Onchain Highlights

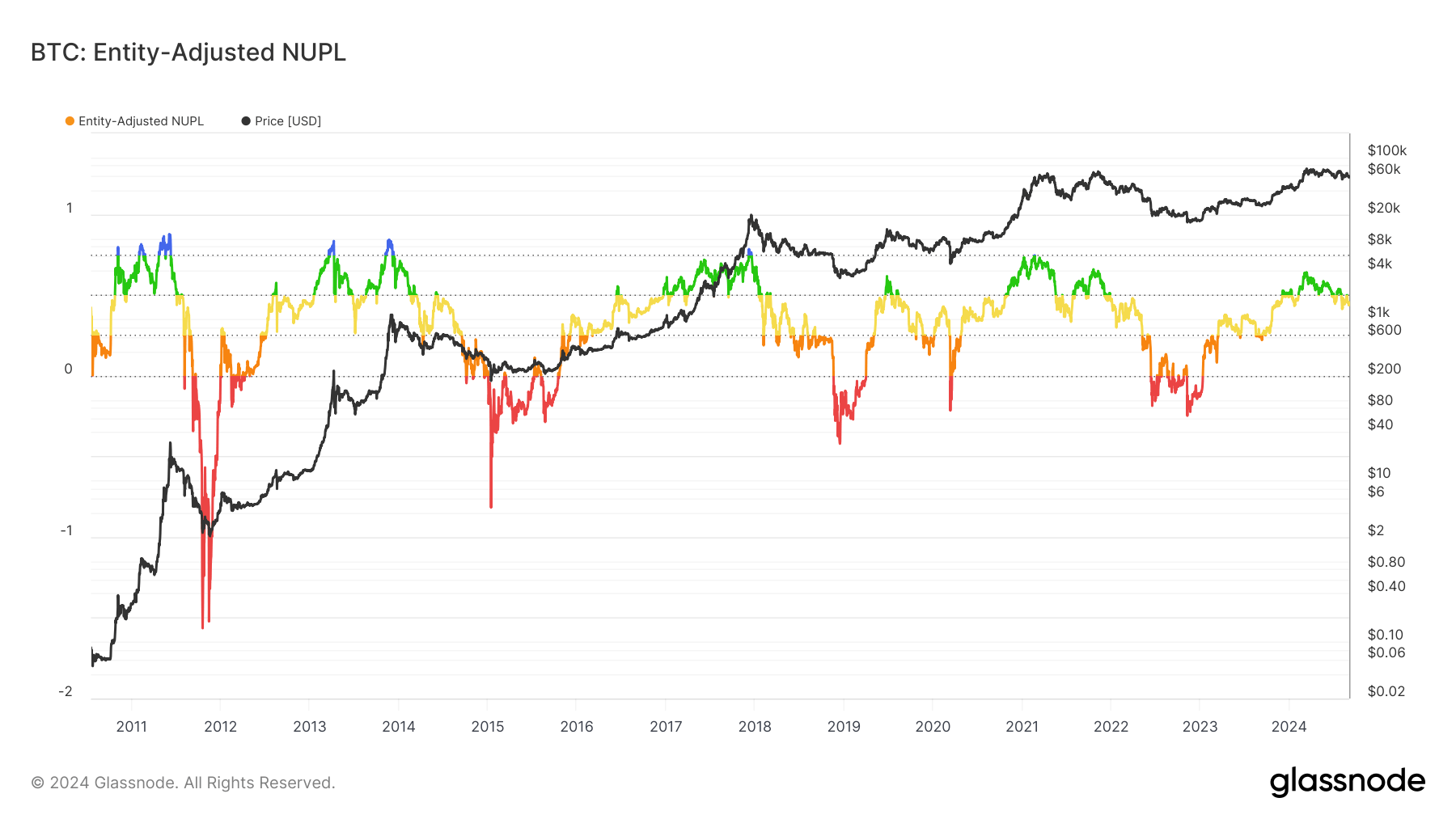

DEFINITION: Entity-adjusted NUPL is an improved variant of Net Unrealized Profit/Loss (NUPL) that discards transactions between addresses of the same entity (“in-house” transactions). It only accounts for real economic activity and provides an improved market signal compared to its raw UTXO-based counterpart.

