On-chain data shows that the Bitcoin taker buy/sell ratio has experienced a significant surge on a particular crypto exchange. Here’s how it could impact the price of the premier cryptocurrency.

Bitcoin Investors Buying The Dip On This Exchange

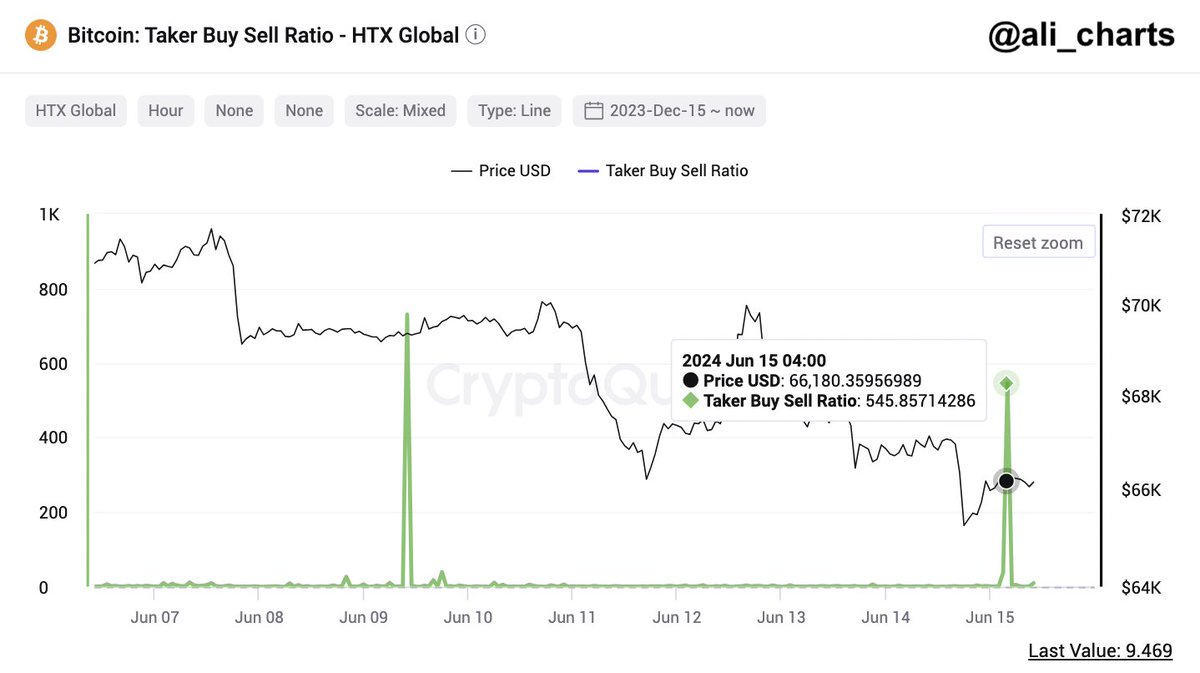

Prominent crypto pundit Ali Martinez took to the X platform to reveal that investors on a particular exchange have been taking advantage of the recent fall in Bitcoin price. The relevant indicator here is the taker buy/sell ratio, which measures the ratio between the taker buy volumes and the taker sell volumes.

Typically, when the value of this metric is greater than 1, it implies that the taker buy volume is higher than the taker sell volume on the exchange in question. In this case, more traders are willing to buy coins at a higher price on the trading platform.

Conversely, when the taker buy/sell ratio is below 1, it means that more sellers are willing to sell coins at a lower price, indicating that the sell volume is greater than the buy volume.

According to data from CryptoQuant, the Bitcoin taker buy/sell ratio on the HTX Exchange (formerly known as Huobi) recently skyrocketed to above 545 on Saturday. This suggests a significant increase in buying pressure and a shift in investor sentiment.

Martinez noted in his post on X that this spike in bullish pressure could be a signal of impending upward price movement for Bitcoin. These high buy volumes on the HTX exchange come on the back of BTC’s recent fall to $65,000.

However, it is worth noting that the average Bitcoin taker buy/sell ratio across all exchanges is still below 1. At the time of writing, the value of this metric stands around 0.8.

BTC’s Average Mining Cost Surges Above $86,500

The latest data shows Bitcoin’s average mining cost has soared to $86,668. This figure reflects the cumulative expenses associated with producing one BTC, including electricity, hardware, and operational costs.

As highlighted by Ali Martinez in a post on X, every significant increase in BTC’s average mining cost is usually followed by a corresponding increase in the coin’s market value. With this historical context, the latest increase in the average mining cost suggests that a price increase could be on the horizon for Bitcoin.

#Bitcoin's average mining cost is currently at $86,668.

And guess what? Historically, $BTC always surges above its average mining cost! pic.twitter.com/S3UkwgvS3N

— Ali (@ali_charts) June 15, 2024

As of this writing, the price of Bitcoin continues to hover around the $66,000 mark, with no significant change in the past day. According to CoinGecko data, the premier cryptocurrency is down by nearly 5% in the past week.