Since June 22, Bitcoin has been trading above the critical psychological level of $30,000. This price rally is a result of increased demand for the digital asset, a demand that is further exacerbated by the low availability of Bitcoin on exchanges.

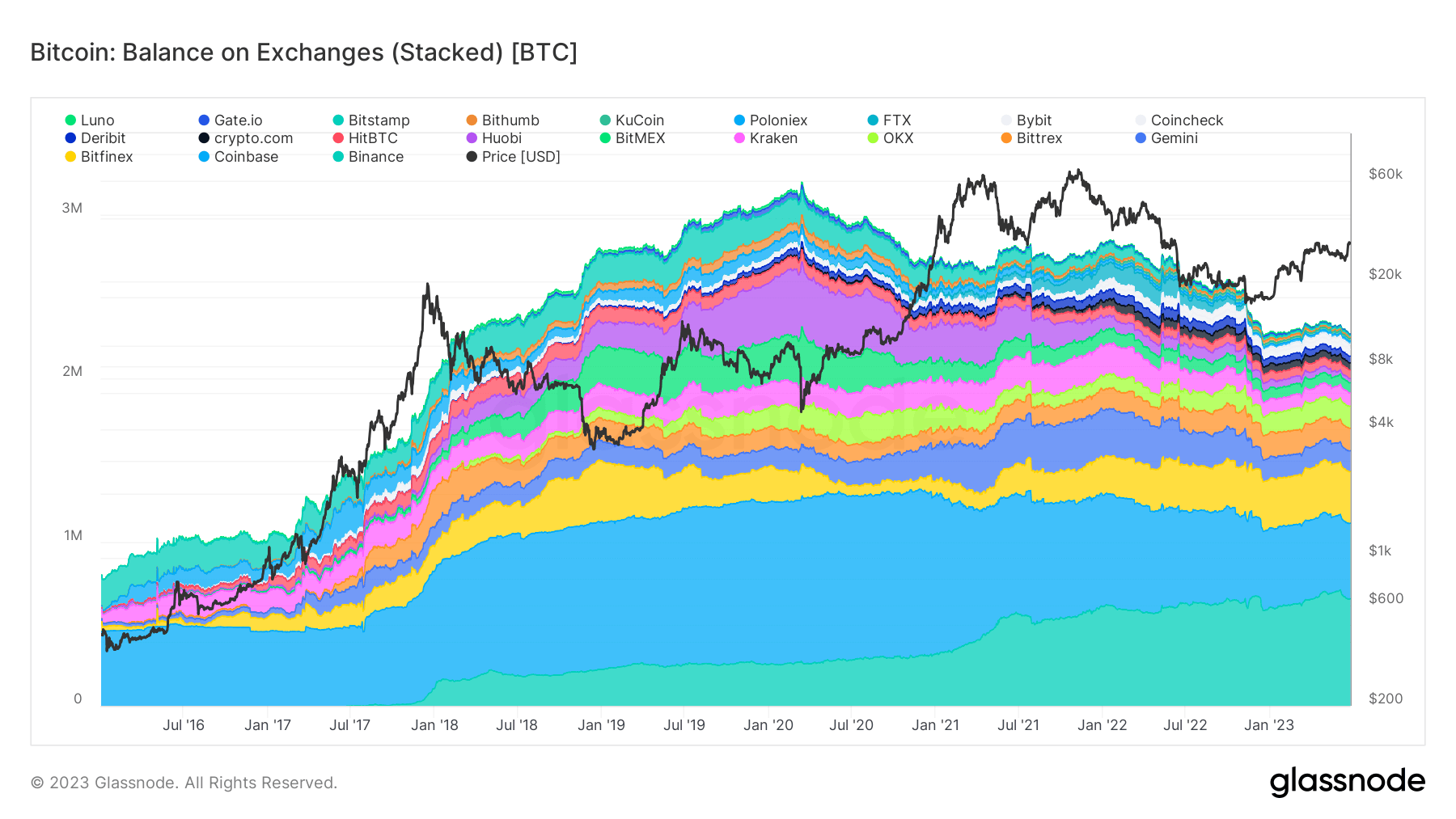

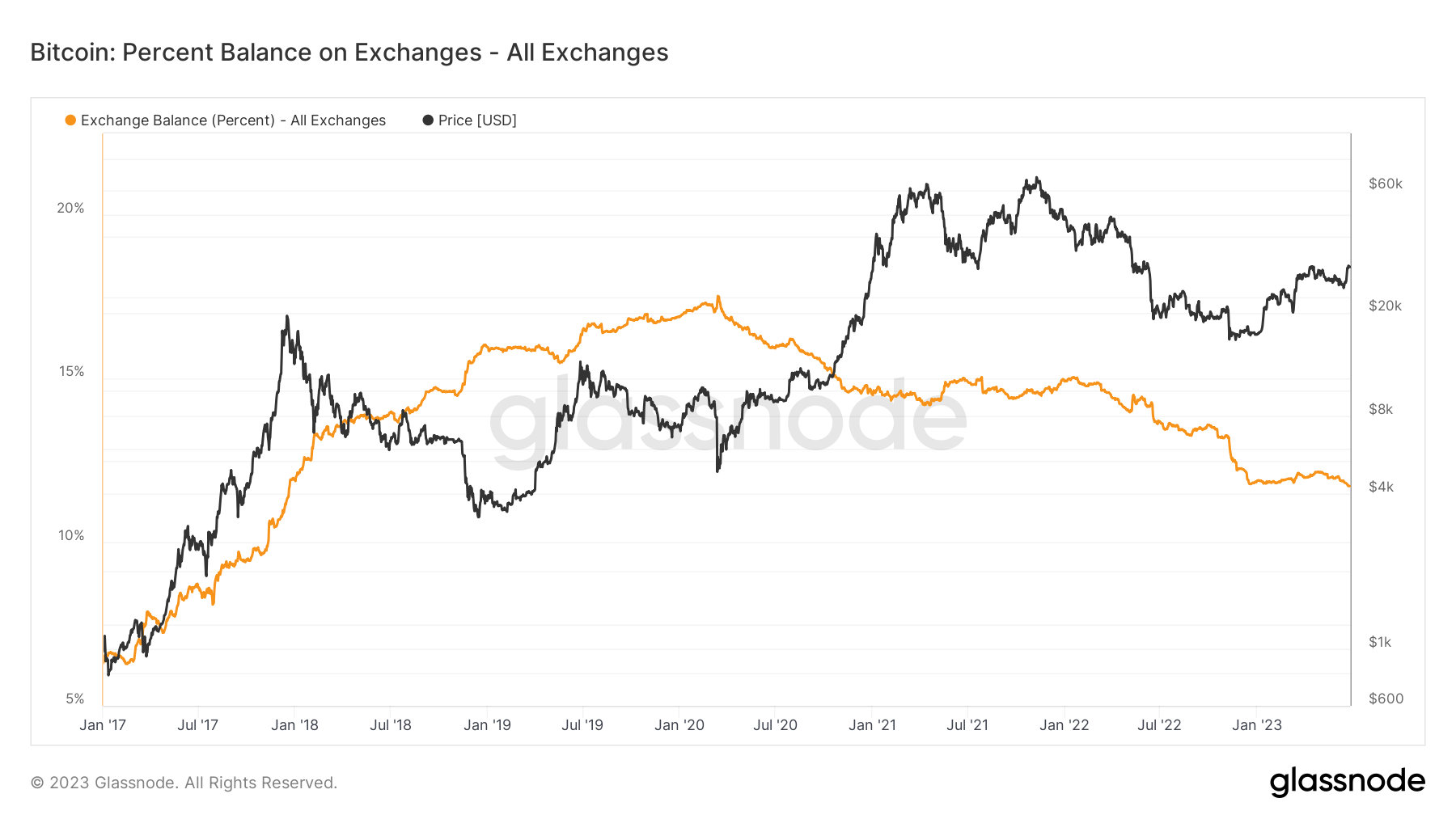

One key metric that underscores this trend is the percentage of Bitcoin’s supply held on exchanges. Data from Glassnode measures the total amount of coins held on exchange addresses and calculates the percentage of the supply on exchanges.

When a large amount of Bitcoin is held on exchanges, it often indicates that investors are ready to sell their holdings, suggesting a bearish sentiment. Conversely, a decrease in the amount of Bitcoin on exchanges can imply that investors are moving their assets to private wallets for long-term holding, signaling a bullish sentiment.

Moreover, the amount of Bitcoin on exchanges directly impacts market liquidity. High liquidity means that there are a large number of market participants, and buyers will quickly absorb any large sell orders. However, if the amount of Bitcoin on exchanges decreases significantly, it could lead to lower liquidity. This means that large sell orders could drastically affect the market price, leading to increased volatility.

Therefore, tracking the amount of Bitcoin held on exchanges can provide valuable insights into potential market movements and investor sentiment.

