Quick Take

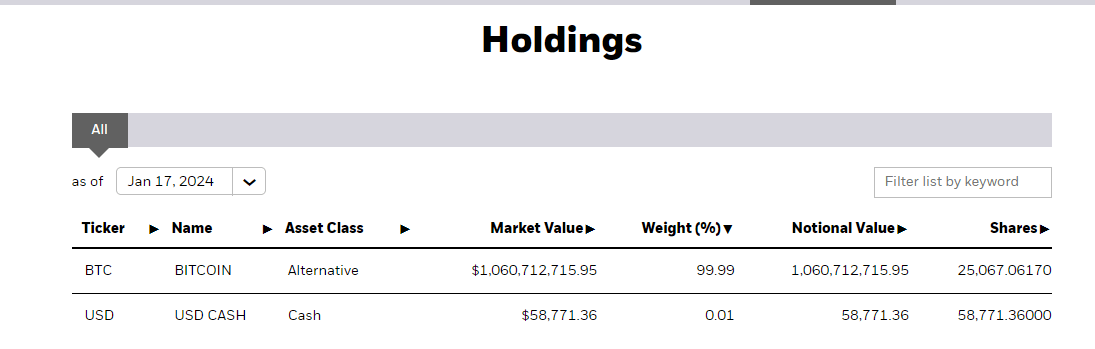

BlackRock’s IBIT Bitcoin ETF has recently made headlines, surpassing a net inflow of $1 billion and acquiring 25,067 Bitcoin within four trading days. A deeper analysis reveals that at this acquisition rate, it would reach 592,000 BTC – an equivalent to Grayscale’s current holdings – in approximately 178 days, setting a target date around mid-July. However, this analysis would be incomplete without considering the concurrent outflows from Grayscale’s Bitcoin Trust (GBTC).

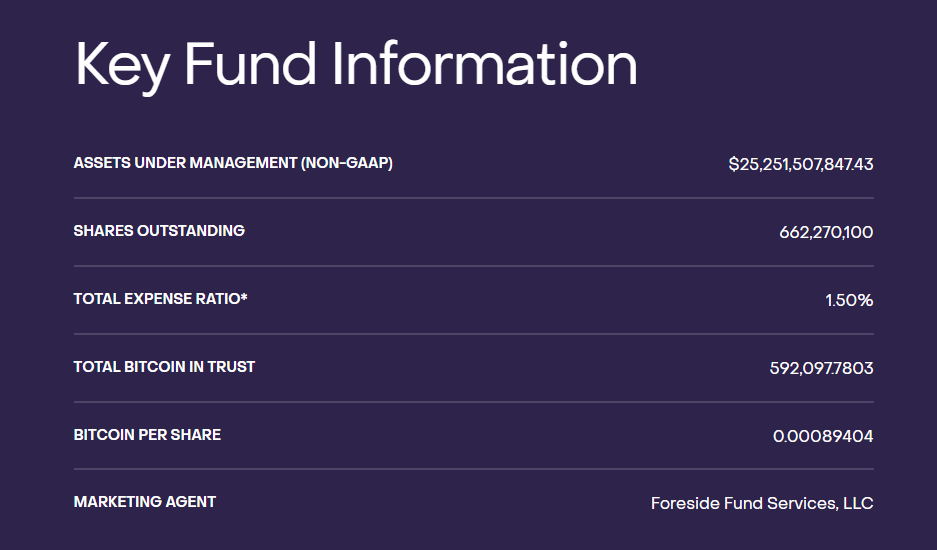

Grayscale has experienced outflows in the region of $1.6 billion over the past four trading days, representing roughly 37,209.30 BTC at a current price of $43,000. If we maintain this rate of depletion, Grayscale’s BTC holdings of 592,000 would be exhausted in approximately 63.64 days.

Pitting these figures against each other, if both entities continue at their current rates, BlackRock’s Bitcoin holdings would surpass Grayscale’s in approximately 37 days. This comparative glimpse into BlackRock’s aggressive acquisition and Grayscale’s significant outflows paints a dynamic picture of the competitive landscape within the Bitcoin ETF market.

The post BlackRock on track to surpass Grayscale Bitcoin holdings in 37 days appeared first on CryptoSlate.