Quick Take

Bitcoin’s price rally from October 2023, which saw it soar from $25,000 to $49,000 in January 2024, witnessed the digital asset hitting the $40,000 mark for the first time since April 2022 on Dec. 4.

From then on, it steadily consolidated above $40,000 for 49 consecutive days. However, it lost the $40,000 support level on Jan. 22. Bitcoin’s trading price currently hovers around $42,000.

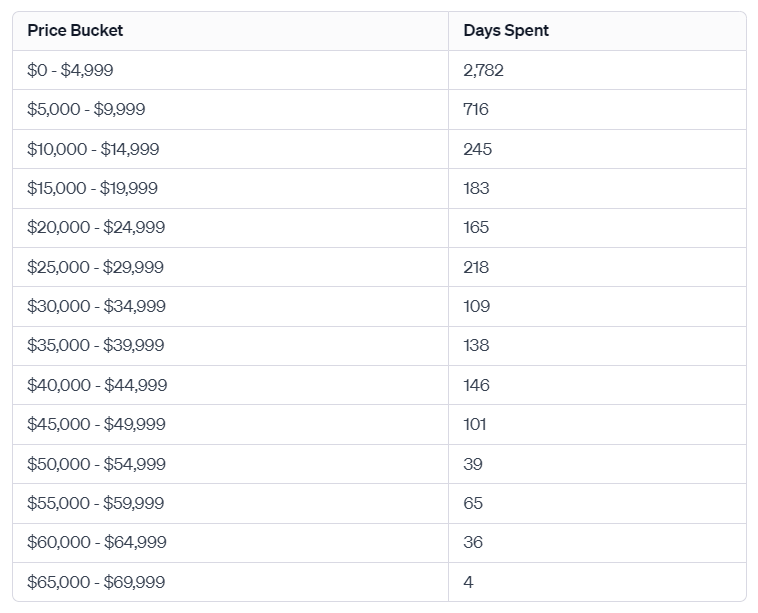

Digging deeper, the price analysis in $5,000 increments reveals a pattern. Bitcoin has been trading within the price range of $40,000 to $44,999 for 146 days. This duration has recently overtaken its previous stint in the $35,000 to $39,999 range, which spanned approximately 138 days.

When assessing price increments from $10,000 and upwards until $49,999, it becomes apparent that Bitcoin typically trades within these ranges for a period between 100 and 250 days. Thus, the current sideways price action aligns with Bitcoin’s historical trading patterns and can be considered characteristic behavior, not an anomaly.

The post Bitcoin’s steady stand: 146 days of trading between $40k and $45k appeared first on CryptoSlate.