Onchain Highlights

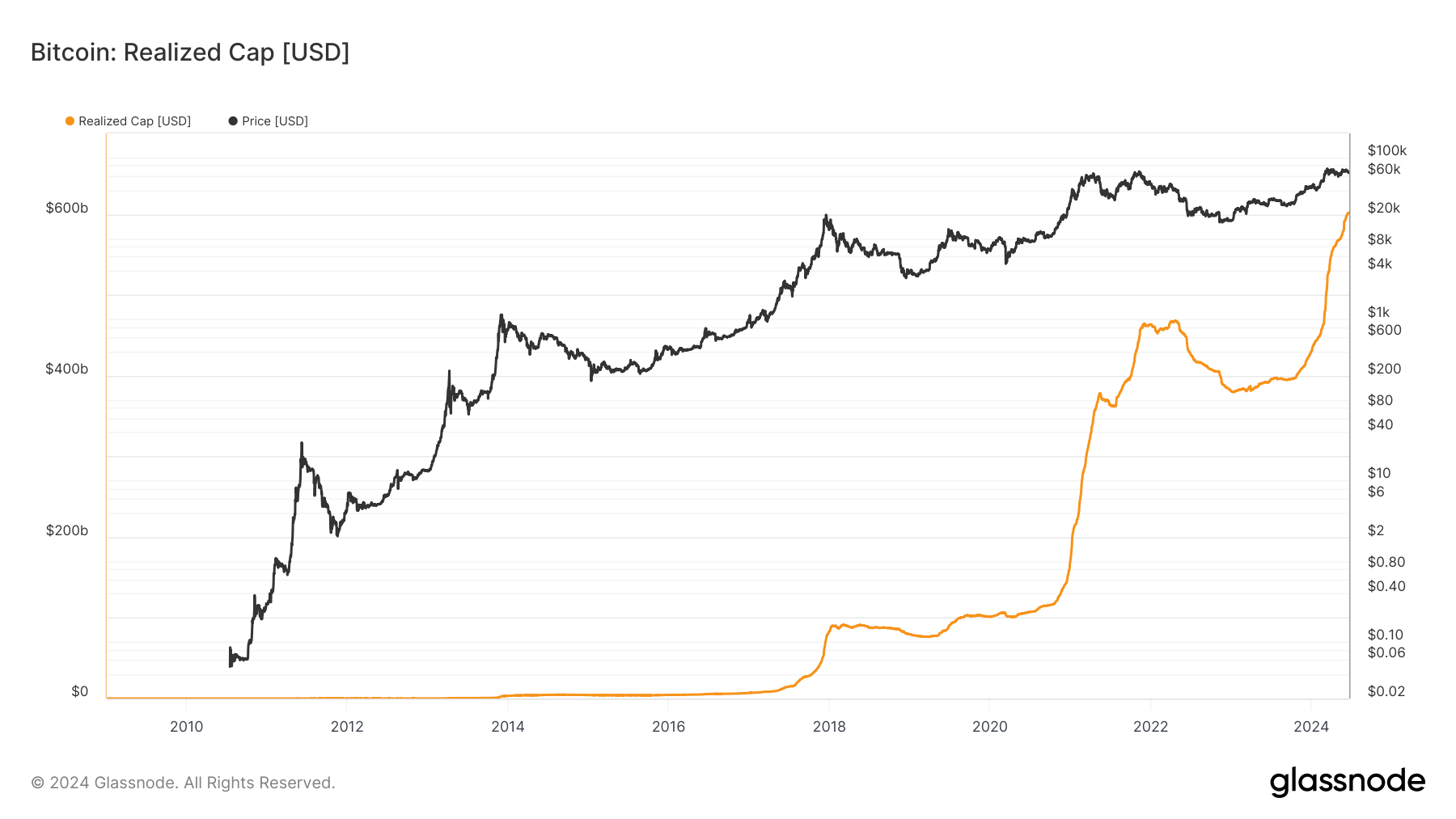

DEFINITION: Realized Cap values different part of the supplies at different prices (instead of using the current daily close). Specifically, it is computed by valuing each UTXO by the price when it was last moved.

Bitcoin’s realized capitalization has shown a marked increase alongside the asset’s price in 2024. As depicted in the charts, realized cap reflects the aggregate value of all BTC at the price they were last moved, diverging from traditional market capitalization metrics. This metric reached approximately $600 billion in June 2024, coinciding with Bitcoin’s price stabilizing near $63,000.

Historical data indicates a consistent upward trajectory in the realized cap, with notable accelerations during significant market rallies. The current surge indicates substantial market activity, with long-term holders transacting and potentially revaluing older UTXOs at higher prices. This trend aligns with the post-halving period’s impact on market forces, often marked by reduced supply growth and increased demand.

The realized cap’s growth provides insights into market sentiment and investor behavior, highlighting confidence in Bitcoin’s value retention over time. The interplay between the realized cap and price illustrates Bitcoin’s maturation as a digital asset, with increasing capital locked in at higher valuations reflecting a robust market structure.

The post Bitcoin’s realized market cap hits $600 billion appeared first on CryptoSlate.