Bitcoin is facing a crucial test as it consolidates just below all-time highs, teasing a breakout into price discovery. After briefly tagging the $112,000 mark, BTC pulled back slightly, and volatility has surged, leaving investors uncertain about the next direction. While some fear a potential correction, many analysts remain confident that the uptrend is still intact, pointing to strong support levels and on-chain indicators backing the bullish case.

Despite recent fluctuations, Bitcoin continues to hold above the $105,000 level, maintaining a bullish structure and keeping market sentiment cautiously optimistic. Traders are now watching for a decisive move that could either confirm a breakout above resistance or sweep liquidity below before the next leg higher.

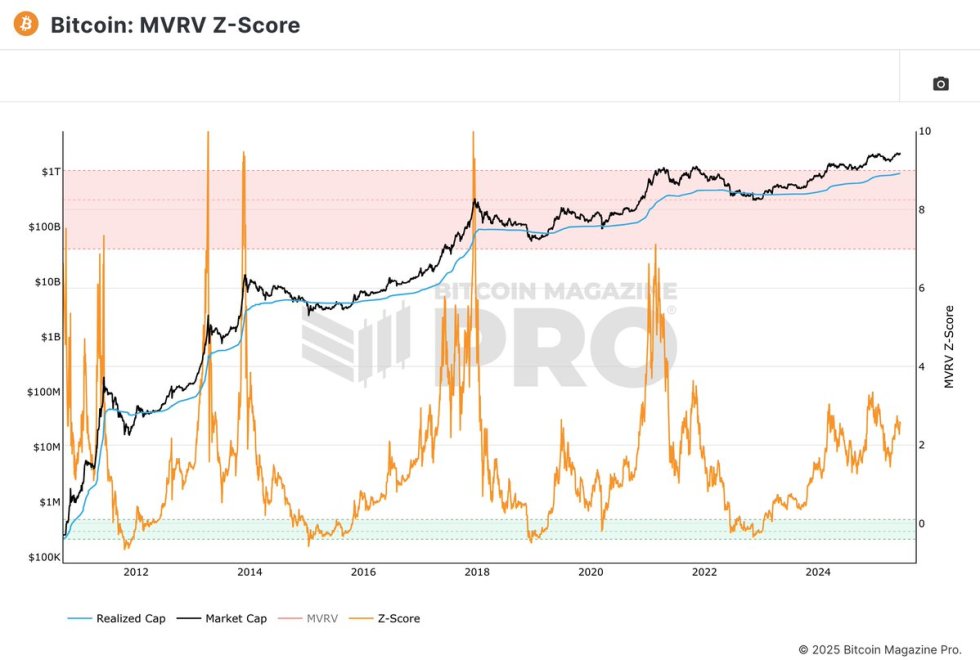

Top analyst Jelle shared on-chain data highlighting the current position of the MVRV Z-Score—a key metric used to gauge whether Bitcoin is overvalued or undervalued relative to historical norms. According to Jelle, the MVRV Z-Score is still far from the red zone levels typically associated with cycle tops, suggesting there is still plenty of room for the market to grow. As BTC holds firm and macro conditions evolve, the coming sessions could shape the next explosive phase in the ongoing bull cycle.

Bitcoin Hovers Near All-Time High As Market Awaits Breakout Confirmation

Bitcoin is trading above critical levels, holding strong above $105,000 and maintaining momentum near its $112,000 all-time high. After weeks of climbing and absorbing macroeconomic uncertainty, BTC now faces one of its most significant resistance levels. A clean breakout from this zone could be the trigger for a full-blown expansion into price discovery, signaling the next explosive leg of the bull market.

This week could prove decisive. Bitcoin’s structure remains bullish, with a series of higher lows and steady volume supporting the uptrend. However, volatility has increased in recent days, suggesting that while bulls are in control, the market is still weighing its next move. A failed breakout could result in a retracement toward lower support, with key demand zones resting around $103,600 and $100,000.

Still, on-chain signals continue to lean bullish. Jelle highlighted the relevance of the MVRV Z-Score, a historical indicator that measures Bitcoin’s market value relative to its realized value. The metric has historically flashed red as price peaks approach—yet according to Jelle, the MVRV Z-Score is “not even close to flashing a signal at the moment,” suggesting there’s still plenty of room for upside.

This combination of price stability above support, technical resistance overhead, and a healthy on-chain backdrop puts Bitcoin in a pivotal position. A breakout above $112,000 could ignite price discovery and accelerate the uptrend across the market. But as long as BTC remains range-bound, traders must remain cautious and prepare for short-term volatility. The direction Bitcoin takes from here will likely define the tone of the market heading into the second half of 2025.

BTC Rejected At $109K Level

Bitcoin is currently trading at $107,044 on the 4-hour chart after facing rejection at the $109,300 resistance level—a key area that has capped upside momentum multiple times in the past two weeks. Following a brief push above $109K, BTC failed to hold the breakout and has since retraced, now testing the mid-range support zone aligned with the 50, 100, and 200 simple moving averages (SMAs), which are all clustered between $106,000 and $106,400.

This cluster of moving averages now serves as immediate support and could act as a pivot point for a bounce. If this area holds, bulls could attempt another run at the $109K level. However, a breakdown below these SMAs opens the door for a move down to the $103,600 demand zone, where Bitcoin previously found strong buying interest earlier this month.

Volume has been increasing slightly during the retrace, suggesting traders are cautious and protecting gains after last week’s rally. Until BTC cleanly breaks above $109,300 with volume, the market is likely to remain in consolidation mode. All eyes are now on whether BTC can defend this support cluster or risk deeper downside in the short term.

Featured image from Dall-E, chart from TradingView