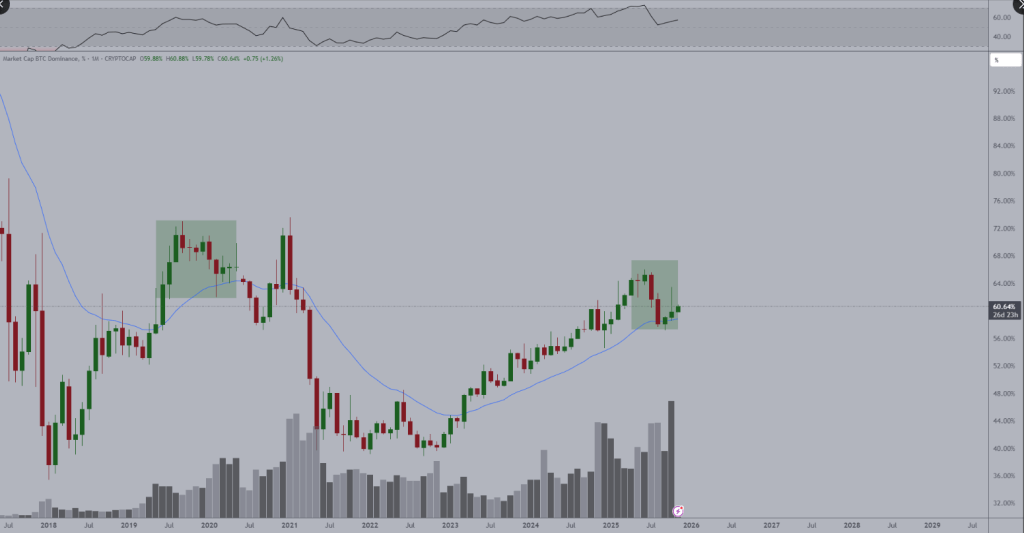

Bitcoin dominance sits at 60% and has been testing a vital long-run support line. According to market veteran Michaël van de Poppe, that support — the 20-month MA, near 59% — is the signal traders should watch.

He warned that a confirmed break under that level could flip the market’s favor toward altcoins. Short moves can happen. Big shifts follow.

Bitcoin Dominance At A Crossroads

Based on reports and chart reads, The 20-month MA has been touched several times recently. In September, Bitcoin dominance briefly slipped below 59% before bouncing back, a move that shows the index is being pushed and probed.

Van de Poppe drew a parallel to late 2019, when a long run above that moving average eventually gave way and set the stage for a long altcoin run. He told followers it could be “party time” if the line is broken with conviction.

The #Bitcoin dominance is still trending upwards, but on edge to be breaking south.

Why?

It’s mimicking Q4 2019.

I’d want to see a break beneath the 20-Monthly MA.

If that happens, that’s party time. pic.twitter.com/m21WnBhKuj

— Michaël van de Poppe (@CryptoMichNL) November 4, 2025

Traders say this test matters because it is not just a small tug of war. It is a structural test that could change where money flows next. Momentum would likely shift. Market behavior could become more favorable to smaller coins.

Historical Echoes From 2019

Back In September 2019, Bitcoin dominance peaked at 73% before the index began a steady slide. It tested the long moving average by February 2020, then in mid-2020 the structure changed and the drop continued until dominance hit 39% by December 2021.

Reports point to that period as when many altcoins outperformed Bitcoin and saw large gains. Some analysts believe a repeat pattern is possible if the same technical threshold fails.

Analyst Steve, from Crypto Crew University, flagged comparable chart shapes and resistance points that came before the major altcoin rallies of 2017 and 2021.

He suggested the pattern might reappear, perhaps around 2026, meaning an altcoin upswing could arrive later rather than sooner.

What Traders Are Watching

Several clear markers are being followed. The 20-month MA at 59.29% is one. A sustained close below that level would be the clearest technical trigger.

Volume trends and how quickly dominance moves after a break will be watched closely. In addition, analysts will watch whether major Bitcoin flows — such as ETF activity, exchange balances, or large holder moves — change, because those can speed up or slow down an altcoin response.

Featured image from Gemini, chart from TradingView