On-chain data shows the Bitcoin supply in profit has plunged following the latest crash in the asset’s price towards the $65,000 level.

Bitcoin Supply In Profit Is Now Down To Around 90%

As analyst James Van Straten pointed out in a post on X, around 10% of the BTC supply is now in a state of loss. The on-chain indicator of interest here is the “Percent Supply in Profit,” which tracks the percentage of the total circulating Bitcoin supply holding an unrealized gain.

This metric works by going through the blockchain history of each coin in circulation to see the price at which it was last transferred. Assuming that this previous transaction involved a change of hands, the price at its moment would serve as the cost basis for the coin.

The coins with a cost basis that is less than the current spot price of the cryptocurrency would naturally be considered to be holding a profit, and as such, they would be counted under the supply in profit.

The Percent Supply in Profit adds up all such coins and calculates what part of the total supply they make up for. The opposite metric, the Percent Supply in Loss, adds up the coins not satisfying this condition.

Since the total circulating supply must add up to 100%, the Percent Supply in Loss can be deduced from the Percent Supply in Profit by subtracting its value from 100.

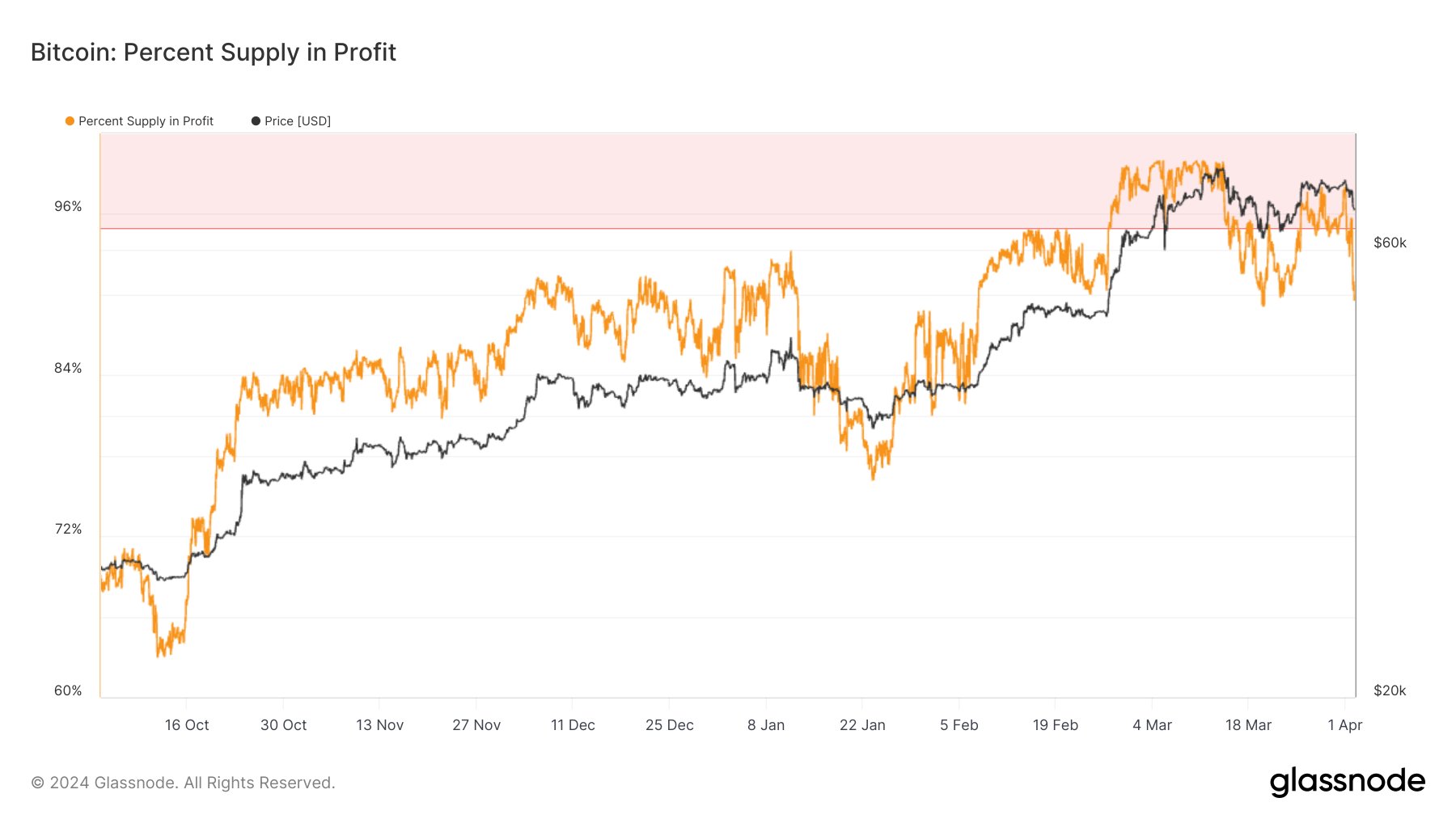

Now, here is a chart that shows the trend in the Percent Supply in Profit for Bitcoin over the last few months:

As displayed in the above graph, the Bitcoin Percent Supply in Profit has seen a sharp drop recently as the cryptocurrency price has gone through a significant drawdown.

The indicator’s value has dropped to around the 90% mark, which means that about 10% of the supply is currently carrying a loss. The chart shows that the last time the metric touched these levels was back on 22 March. Interestingly, the asset also found its bottom around then.

Earlier, the Percent Supply In Profit had pushed towards the 100% mark, which was a natural consequence of the price setting a new all-time high (ATH), since at fresh highs, all of the supply must be out of the red.

Generally, the investors in profit are more likely to sell their coins, so if many come into gains, the possibility of a mass selloff rises. Due to this reason, high levels of the Percent Supply In Profit have often led to tops.

Similarly, bottoms become more likely when investor profitability levels drop relatively low. The current value of 90% is still quite high, but this isn’t unusual during bull runs, as there is strong demand and ATHs are being explored.

The fact that the profitability has cooled off compared to earlier levels may be constructive for the rally’s chances to see a continuation, just like it did last month.

BTC Price

At the time of writing, Bitcoin has been trading at around the $65,700 level, down more than 5% over the past week.