Quick Take

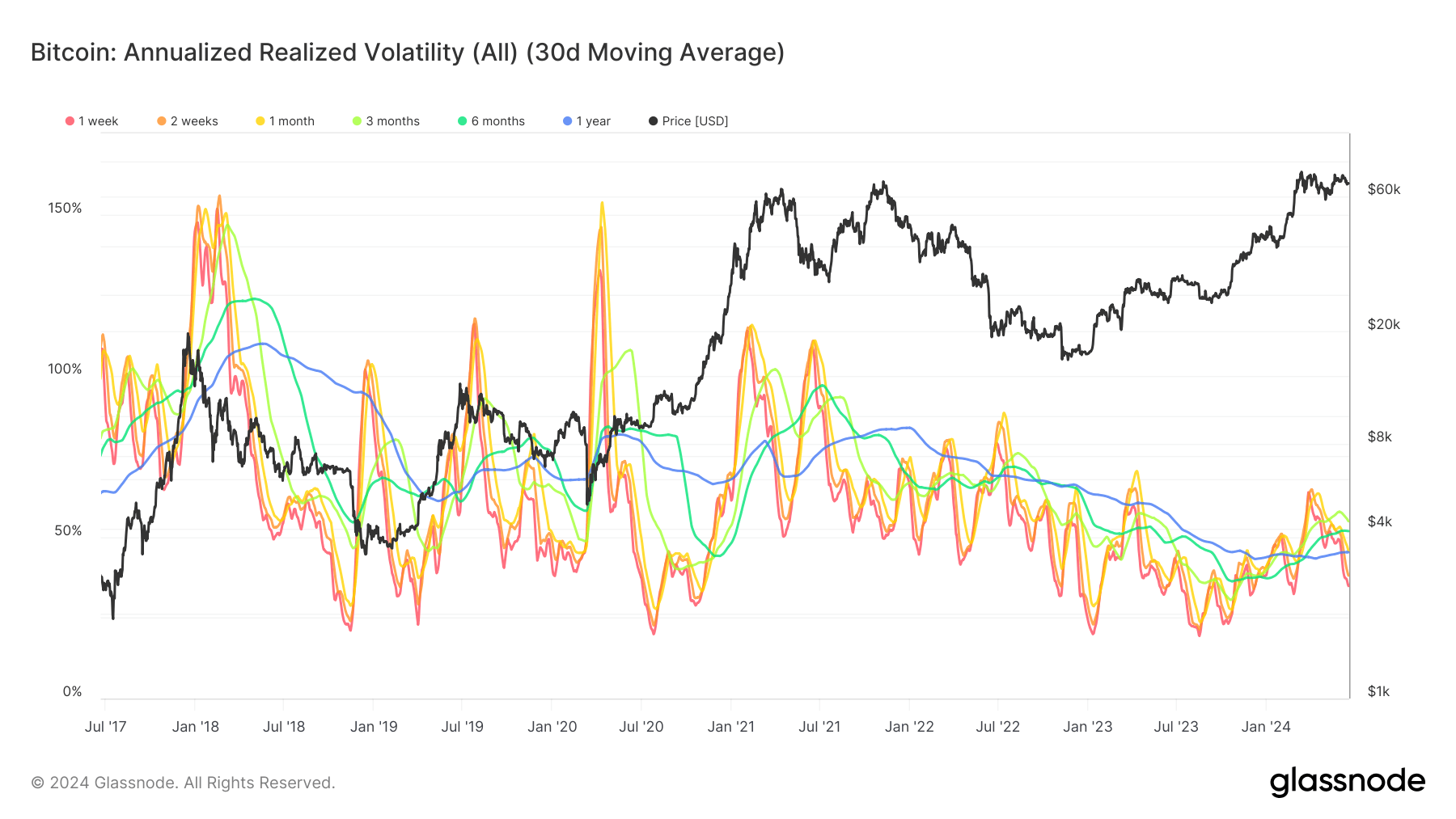

Glassnode defines realized volatility as the standard deviation of returns from the mean return of a market, indicating market risk. High values signal high-risk phases. Unlike implied volatility, which predicts future market volatility, realized volatility measures past market fluctuations. Calculated based on daily returns and annualized, it offers insight into market behavior over rolling windows of various durations: 1 week, 2 weeks, 1 month, 3 months, 6 months, and 1 year.

The chart illustrates that annualized realized volatility for Bitcoin has trended downwards since its March peak. Specifically, the 1-week, 2-week, and 1-month volatilities have decreased from around 60% to approximately 30%. Historically, high volatility rates coincide with significant market events, such as the 2017 peak, the September 2019 bottom, the mid-cycle top in July 2019, and the 2021 peak. Despite these fluctuations, the overall trend shows a decline in volatility, according to Glassnode data.

The current low volatility can be attributed to Bitcoin’s ongoing consolidation phase. Notably, Bitcoin has been consolidating in the previous all-time high (ATH) region for 3.5 months, marking the most extended period of sideways movement around a previous cycle’s ATH, according to an anonymous X account, Daan Crypto Trades.

Daan Crypto Trades highlights this extended consolidation, contrasting it with the quicker consolidation period in 2020, which lasted just 3-4 weeks. This prolonged sideways movement emphasizes the current stability and reduced volatility in the Bitcoin market.

“Currently we’re on our longest sideways chop around a previous cycle’s all time high. 2020 was the quickest and took just 3-4 weeks”.

The post Bitcoin’s volatility hits new lows during prolonged market consolidation appeared first on CryptoSlate.