Bitcoin (BTC) has been battered by a relentless bear market over the past month, with its price tumbling 20% from its record highs. However, amidst the carnage, glimmers of hope emerge as prominent analysts predict a potential bottom forming around the current $57,000 mark.

Tough Opening Month For Bitcoin

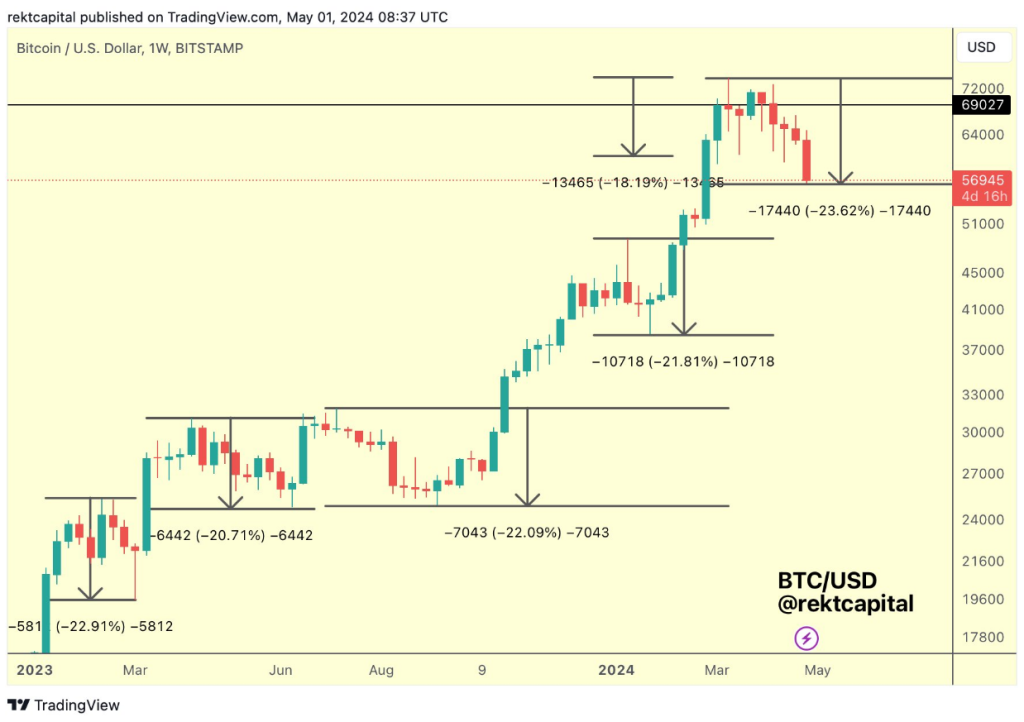

The start of May has not been kind to Bitcoin. The once-dominant cryptocurrency has seen a steady decline, plunging back to levels last witnessed in March before its monumental surge to $73,700. This recent price drop represents the most significant decline of this cycle, raising concerns about a prolonged bear market.

The pain extends beyond Bitcoin, with the broader altcoin market feeling the tremors. Litecoin (LTC), the silver to Bitcoin’s gold, has mirrored the downward trend, shedding a staggering 25% of its value in the past month. While historically seen as a more stable alternative to Bitcoin, Litecoin seems to be tethered to its big brother’s fate in this current downturn.

Finding The Bottom: Bullish Predictions Surface

Despite the prevailing gloom, a chorus of optimism is rising from the crypto analysis community. Several heavyweight analysts believe Bitcoin may have found its footing around the current price range of $56,000 to $58,000.

Rekt Capital, a popular crypto analyst, emphasizes a historical pattern where similar 20% dips have been followed by significant rebounds. Michaël van de Poppe, another well-respected voice, echoes this sentiment, suggesting Bitcoin may be nearing the end of its price consolidation phase. He cautions of potential short-term fluctuations but highlights the $56,000 to $58,000 zone as a crucial support level.

This is officially the deepest retrace in the cycle (-23.6%)$BTC #BitcoinHalving #Bitcoin pic.twitter.com/Gcapbl0Nu6

— Rekt Capital (@rektcapital) May 1, 2024

Uncertainty Looms As Market Awaits Fed Decision

While analyst optimism is a welcome sign, a cloud of uncertainty hangs over the crypto market. The upcoming Federal Reserve decision on interest rates could significantly impact investor sentiment and, consequently, Bitcoin’s price trajectory. A more hawkish stance from the Fed could trigger further selling, while a dovish approach might provide the tailwind needed for a Bitcoin rebound.

Related Reading: Ethereum Fees Dive: Will This Spark A Surge In Network Activity?

Buckle Up For A Bumpy Ride

The next few weeks will be crucial for Bitcoin and the broader cryptocurrency market. The Federal Reserve’s decision and investor reaction to the current price slump will likely dictate the short-term direction. While bullish sentiment suggests a potential reversal, the inherent volatility of the crypto market means investors should brace for a bumpy ride.

Featured image from Pixabay, chart from TradingView