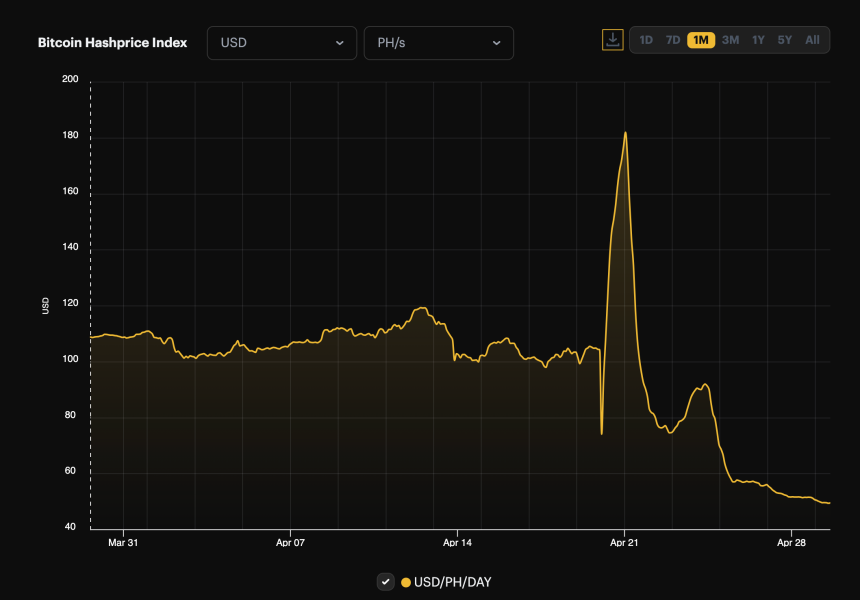

In Bitcoin mining, the activity’s profitability is significantly influenced by a metric known as the ‘hash price.’ This metric has recently plummeted to unprecedented levels, causing concerns within the mining community.

Bitcoin’s Latest Halving Sends Hash Price Into Freefall

As Bitcoin underwent its fourth halving event on April 20, expectations were high regarding a potential increase in miner revenue. However, contrary to these expectations, the hash price witnessed a steep decline, currently valued at less than $50 per PH/s per day.

The concept of hash price, developed by Luxor, a Bitcoin mining services company, helps understand the daily dollar earnings a miner can expect per unit of hashing power.

Despite Bitcoin’s hash rate remaining strong, the halving event, which reduced the mining reward from 6.25 BTC to 3.125 BTC per block, has exerted downward pressure on the critical profitability metric.

This reduction in potential earnings comes when the overall cryptocurrency market, including Bitcoin, is experiencing volatility.

This downturn in hash price is not isolated but coincides with other declining metrics in BTC. According to TradingView, Bitcoin’s dominance index has also reduced, highlighting a decrease in capitalization relative to the total crypto market.

Bitcoin’s dominance has declined from 57.10% mid-month to approximately 54.69% today. Concurrently, Bitcoin’s market value has also trended downward; over the past week, the cryptocurrency experienced a decrease of about 4.4%.

This downward trend persisted into the past day, with Bitcoin’s price dropping an additional 0.8%.

Signs Of A Bullish Future Amid Bitcoin Current Slump

Despite the downward turns, analysts like those from CryptoQuant suggest that bullish signals might still be on the horizon. They point to the Adjusted Spent Output Profit Ratio (aSOPR), which, despite current market indecisiveness, continues to exhibit bullish trends.

Moreover, expert analysts like Rekt Capital have weighed in with a long-term perspective, suggesting that Bitcoin could see a significant rally as part of this halving cycle, drawing parallels with previous cycles.

Historical data shows that Bitcoin typically reaches a market peak within 500-550 days post-halving. If these patterns hold, Bitcoin could be poised for substantial gains by mid to late 2025, reinforcing the cyclical nature of this leading digital asset’s market movements.

Overall, while the immediate effects of the halving on hash price and market dynamics paint a sad picture, the underlying data indicates a mix of caution and optimism.

Featured image from Unsplash, Chart from TradingView