The price of Bitcoin appears to have cooled off after displaying great strength in recovering the $90,000 level over the past week. According to the latest price action data, this price jump will only be transient, as the premier cryptocurrency is seemingly still stuck in a bearish structure.

BTC Price Momentum Continues To Slow Down

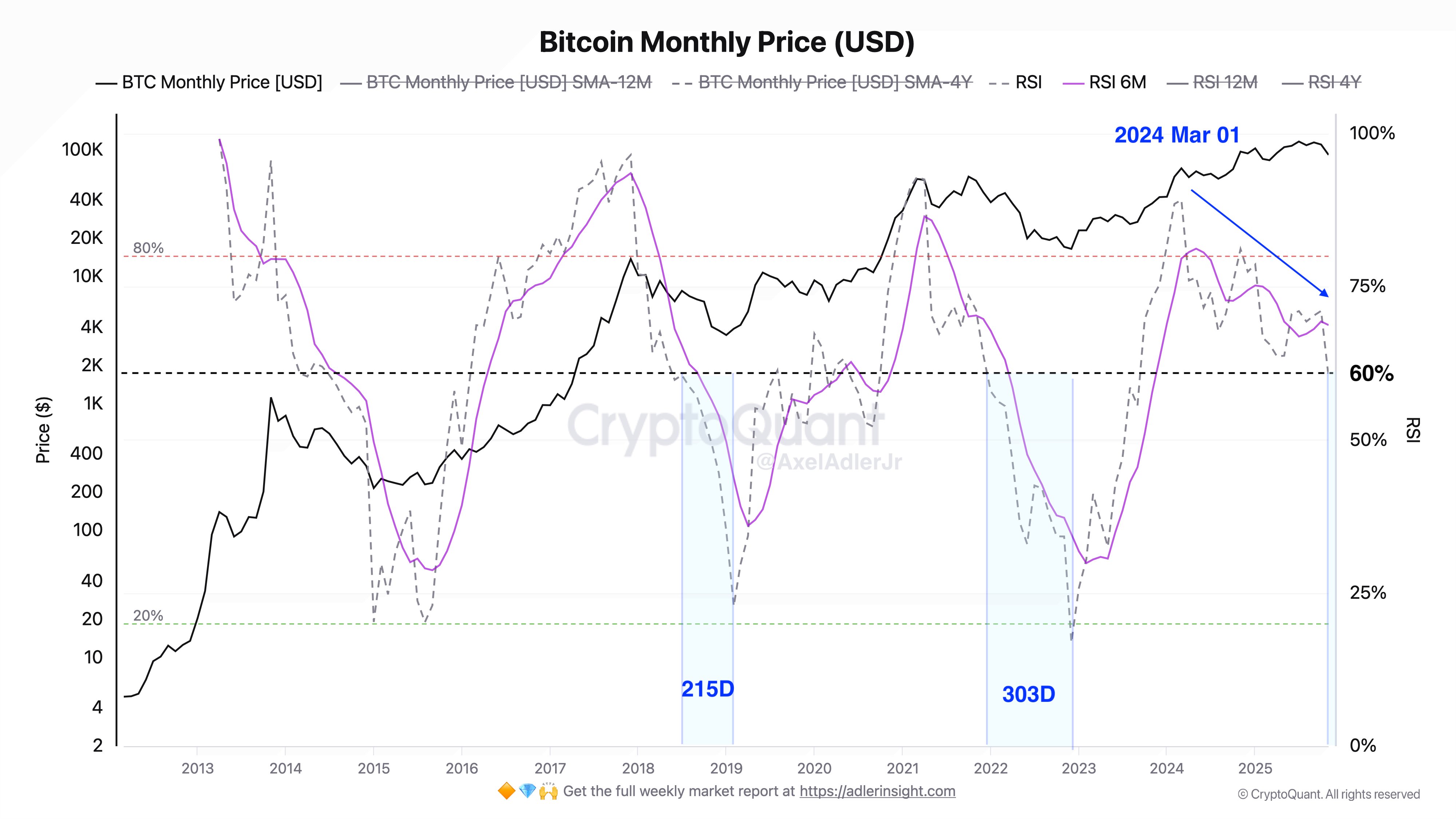

On November 29, market analyst Axel Adler Jr. shared a fresh outlook on the price of BTC on the social media platform X. The crypto pundit revealed that the market leader might be entering a zone of “elevated risk for a prolonged correction.”

According to Adler Jr., the price momentum of Bitcoin has been witnessing a cool-off since March 2024. This observation is based on changes in the monthly Relative Strength Index, an indicator that measures the speed and magnitude at which an asset’s price changes.

Related Reading: Bitcoin Investors Are Not ‘Remotely Bullish Enough’ — Bitwise Researcher

Data from CryptoQuant shows that the monthly Bitcoin RSI has fallen from overheated levels down to 60% since March 2024, a period marked by significant price surges. From a historical perspective, this decline could spell further trouble for the price of BTC.

