Bitcoin (BTC) witnessed a slight surge earlier today, climbing from $113,000 to around $117,000 at the time of writing, in contrast to expectations of several crypto analysts who were predicting a decline in risk-on assets due to the US government shutdown.

Bitcoin Rises Despite US Government Shutdown

The US federal government shut down at midnight on September 30, as President Donald Trump and Congress failed to reach a deal on funding. Specifically, the two camps were at odds over enhanced Obamacare subsidies, with neither party willing to take the blame.

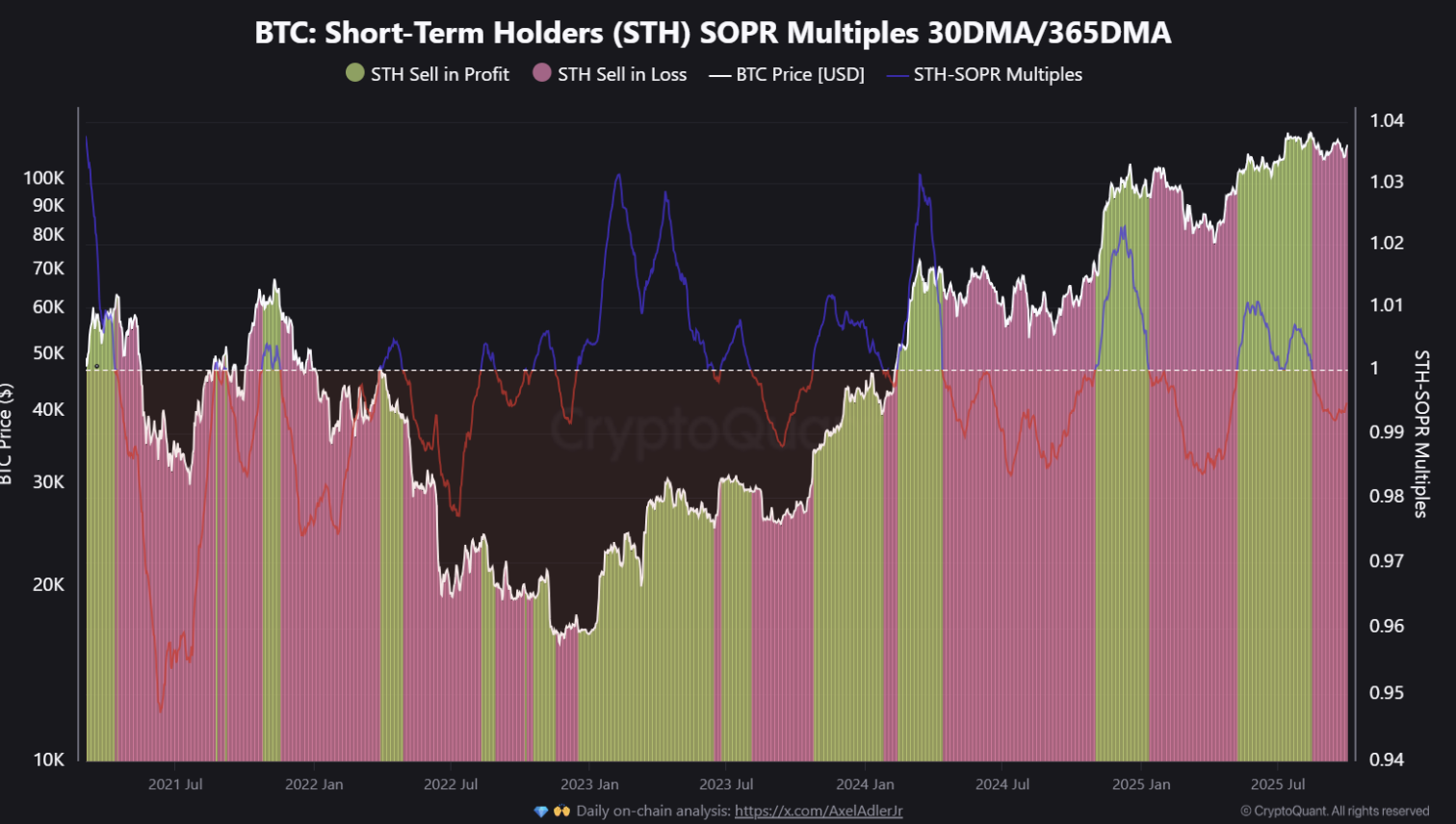

However, Bitcoin made a surprise move to the upside despite the uncertain environment created by the US government shutdown, recording strong gains earlier today. CryptoQuant analyst Kripto Mevsimi stated that September saw deeper losses among short-term holders (STH), as their Spent Output Profit Ratio (SOPR) fell as low as 0.992.

As a result, most of September was marked by STH continuing to sell their BTC holdings at a loss. However, the metric recovered slightly to 0.995, although it is still below August’s reading of 0.998.

The current STH-SOPR reading is showing signs of stabilization after a period of depression. It is interesting to note the timing of this recovery, as it occurred at a time when BTC is trading in the high $110,000 range, slightly below a heavy resistance zone.

Past data shows two potential scenarios that can happen following such a reset in the STH-SOPR. First, it could be early warning signs of a weakening momentum for BTC, as extended loss realization can precede corrective phases where weak hands capitulate.

The other, more bullish scenario, is that it could be a healthy reset. Quick absorption of realized losses often paves the way for more sustainable rallies, which could catapult BTC to new all-time highs (ATH) in the near term. The CryptoQuant analyst added:

With BTC consolidating under resistance, this rebound in STH-SOPR is a key barometer of market health. If buyers continue to absorb weak-hand selling, it could mirror past resets that paved the way for the next leg higher.

Will BTC Decline In Q4 2025?

While the dwindling active circulating supply of Bitcoin offers some hope to the bulls, others are not as optimistic. According to recent analysis by fellow CryptoQuant contributor Axel Adler, demand for BTC cooled after it failed to hold above $115,000.

Meanwhile, crypto analyst Doctor Profit recently remarked that BTC is likely to experience another 20% decline from its current price, reaching his projected target range between $90,000 – $94,000. At press time, BTC trades at $117,226, up 3.5% in the past 24 hours.