On-chain data shows the Bitcoin whales have gone on a huge buying spree in the past week, a sign that could be bullish for the coin’s value.

Bitcoin Whales Have Scooped Up More Than 100,000 BTC Recently

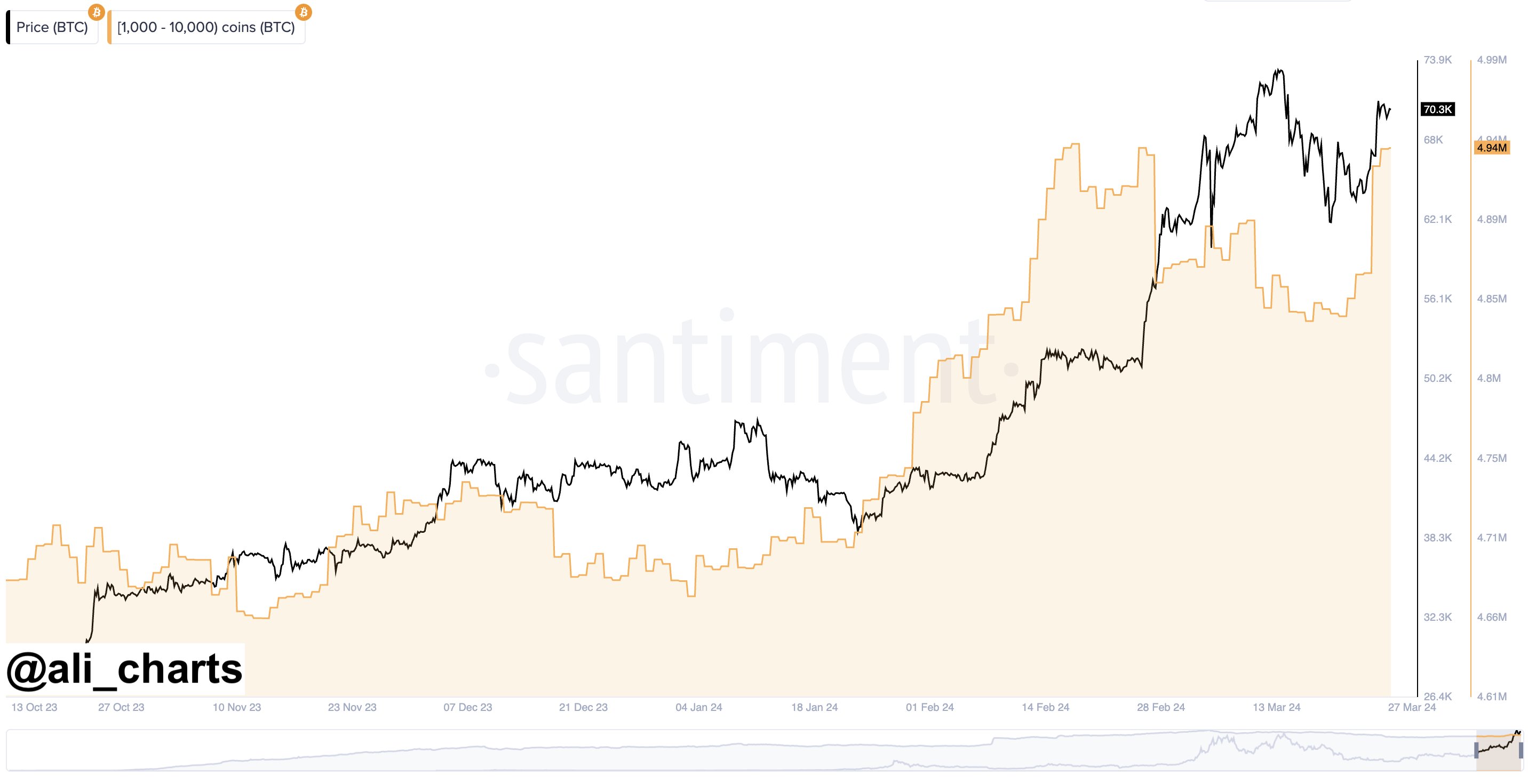

As pointed out by analyst Ali in a post on X, the BTC whales have purchased more than 100,000 BTC over the last week. The indicator of relevance here is the “Supply Distribution” metric from the on-chain analytics firm Santiment.

This indicator tells us about the total amount of Bitcoin that the different wallet groups in the market are holding right now. The addresses are divided into these cohorts based on the total number of coins that they are carrying in their balance.

The 1-10 coins group, for instance, includes all wallets holding at least 1 and at most 10 BTC. In the context of the current discussion, the whale cohort is the one of interest. These humongous entities are typically defined as investors owning between 1,000 and 10,000 BTC.

The chart below shows how the ‘Supply Distribution’ for the Bitcoin whales has changed over the past few months:

As displayed in the above graph, the total amount of Bitcoin supply held by the 1,000-10,000 BTC group has registered a significant jump over the past week or so.

During this buying spree, the BTC whales have added more than 100,000 BTC to their holdings, worth upwards of $7 billion at the current exchange rate of the cryptocurrency.

This latest accumulation from the whales started when BTC was trading around its recent lows, so it’s possible that these large investors believed those prices to be low enough to be profitable entry points, which is why they bought big at them.

As this buying has occurred, BTC’s bullish momentum has reignited, with its price now surging back above the $70,000 level. Given the close timing, it would appear that the whale accumulation was in part a driver for the rally.

Between the start of the year and the end of February, these humongous holders had been continuously buying more of the asset, with their holdings riding on an uptrend.

As the rally progressed further, though, these investors started falling for the allure of profit-taking as they had shifted towards a trend of net distribution instead.

With the recent buying, however, not only has the trend of net distribution reversed, but the supply of the whales has in fact also returned back to levels similar to the ones seen before the distribution had first begun.

If the Bitcoin whales can keep up this buying in the coming days, then the latest rally may be able to continue further, just like how it was earlier in the year.

Naturally, a continuation from here would mean the possibility of a brand new all-time high, as BTC currently isn’t far from setting one.

BTC Price

At the time of writing, Bitcoin is floating around the $71,000 mark, up more than 11% in the last seven days.