Onchain Highlights

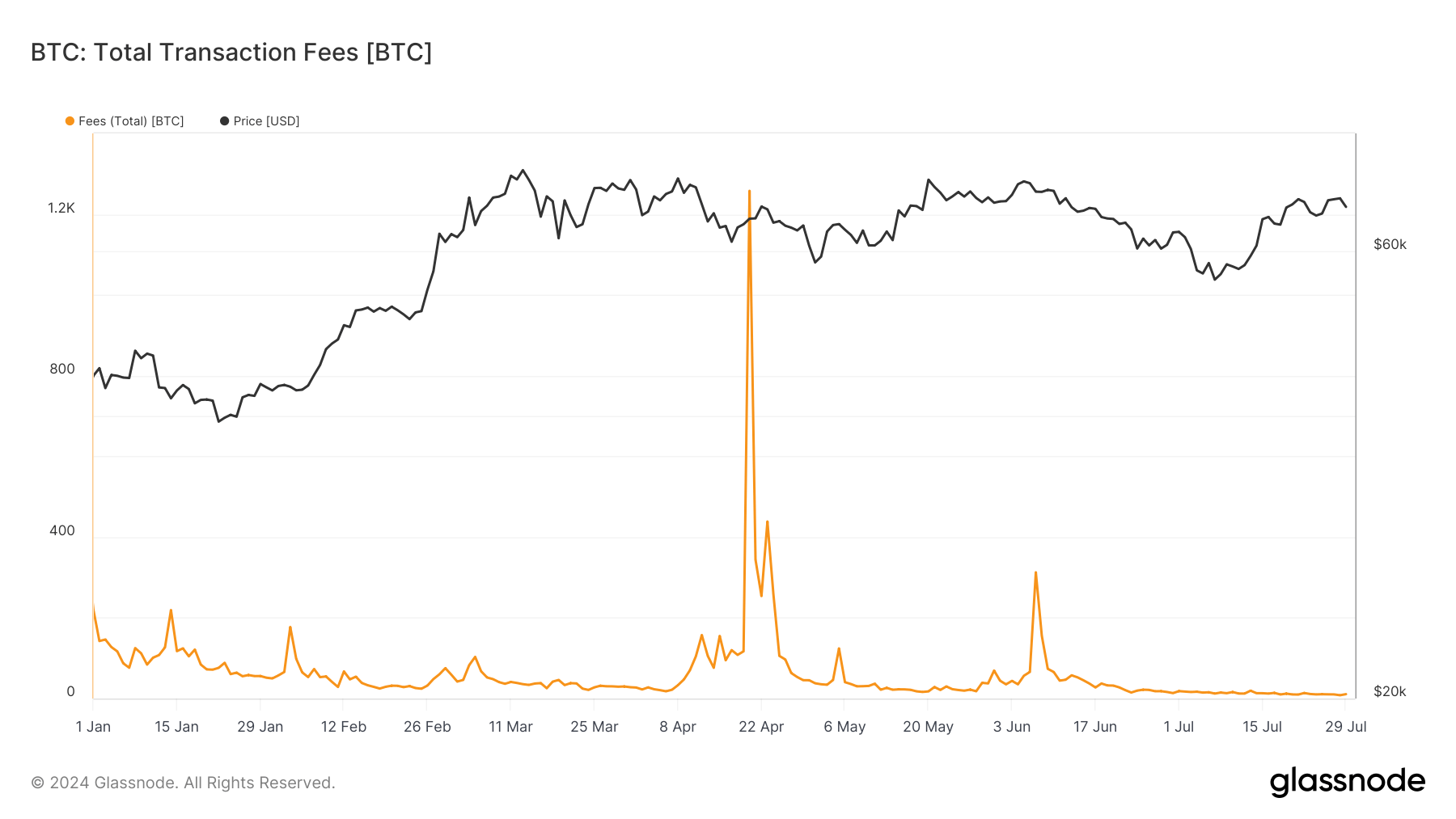

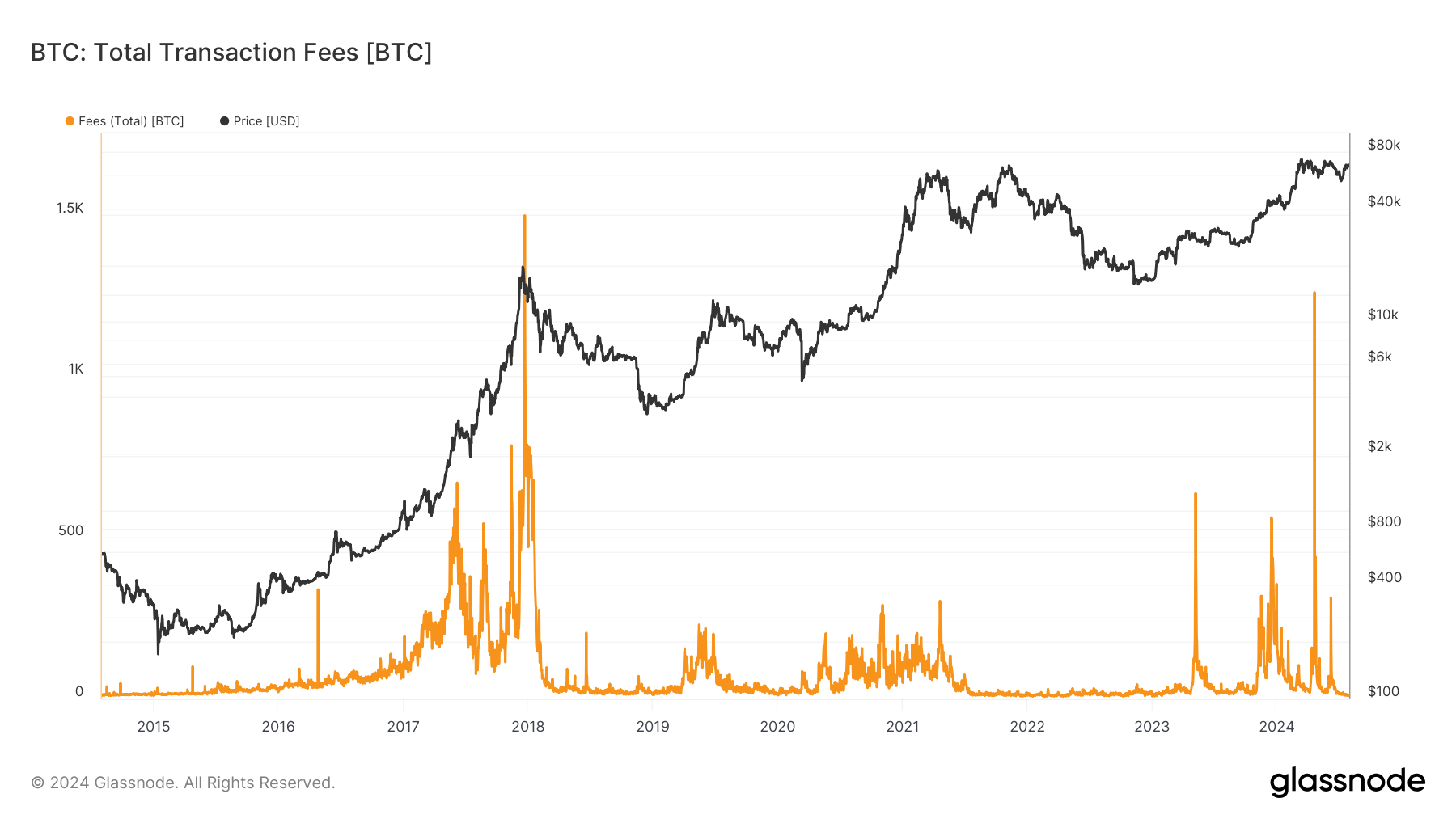

DEFINITION: The total amount of fees paid to miners. Issued (minted) coins are not included.

The total fees paid to Bitcoin miners are a crucial metric indicating network activity and economic behavior within the blockchain. This metric reflects user willingness to pay for transaction prioritization, and it correlates with periods of high demand.

Historically, spikes in transaction fees have correlated with price volatility and increased trading volumes, indicating heightened network utilization. This pattern is consistent with past bull runs, where network congestion drove fees higher. For instance, during the 2021 bull run, total fees surged as transaction volumes reached new heights.

After the April 2024 halving, the Bitcoin network witnessed extremely low transaction fees, indicating reduced congestion and a temporary lull in network activity. This reduction in fees contrasts with the heightened activity observed during the halving, suggesting a unique market phase influenced by a variety of factors, such as the launch of Runes.

The relationship between transaction fees and network demand illustrates the complexity of Bitcoin’s ecosystem, where economic incentives play a pivotal role in shaping miner behavior and network performance.

The post Bitcoin transaction fees drop to yearly low appeared first on CryptoSlate.