Data shows the Bitcoin market sentiment has retreated away from the extreme greed territory, something that may pave way for the rally to continue.

Bitcoin Fear & Greed Index Is Currently Pointing To ‘Greed’

The “Fear & Greed Index” is an indicator created by Alternative that measures the general sentiment present among traders in the Bitcoin and wider cryptocurrency market.

The index takes into account these five factors in order to calculate this average sentiment: volatility, trading volume, social media sentiment, market cap dominance, and Google Trends.

To represent the sentiment, the indicator makes use of a numeric scale that runs from zero to hundred. Values on this scale below the 47 mark correspond to the presence of fear among the investors, while values above 53 suggest greed in the market.

The region between 47 and 53 naturally signifies the region of “neutral sentiment.” Besides these three core territories, there are also two extreme sentiments called extreme fear and extreme greed, which occur at the ends of the fear and greed ranges (below 25 and above 75, respectively).

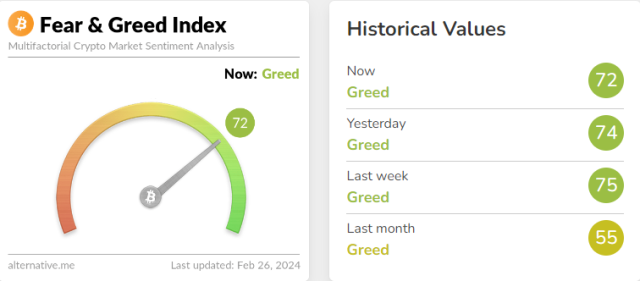

Now, here is what the value of the Bitcoin Fear & Greed Index looks like right now, to see which of these territories the current market is in:

As is visible above, the Bitcoin Fear & Greed Index has a value of 72 currently, suggesting that the sentiment is deep into the greed region, but still outside the extreme greed territory.

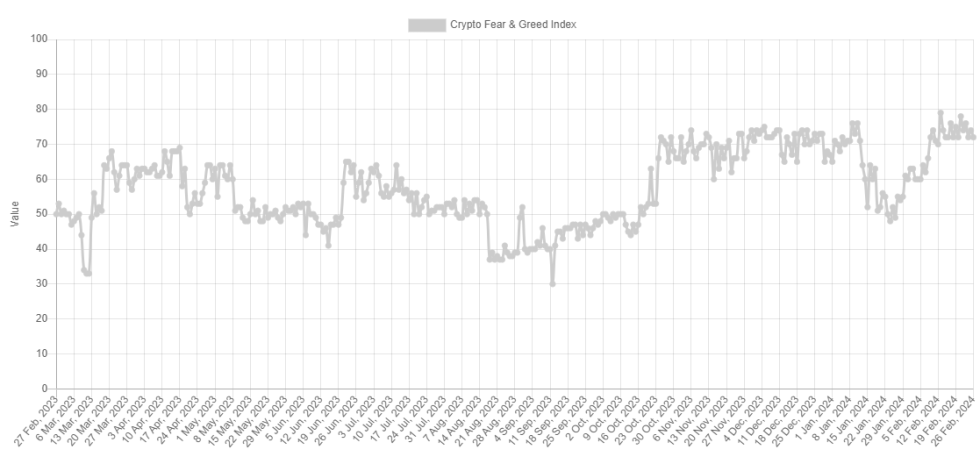

This is a recent change, however, as just earlier the sentiment had surged into the extreme greed region. The below chart shows how the metric’s value has fluctuated over the past year.

From the graph, it’s apparent that the Fear & Greed Index has recently been at its highest point for the past year. This is a sharp contrast from the sentiment of late January, where the index had neutral values.

This strong uplift in the market mentality has come as the cryptocurrency has gone through its rally towards the current $51,000+ price levels. Historically, however, breaks into extreme greed have actually been a bearish predictor for the asset.

This is because Bitcoin has generally tended to show moves against what the majority are expecting. The probability of such a contrary move occurring rises as this expectation grows stronger. Naturally, this likelihood is at its strongest inside the regions of extreme sentiments.

Followers of a trading philosophy called “contrarian investing” exploit this pattern in the market to time their buying and selling moves. As Warren Buffet said in his famous quote, “Be fearful when others are greedy, and greedy when others are fearful.”

The Bitcoin top around the time of the spot ETF approval, as well as the recent local tops above $52,000 and $53,000, all coincided with surges into extreme greed.

The fact that the Bitcoin Fear & Greed Index has come back down from extreme greed recently means that, although the danger of a top isn’t entirely over, its probability has certainly reduced. This could allow for a potential continuation of the rally from the current price levels.

BTC Price

Bitcoin has been consolidating recently as the market has gone through euphoria. At present, the coin is trading around $51,100.