Bitcoin’s (BTC) price briefly reclaimed $31,000 earlier today before suddenly plunging below $30,000 in a sell-off that led to losses for traders who held positions in the market.

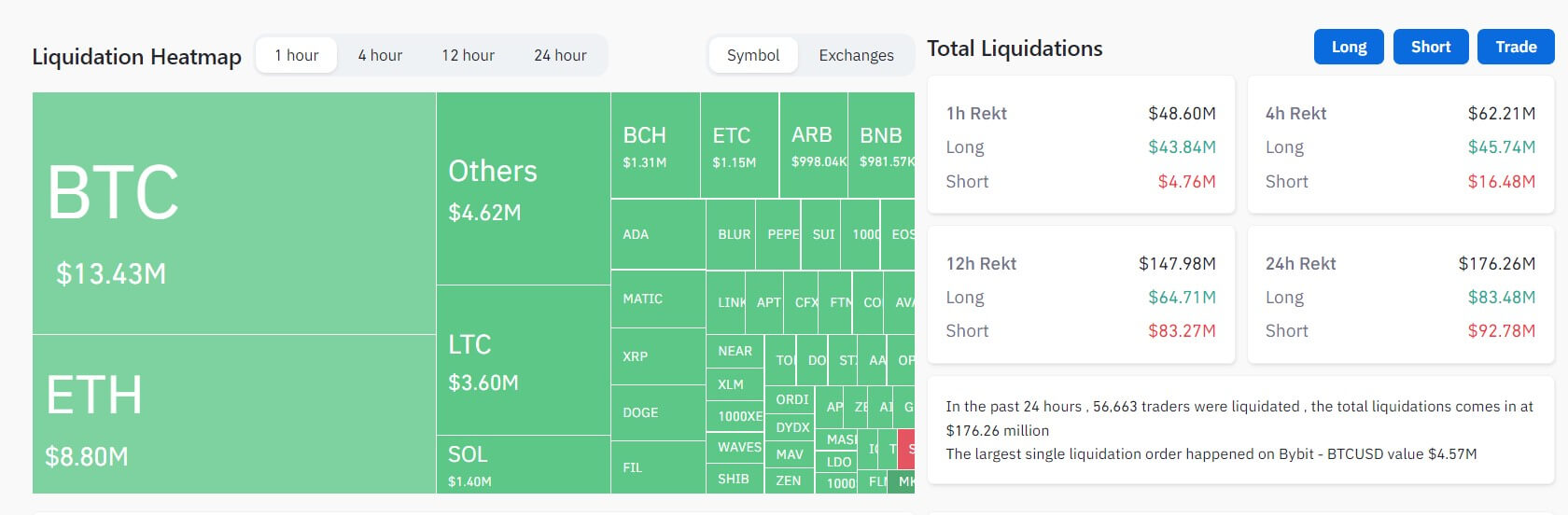

According to Coinglass data, the sudden price movement wiped off over $176 million who held positions in different digital assets in the last 24 hours.

Over $170 million liquidated

The crypto market saw $176.26 million liquidated in the past 24 hours, with more than 56,000 traders impacted by the market volatility.

Data from Coinglass showed that short traders lost $92.78 million, with Bitcoin and Ethereum accounting for over $46.22 million of these losses.

Meanwhile, long traders experienced $83.48 million in liquidations. The top two digital assets were responsible for more than $35.54 million of these losses.

Bitcoin Cash (BCH), which has enjoyed a surge in value since it was listed on EDX Markets on June 20, saw nearly $20 million in long and short traders’ liquidations, while Litecoin liquidated over $10 million.

Meanwhile, other assets such as Dogecoin, BNB, Chainlink, XRP, and Solana also recorded significant liquidations.

Across exchanges, most of the liquidations occurred on OKX, Binance, and ByBit. These three exchanges accounted for over 80% of the overall liquidations, with 55% being long positions.

The most significant liquidation occurred on ByBit– BTCUSD, valued at $4.57 million.

Sudden crash

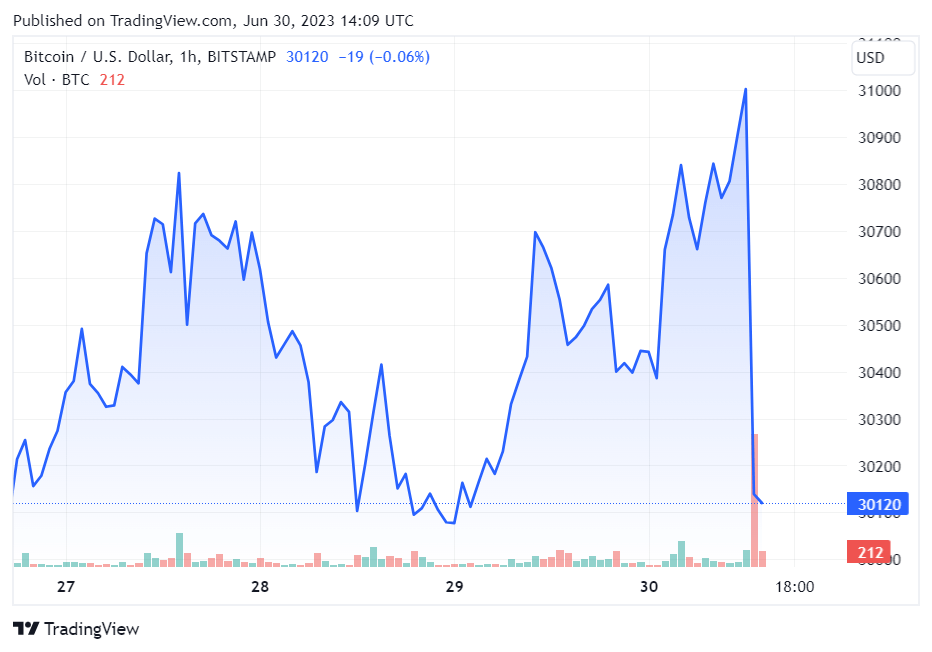

According to CryptoSlate’s data, BTC suddenly crashed by 3.53% on the 1-hour candle to $29,946 at the time of writing. This sudden collapse coincided with a Wall Street Journal article that reported shortcomings in the spot Bitcoin ETF applications recently filed by BlackRock and Fidelity.

The sudden price movement bucks the flagship digital asset’s positive trend over the past month, which has seen it rise by 15% and peak at over $31,000.

During this period, the crypto industry witnessed a wave of institutional interest triggered by BlackRock’s June 15 Bitcoin Spot ETF application. Since then, several traditional financial institutions, including Fidelity and others, have applied as well.

The post Bitcoin’s sudden plunge below $30k triggers $176 million in liquidations appeared first on CryptoSlate.