As Adler Jr. highlighted on X, the flagship cryptocurrency took between 200 to 300 days to begin a new bullish wave after an RSI decline of that magnitude in the previous two cycles. Using this historical pattern, the Bitcoin price might not reach its next bottom until between June and October 2026.

Bitcoin Whales Show Reduced Conviction: Alphractal CEO

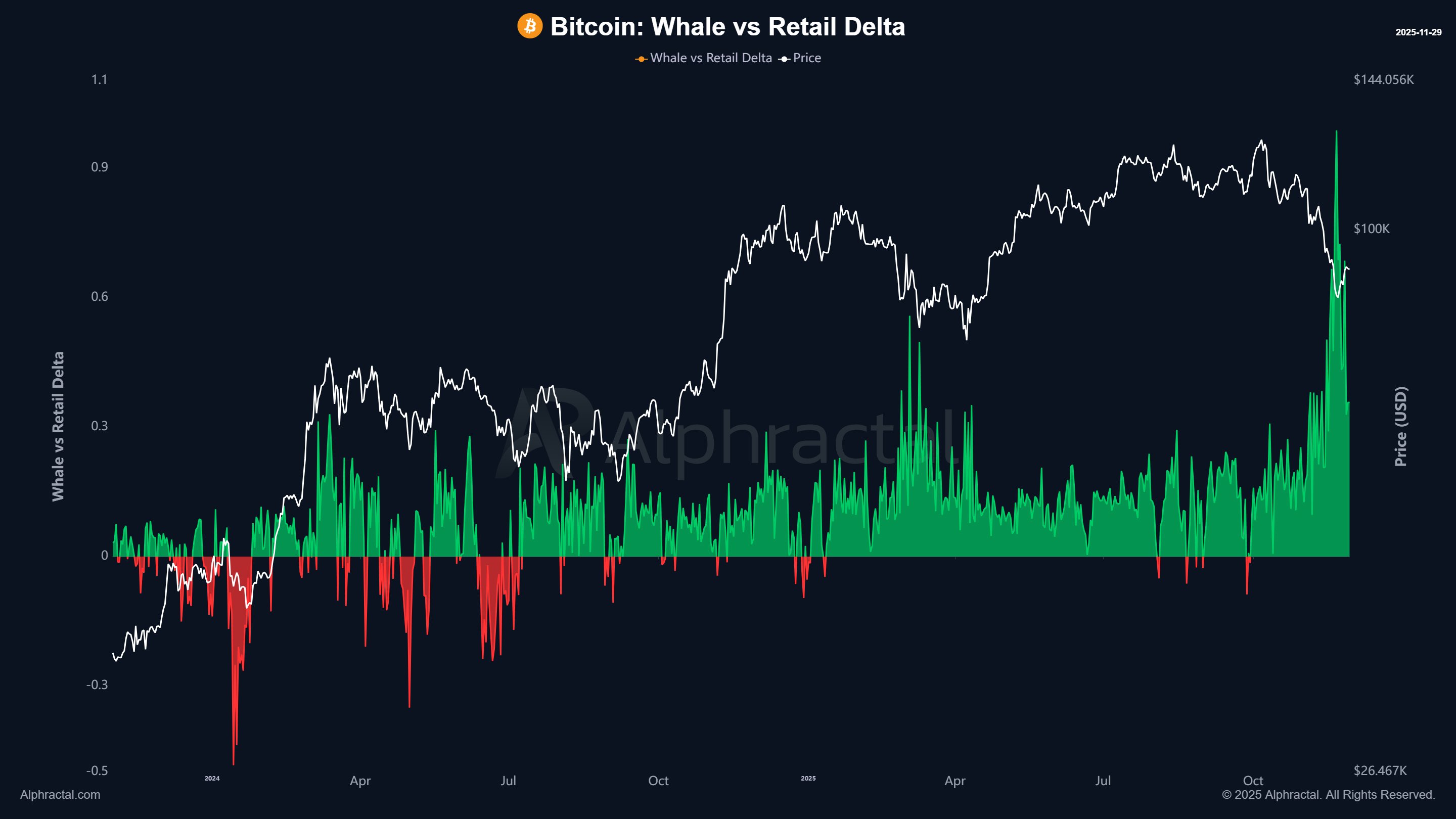

From a different on-chain standpoint, Alphractal CEO and founder Joao Wedson also has a similar not-so-optimistic stance on the price of Bitcoin in the near term. This evaluation is based on the positions of the largest investors (whales) compared to retail investors.

According to Wedson, BTC whales are either closing their long positions or slightly increasing their BTC shorts compared to retail investors. Typically, this trend leads to a period of sideways price movement — as seen between March and April 2025.

Wedson also noted that some bears are probably looking to push the BTC price toward the $80,000 level before going on an accumulation spree. Ultimately, the combination of the falling momentum and whales’ lack of conviction paints a somewhat pessimistic picture for Bitcoin.

As of this writing, the price of BTC stands at around $90,979, reflecting no significant changes in the past 24 hours. Meanwhile, the market leader is up by more than 7% on the weekly timeframe, according to data from CoinGecko.