Bitcoin has slipped below the $105,000 level, signaling mounting selling pressure and a notable rise in volatility as the market enters a critical phase. After months of strong resilience and repeated defenses of key support zones, bulls are now on the back foot, struggling to regain momentum while bears attempt to force BTC toward the psychological $100,000 threshold. Despite the sharp pullback, Bitcoin is still trading near important demand levels that previously acted as a base for significant upside movements — placing the market at a pivotal crossroads.

According to data highlighted by top analyst Darkfost, short-term behavior is intensifying the sell-off. Short-term holders (STHs) continue sending Bitcoin to exchanges at a loss, with around 28,600 BTC currently being realized at negative profit. This aligns with heightened capitulation pressure, where newer market participants are exiting positions amid fear and short-term panic rather than a conviction-based strategy.

While long-term on-chain metrics remain relatively stable, the market is now watching closely to see whether demand absorbs this wave of selling — or whether momentum shifts decisively in favor of the bears. With macro uncertainty still looming and liquidity thinning across major assets, the next few sessions could determine Bitcoin’s near-term direction.

Short-Term Holders Remain Under Pressure

According to Darkfost, the short-term holder (STH) cohort remains the key source of sell-side pressure in the current phase of the Bitcoin market. The analyst highlights that we can still expect a stronger capitulation from STHs, as their SOPR (Spent Output Profit Ratio) continues to hover around 1 — a level that historically reflects indecision and stress.

When SOPR hovers around parity, it indicates that short-term holders are either selling at break-even or only slightly above or below cost, suggesting little conviction and a lack of willingness to hold through volatility.

This behavior also aligns with another critical pattern: each time Bitcoin approaches the STH realized price, roughly around $112,500, the market sees waves of profit-taking or break-even selling. Instead of holding through potential reversals, short-term participants are consistently exiting positions as soon as the price recovers toward their entry level.

This repeated supply response near the STH cost basis has effectively become a rotating ceiling for BTC, preventing clean continuation and creating a structurally heavy price environment in the short term.

Darkfost notes that this behavior signals doubt, fatigue, and heightened sensitivity to drawdowns among recent buyers. While long-term holders remain largely steady and are not contributing meaningfully to sell pressure, the STH cohort continues to react to every bounce with caution — a dynamic that often precedes final shakeouts or deeper wick-down events before trend continuation.

BTC Tests Weekly Support Zone as Momentum Weakens and Sellers Tighten Control

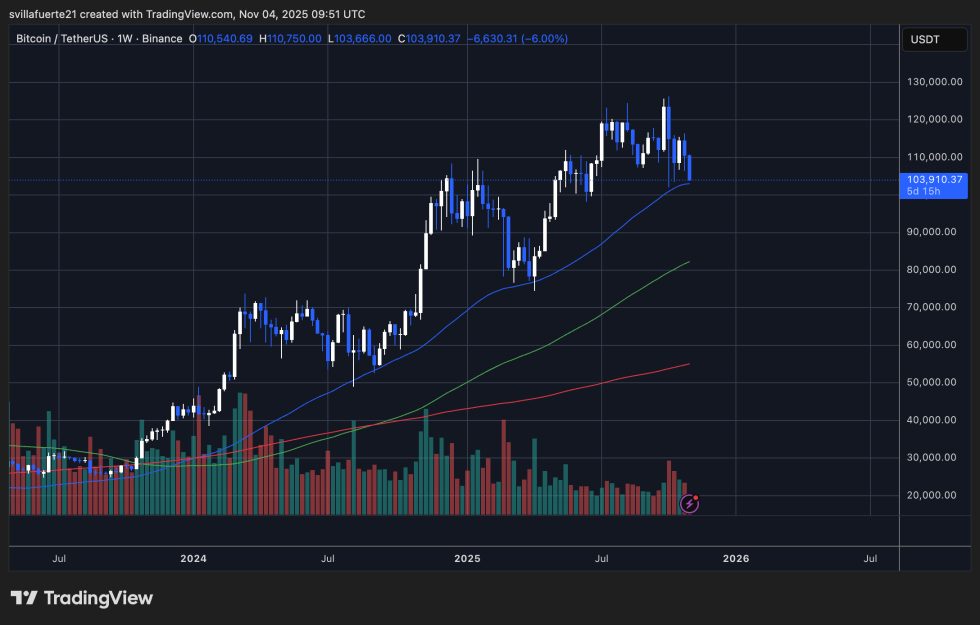

Bitcoin’s weekly chart shows a decisive shift in momentum, with price sliding toward the $103,000–$105,000 support area and testing the 50-week moving average after a period of sustained weakness. The market has now posted several lower highs from the peak near $127,000, signaling a gradual transition from strong uptrend behavior to consolidation — and now, potential trend vulnerability if buyers fail to defend current levels.

The recent weekly candle shows a sharp wick to the downside and increased selling volume, reflecting panic-driven exits and short-term capitulation. Despite this, price remains above a key structural support zone that held during previous pullbacks earlier in the cycle, making this level crucial for bulls to protect.

A decisive break below the 50-week MA could accelerate downside momentum and open the door to deeper retracement targets toward $95,000 or even $88,000 if risk aversion intensifies.

However, macro trend structure still leans bullish over the long term as the 200-week moving average continues to trend upward and sits comfortably below the current price. For now, eyes remain on whether BTC can reclaim $110,000 in the coming sessions — a move that would signal absorption of selling pressure and prevent further deterioration of market sentiment.

Featured image from ChatGPT, chart from TradingView.com