Data shows Bitcoin treasury companies have seen an explosive growth trajectory since 2023, gaining relevance as an important pillar of the market.

Public & Private Companies Now Hold More Than A Million Bitcoin

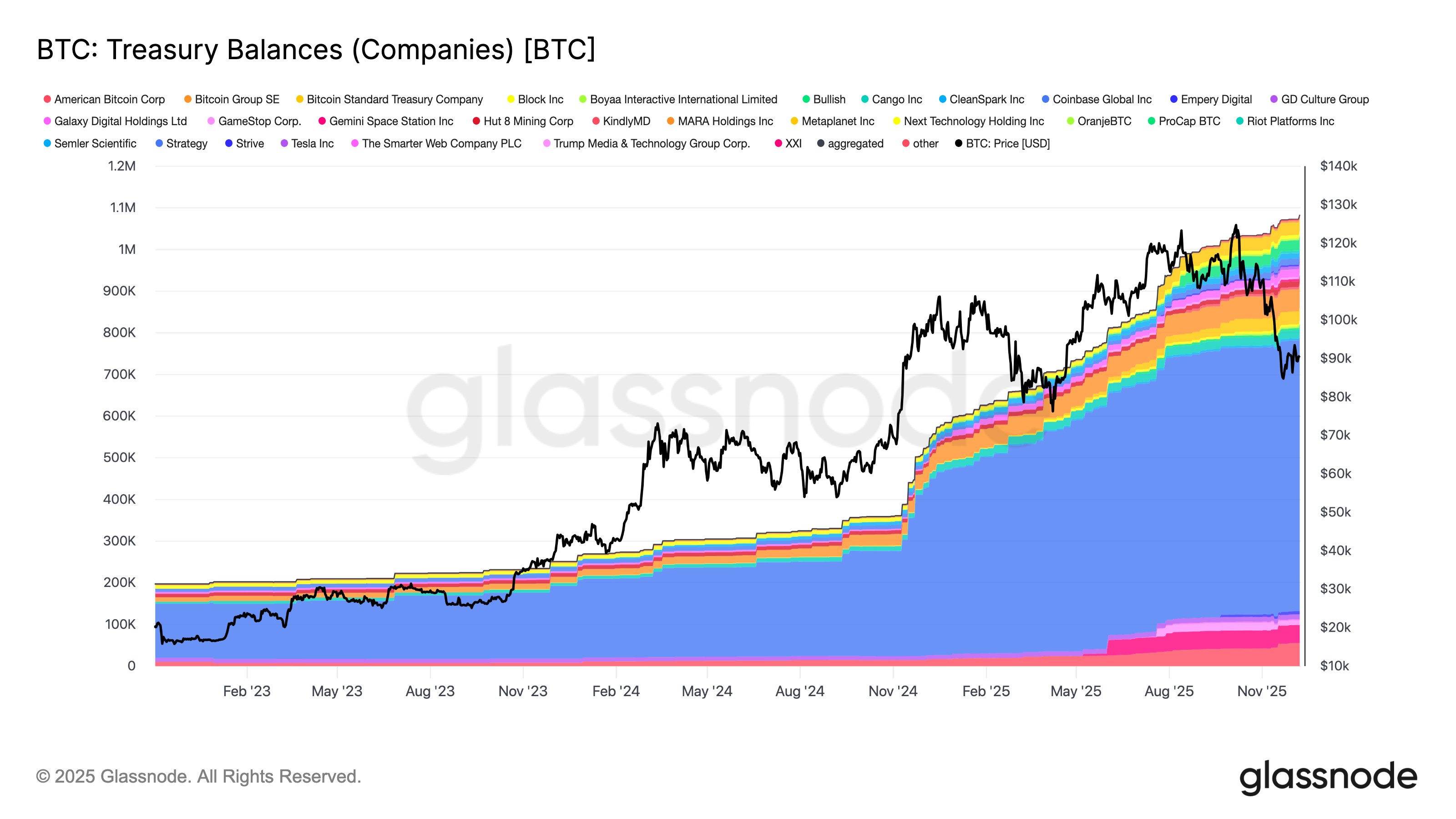

In a new post on X, on-chain analytics firm Glassnode has talked about the trend in the Bitcoin treasuries held by public and private companies. Below is the chart shared by Glassnode that shows changes in both the holdings of the various companies as well as their combined balance.

As is visible in the graph, Bitcoin treasuries held by companies saw slow, but steady growth during 2023 and most of 2024, but in late 2024, the growth became much more rapid.

This sharp trajectory continued into 2025 and so far, with the year’s end approaching, the uptrend hasn’t faded. This would suggest that corporates have been accumulating BTC at a significant pace for a year now.

In January 2023, the size of the Bitcoin holdings that private and public firms held stood at 197,000 BTC. Today, that figure has grown to 1.08 million BTC, implying a massive jump of about 448%.

Today, there are about 19.96 million tokens in circulation, so more than 5.4% of the cryptocurrency’s supply is sitting in the treasuries of public and private companies. “Corporate balance sheets are becoming an increasingly significant pillar of demand for BTC,” noted the analytics firm.