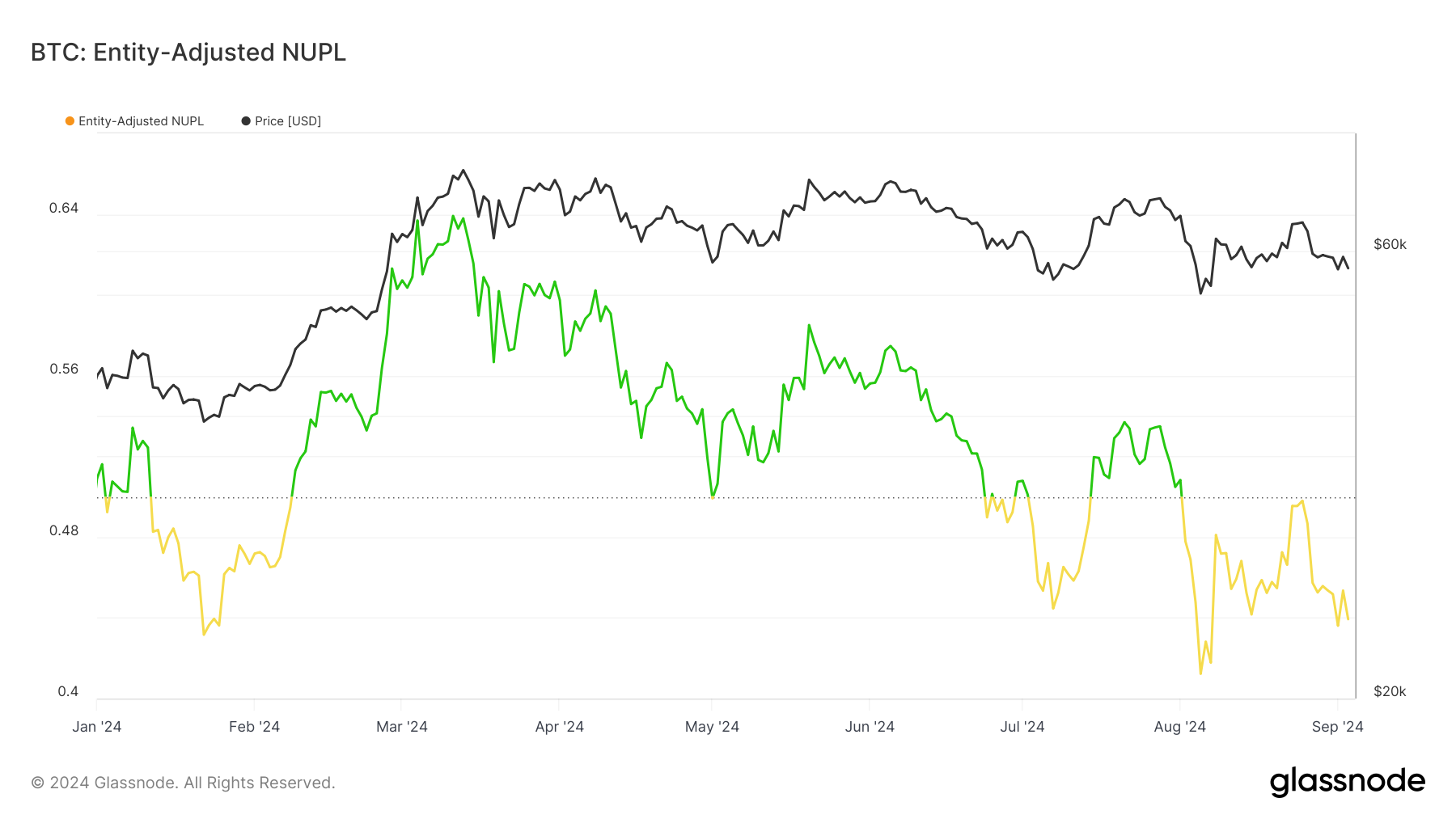

Bitcoin’s Entity-Adjusted NUPL has been in a downtrend since mid-2024, reflecting increased market uncertainty. This metric, which excludes internal transactions and focuses on external economic activity, has shifted from positive territory early in the year to neutral and now near-loss levels.

Historically, similar shifts in NUPL values have signaled market corrections or extended consolidation phases. The pattern aligns with Bitcoin’s recent price movements, as it continues to hover below the $60,000 mark.

Comparing this to earlier periods, a similar downturn in NUPL was observed following the 2017 and 2021 bull cycles, preceding Bitcoin’s market retracements. While NUPL is currently trending lower, previous cycles have demonstrated that a transition into the yellow and red zones often precedes a recovery phase. The present state highlights a potential shift in market sentiment, reflecting caution and reduced profitability for market participants.

The post Bitcoin’s entity-adjusted NUPL signals heightened market uncertainty below $60k appeared first on CryptoSlate.