Data shows the Bitcoin sentiment is currently not far from the extreme fear region, something that could be positive for the asset’s recovery.

Bitcoin Fear & Greed Index Is Deep Into The Fear Zone

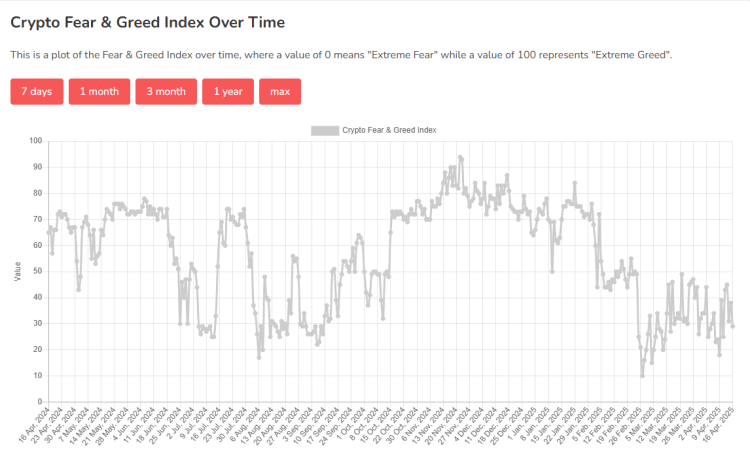

The “Fear & Greed Index” is an indicator made by Alternative that tells us about the average sentiment present among the traders in the Bitcoin and wider cryptocurrency markets.

The index uses the data of these five factors in order to determine the market sentiment: trading volume, volatility, market cap dominance, social media sentiment and Google Trends.

To represent the mentality, the indicator uses a numeric scale running from zero to hundred. All values under the 47 mark correspond to a sentiment of fear, while those above 53 to that of greed.

Now, here is how the sentiment is like in the sector right now, according to the Fear & Greed Index:

As is visible in the above graph, the Bitcoin Fear & Greed Index has a value of 29 at the moment, which means the investors as a whole share a sentiment of fear, a particularly strong one at that. In fact, the indicator’s value is currently so deep that it’s quite close to a special region known as the extreme fear (25 and under).

Just earlier, the sentiment had seen an improvement as a result of the news related to the 90-day pause on the tariffs and the price surge that had followed. But it would appear that the obstacle that BTC has encountered in its recovery has worsened market mood once more.

So far, BTC’s pullback has been small, yet the sentiment has already returned nearly to extreme fear levels. This could be an indication that the earlier renewed confidence was still quite weak.

This fact may not actually be a bad sign for Bitcoin, however, if history is to go by. In the past, the asset’s price has tended to move in the direction that’s the opposite of the crowd’s expectations. The probability of such a contrary move taking place has also only grown the more sure the investors have become.

The extreme fear happens to be where a fearful mentality is the strongest, so bottoms have historically occurred when the Fear & Greed Index has been inside the zone. There is also a similar region on the greed side as well, known as the extreme greed. Naturally, it’s where tops can be likely to form.

With the market sentiment currently being near the extreme fear region, the current recovery rally could be good to go, at least from a contrarian perspective.

BTC Price

At the time of writing, Bitcoin is trading around $84,100, up over 2% in the past week.