The post Breakout Alert! Cardano (ADA) Price Set for Major Rally, $1.50 Next? appeared first on Coinpedia Fintech News

ADA, the native token of the Cardano blockchain, is poised to continue its upward momentum after trading sideways for a week. On November 29, 2024, ADA has formed a bullish price action pattern on a smaller time frame and is on the verge of a breakout.

This breakout could potentially propel ADA’s price to a new high and attract new investors.

ADA Price Action, Breakout Imminent?

According to expert technical analysis, ADA has formed a bullish inverted head-and-shoulders price action, signaling a potential breakout.

Cardano (ADA) Price Prediction

Based on recent price action and technical analysis, if ADA breaches the neckline of the pattern and closes a four-hour candle above the $1.07 level, there is a strong possibility that it could soar by 15% to reach the $1.23 level in the coming days, and potentially even higher to $1.50 if the momentum remains unchanged.

On the positive side, ADA’s Relative Strength Index (RSI) indicates that the altcoin has sufficient room for upward momentum in the coming days. The chart on the four-hour time frame shows that ADA’s RSI is currently at 59, which is below the overbought zone of 70.

Bullish On-Chain Metrics

ADA’s bullish technical outlook is further supported by large holders and traders. According to the on-chain analytics firm Coinglass, traders and investors are actively participating in the altcoin.

Coinglass’s ADA spot inflow/outflow data indicates that whales and investors have significantly accumulated the token. Since November 17, 2024, ADA has experienced negative net flow, meaning whales and traders have continuously withdrawn tokens from exchanges to their wallets.

This negative net flow is a bullish sign for token holders and suggests that a price decline is less likely in the coming days.

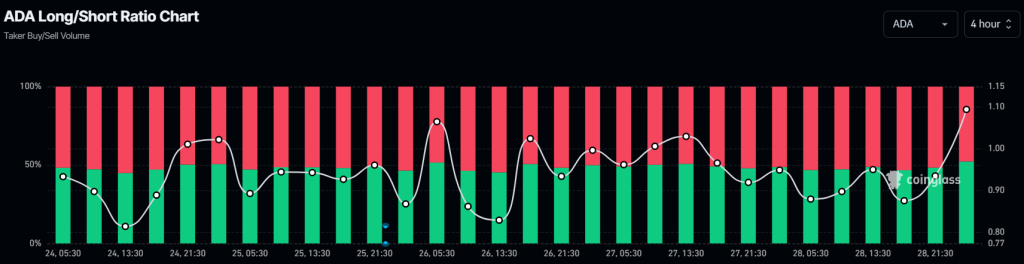

Additionally, traders also appear bullish, as indicated by the ADA Long/Short ratio. This Coinglass metric currently stands at 1.10, reflecting strong bullish sentiment among traders. At present, 54% of top traders hold long positions, while 46% hold short positions.

Combining these on-chain metrics with technical analysis suggests that bulls are currently dominating the asset, which could support the altcoin in an upcoming bull run.

Current Price Momentum

At press time, ADA is trading near $1.04 and has experienced an upside momentum of 2.5% in the past 24 hours. During the same period, its trading volume dropped by 40%, indicating lower participation from traders and investors compared to previous days.