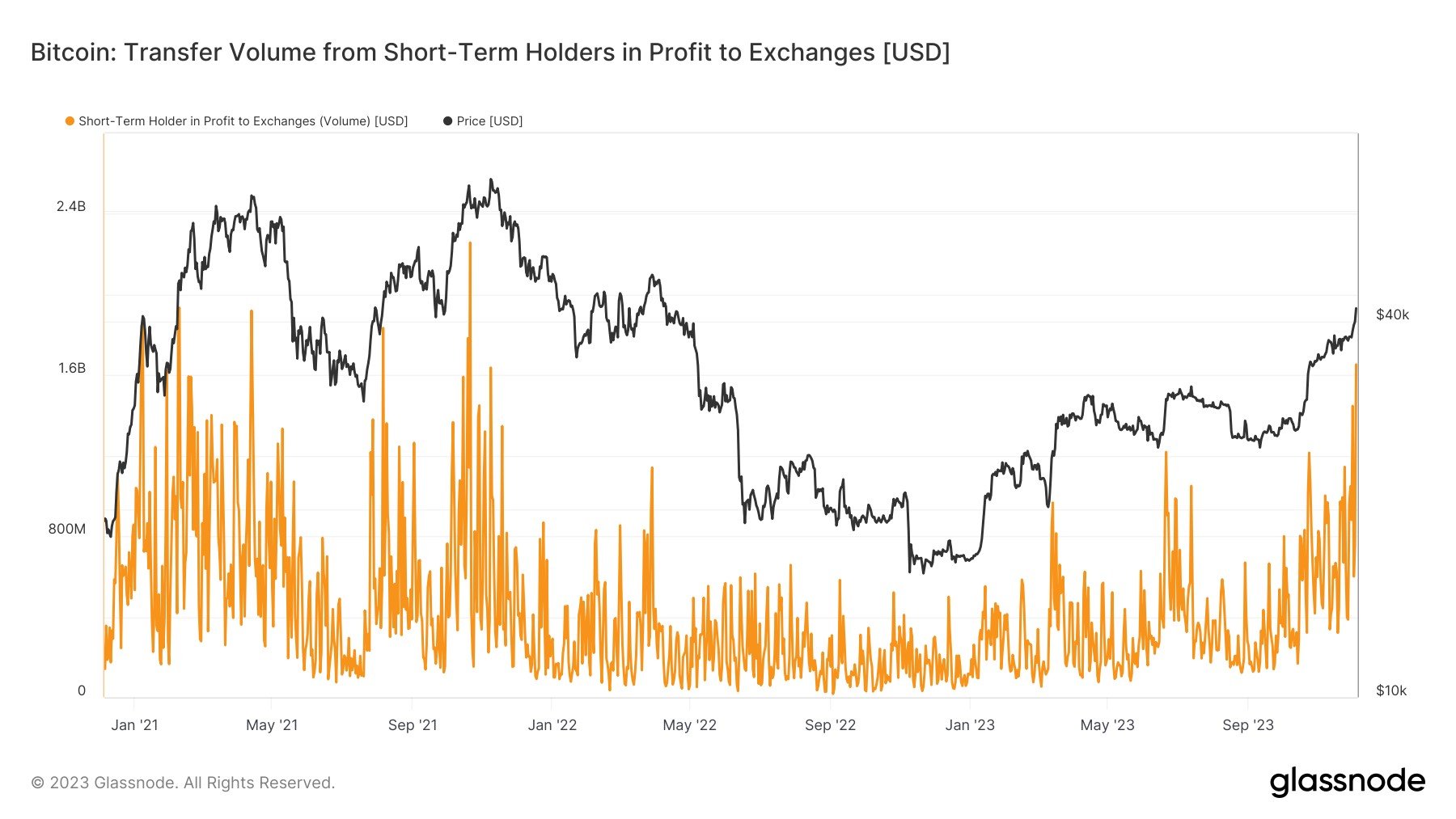

Now, here is a chart that shows the trend in this Bitcoin indicator over the past few years:

The above graph only displays the data for the exchange inflow volume of the Bitcoin STHs who are carrying some profit. However, since the price has recently been exploring new highs for the year, almost all the STHs are bound to be in profits, so the indicator’s value won’t be too different from the usual one.

The chart shows that the transfer volume going from the STHs to exchanges has spiked alongside the latest rally, suggesting that these investors are making large deposits to these central entities.

Not all the deposits would be for selling, of course, but during opportunities as profitable as the latest one, a large chunk of the inflows are indeed signs of a profit-taking rush.

According to Straten, the Bitcoin STHs have made deposits equal to almost $4.5 billion in the last four days, with $1.5 billion coming yesterday alone. This latest profit-taking event is the largest this cohort has participated in since November 2021, when the BTC price set its all-time high.

It’s not unusual to see the price slow down when large selloffs occur, like during the rallies in March and June of this year. However, so far, Bitcoin has managed to hold itself afloat since this profit-taking started and has only been pushing towards higher levels.

This is undoubtedly a positive sign for the rally’s sustainability, as it means that even though a large number of sellers are present in the market, there is also sufficient demand to absorb them.

BTC Price

Bitcoin is about to make another retest of the $42,000 level, as it’s currently floating around $41,900.