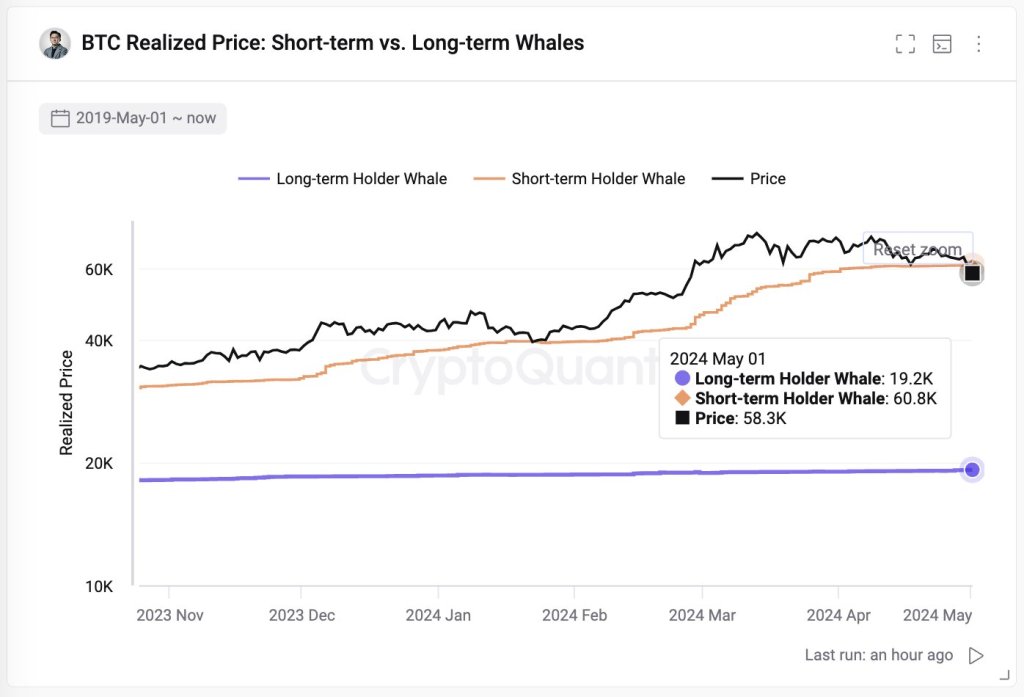

As Bitcoin slumps, on-chain data by Ki Young Ju, the founder of the blockchain analytics platform CryptoQuant, paints a stark picture: all new whales, including holders of spot exchange-traded funds (ETFs), are now underwater.

New Whales And Spot ETF Investors Are In Red

Taking to X, Ju said that more losses would be incoming, predicting that HODLers will find “max pain” at around $51,000. The dip is less than $10,000 from spot rates, suggesting that although there are cracks, the correction might not be deep.

This overview is welcomed, considering the recent sell-off. Even so, predicting price bottoms in a fast-moving market influenced by multiple forces is tough.

As price action stands, Ju says believers may take the opportunity to double down on the coin. The founder adds that the current price discount presents an opportunity for savvy investors to outperform traditional finance whales, including institutions with BTC exposure via spot ETFs in the United States.

Bitcoin is under immense liquidation pressure at the time of this writing. Though bulls soaked up the sell-off earlier today, the coin remains within a bearish breakout. Prices are trading below the support zone of between $60,000 and $61,000 and below April 2024.

Inflow To Spot Bitcoin ETFs Decline As Sentiment Deteriorate

This formation suggests that though bulls are optimistic, the path of least resistance remains southwards for now. BTC dropped after posting impressive returns from October 2023 to March 2024, when prices peaked. Some analysts think the current cool-off is inevitable following sharp gains in the last six months.

The fact that whales are underwater was unexpected, considering the state of affairs in the last week of April. Then, the inflow from new whales nearly doubled the cumulative holdings of older whales. Analysts said this influx of fresh capital pointed to growing institutional interest.

However, looking at the current price action, new whales are now in the red territory, and their excitement seems to wane.

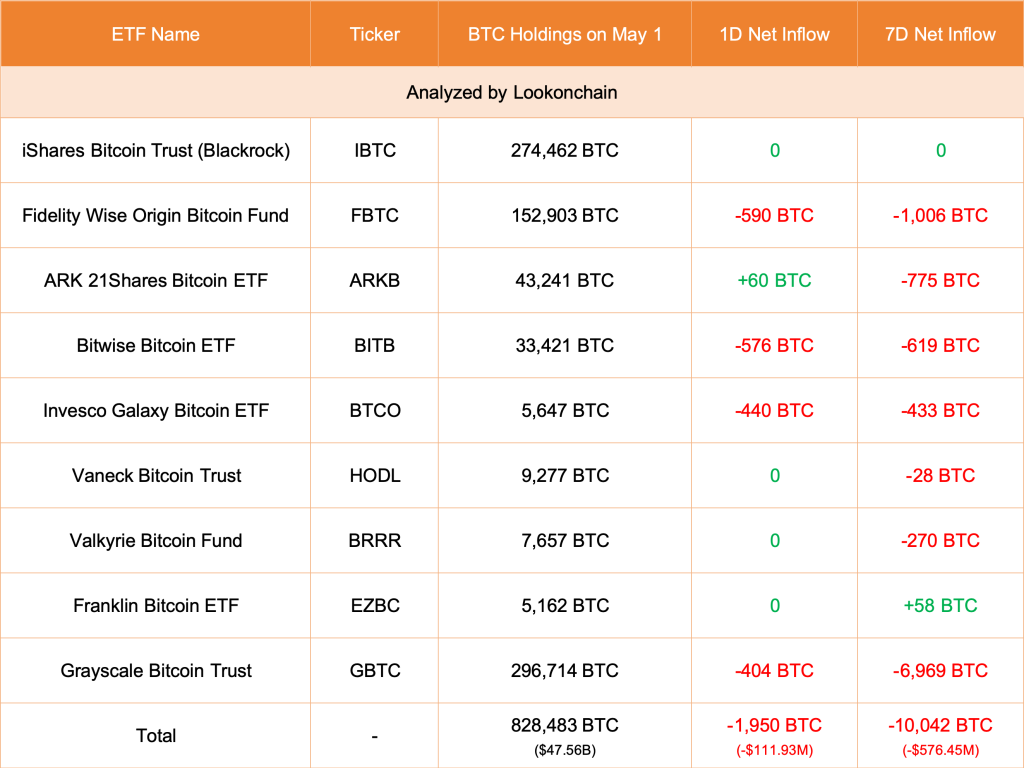

According to Lookonchain data, inflow into the eight-spot Bitcoin ETFs, including BlackRock, has stalled. On May 1, all issuers, including Grayscale via GBTC, decreased by 1,950 BTC. Of note is that BlackRock’s IBIT has not seen inflows for five straight days.

Still, confidence abounds. Inflows into spot Bitcoin ETFs are highly influenced by sentiment, which rests on how prices perform. If BTC shakes off the current weakness and tears higher in the expected post-Halving rally, spot ETF issuers will begin receiving new inflows.