Amidst positive sentiment surrounding the cryptocurrency market, well-known crypto analyst and enthusiast Crypto Con has offered a bullish overview of Bitcoin by identifying historical patterns that indicate that the price of BTC might rise to $123,832 in the upcoming months.

By analyzing past market behavior and trends, the expert has discovered crucial indicators that suggest Bitcoin’s potential to outperform previous highs and reach unprecedented heights.

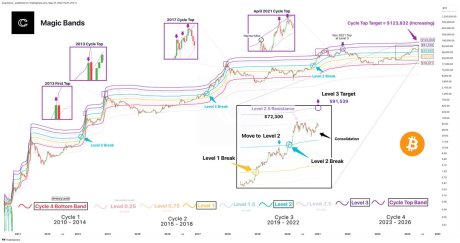

Most Accurate Bitcoin Price Bands

Crypto Con’s analysis delves into Bitcoin’s current behavior based on its price bands at several levels, particularly 3 levels, as shown in his chart. According to the analyst, level 3 is currently one of the most precise bands for the crypto asset, which is valued at $91,539. The expert noted that even with consolidation at level 2.5, the repercussions of this development are already becoming apparent. As a result, the major goal for BTC is reaching the level 3 price band.

Related Reading: Bitcoin Price Aims Higher: Bullish Trend Signals New Peaks Ahead

Furthermore, he underscored there has never been a cycle in which the top band of the cycle is not precisely touched, which is valued at $123,832, and this is currently witnessing an increase. Thus, at the conclusion of the Bitcoin parabola, the cycle top band will have its biggest growth.

A further dive into BTC’s cycle top, Crypto Con has managed to pinpoint the past 2 accurate cycle tops, by employing basic indicators. Specifically, the bottom of the first early top (a yellow dot identified in his chart) in Green Year is when these patterns start.

The lowest points of the trend that have been retested the most often are used by these patterns. However, Bitcoin recently reached the cycle’s line at the $74,000 price level, which is the problem.

With BTC reaching a new all-time high a year ahead of schedule, it has created an unnatural collision with the trend. Due to this, the expert believes that the line this cycle based on BTC’s fast price action will not rule this cycle peak.

So far, Crypto Con claims there will be unprecedented price movement, which will trigger some cycle top measures to break. However, it is still beneficial to pay attention to past trends in order to determine BTC’s price action.

BTC Poised For 6-Figure Price Target

As Bitcoin continues to display resilience, macro strategist Henrik Zeberg has also forecasted a 6-figure target for the digital assets in the coming months. Zeberg claims that the crypto asset is already preparing to enter an upward trend that began on May 20.

As a result, Zeberg anticipates an over 64% increase by the third of this year, putting his target between $110,000 and $115,000. According to the expert, a pattern of highs and lows will serve as a catalyst for the aforementioned price levels.