On-chain data shows the Bitcoin whales have seen their population grow recently, despite the bearish action that the price has been facing.

Bitcoin Whales Have Seen Notable Growth In Past Five Weeks

According to data from the on-chain analytics firm Santiment, whale-sized Bitcoin wallets have recently climbed to their highest point since December of last year.

The indicator of relevance here is the “Supply Distribution,” which tells us, among other things, the number of wallets that belong to a particular coin range. The metric’s value for the 1 to 10 coins range, for example, represents the number of investors or addresses who own between 1 and 10 tokens.

In the context of the current topic, the range of interest is 1,000 to 10,000 coins. The investors of this size ($84.2 million to $842 million in USD terms) are popularly known as the whales.

Due to the massive scale of their holdings, these investors can carry some degree of influence in the market. Naturally, each of them on their own may not be relevant for the cryptocurrency, but the group as a whole can be. The Supply Distribution helps track exactly this collective behavior.

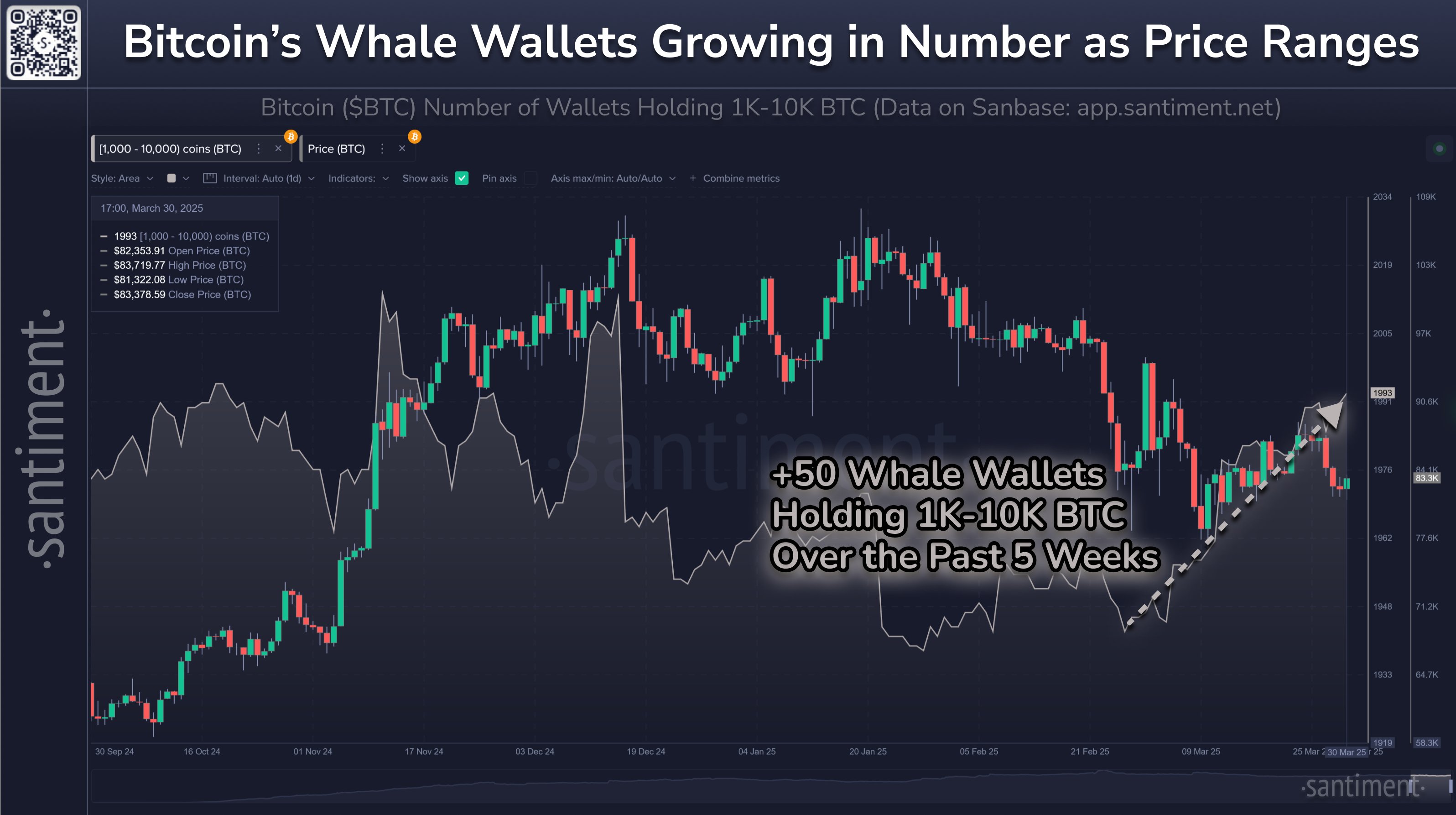

Now, here is the chart shared by the analytics firm that shows the trend in the Bitcoin Supply Distribution for the 1,000 to 10,000 coins group over the last few months:

As displayed in the above graph, the Bitcoin Supply Distribution for the whales observed a plummet alongside the December price peak, implying a large amount of these humongous investors exited the market.

The same pattern was also witnessed during the January top, albeit at a much smaller scale. This would indicate that the selling from the whales once again obstructed the BTC rally.

During most of February, the metric consolidated at its lows, but starting with the last week of the month, its value began to rise. The surge continued throughout March and today, there are 1,993 whale-sized addresses on the network, the highest level since the December top.

From the chart, it’s visible that this growth in whale entities has come while Bitcoin has been struggling around its lows, a potential sign that big-money investors have been looking at the recent price levels as profitable entry points into the cryptocurrency.

“There are many factors contributing to the polarizing crypto markets right now, but it can be taken as a slight sign of confidence that one of the most important key stakeholder tiers in cryptocurrency has grown by +2.6% in the past five weeks alone,” notes Santiment.

It now remains to be seen whether this buying from the Bitcoin whales will pay off or not.

BTC Price

Bitcoin has continued its sideways movement recently as its price is still stuck around the $84,000 level.