A major force behind the increase in Bitcoin corporate holdings is naturally Strategy (formerly MicroStrategy). The Michael Saylor-led firm has been a regular presence in the market for some time now, participating in buying almost every week and making no sales since December 2022.

Strategy currently owns about 660,624 BTC, which means that the treasury company alone accounts for over 61% of all BTC holdings attached to public and private firms.

While Strategy has been a big factor behind the surge in corporate holdings, it hasn’t been the only one. 2025 has seen the rise of treasuries like Metaplanet, which have also contributed to growth in BTC treasuries.

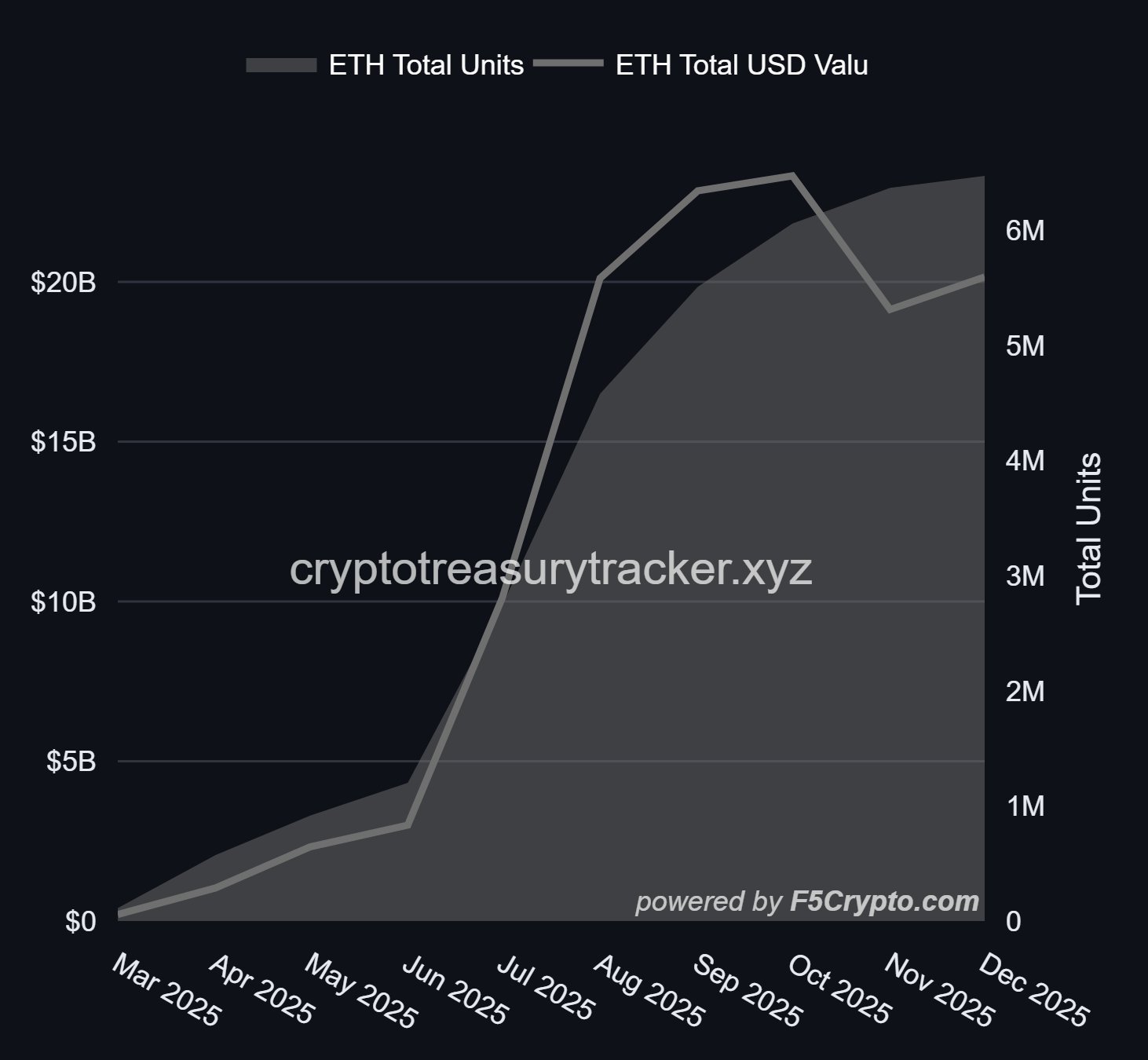

The year has also witnessed a treasury movement related to altcoins, with both Ethereum and Solana seeing a significant amount of accumulation. ETH treasuries went through some sharp growth in mid-2025, but during the recent phase of price decline, buying has slowed down.

That said, it hasn’t hit a complete pause, as institutional DeFi solutions provider Sentora has pointed out in an X post that Ethereum treasuries added a significant amount during November.

As displayed in the above chart, Ethereum treasuries added 309,000 ETH during November, and so far in December, they have accumulated another 100,000 ETH.

BTC Price

Bitcoin surged to $94,500 on Tuesday, but the cryptocurrency has since faced a drawdown as it’s now back at $92,200.