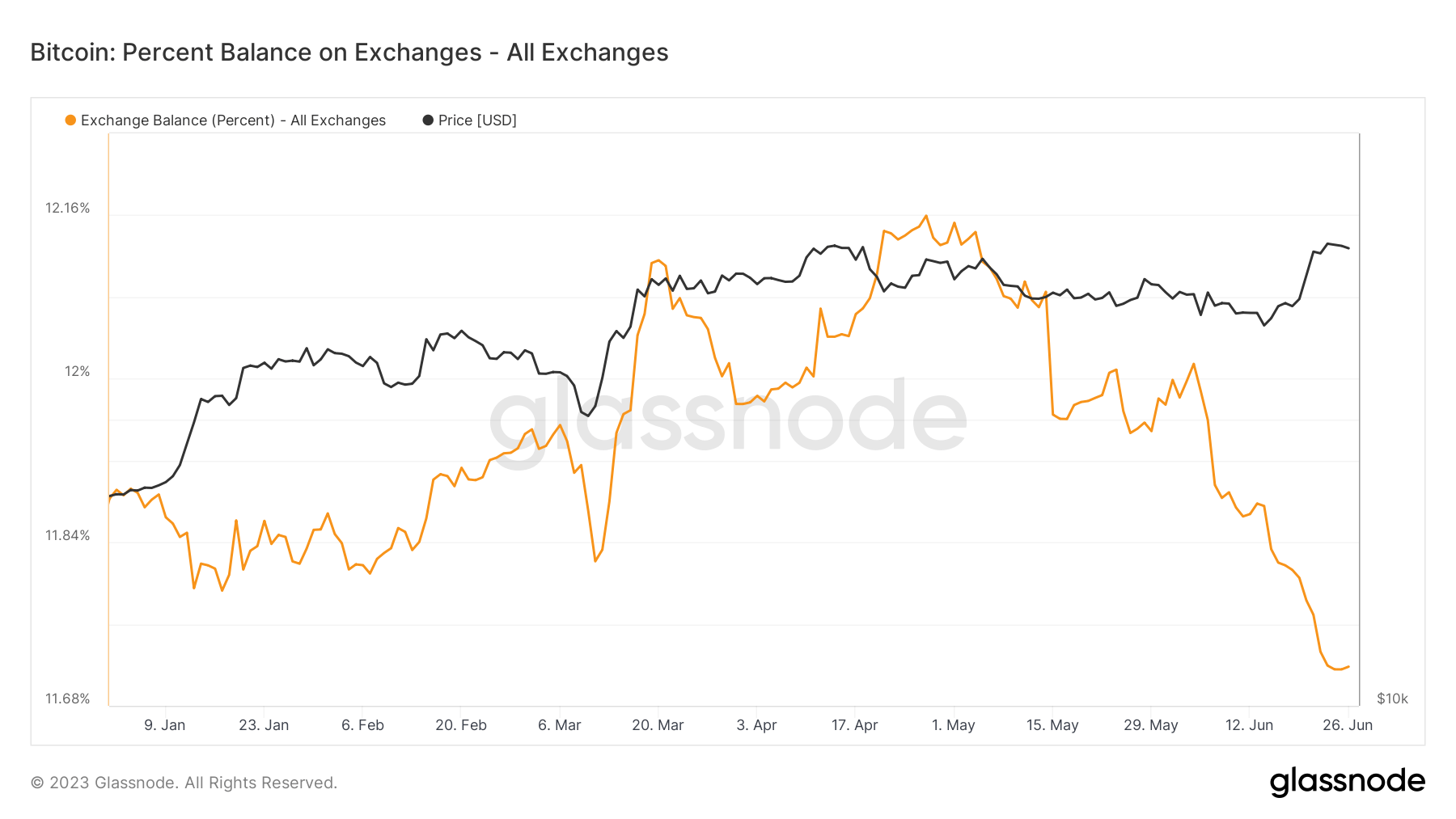

The percentage of Bitcoin’s supply held on exchanges has been on a downward trajectory since the end of April when it reached its year-to-date (YTD) high of 12.16%.

However, a broader perspective reveals that the amount of Bitcoin held on exchanges has been in decline since March 2020, when it reached an all-time high of 17.51%.

The percentage of Bitcoin’s supply held on exchanges has now dropped to a five-and-a-half-year low of 11.71%, reaching levels last recorded in December 2017. This trend indicates a shift in investor behavior, with more holders opting to store their Bitcoin off exchanges, possibly in anticipation of future price appreciation.

The post Bitcoin’s exchange balance drops to 5-year low as price hits $30K appeared first on CryptoSlate.