Data from Glassnode has revealed what percentage of traders on Uniswap are bots, and what percentage are humans. Here are the exact numbers.

The Dominance Of Each Trader Type On The Uniswap DEX

In its latest weekly report, the on-chain analytics firm Glassnode has looked into the various underlying metrics related to Uniswap. One of the interesting findings of the report includes the distribution of the platform’s trading activity among the different trader types.

More specifically, the analytics firm has separated the DEX’s trading volume (that is, the total amount of tokens being moved around on the platform) for humans and bots.

The bots here refer to automated programs that watch the blockchain to find lucrative trades and execute them. There are various types of these bots, but in the context of the current discussion, only two types are of interest: Arbitrage and Sandwich.

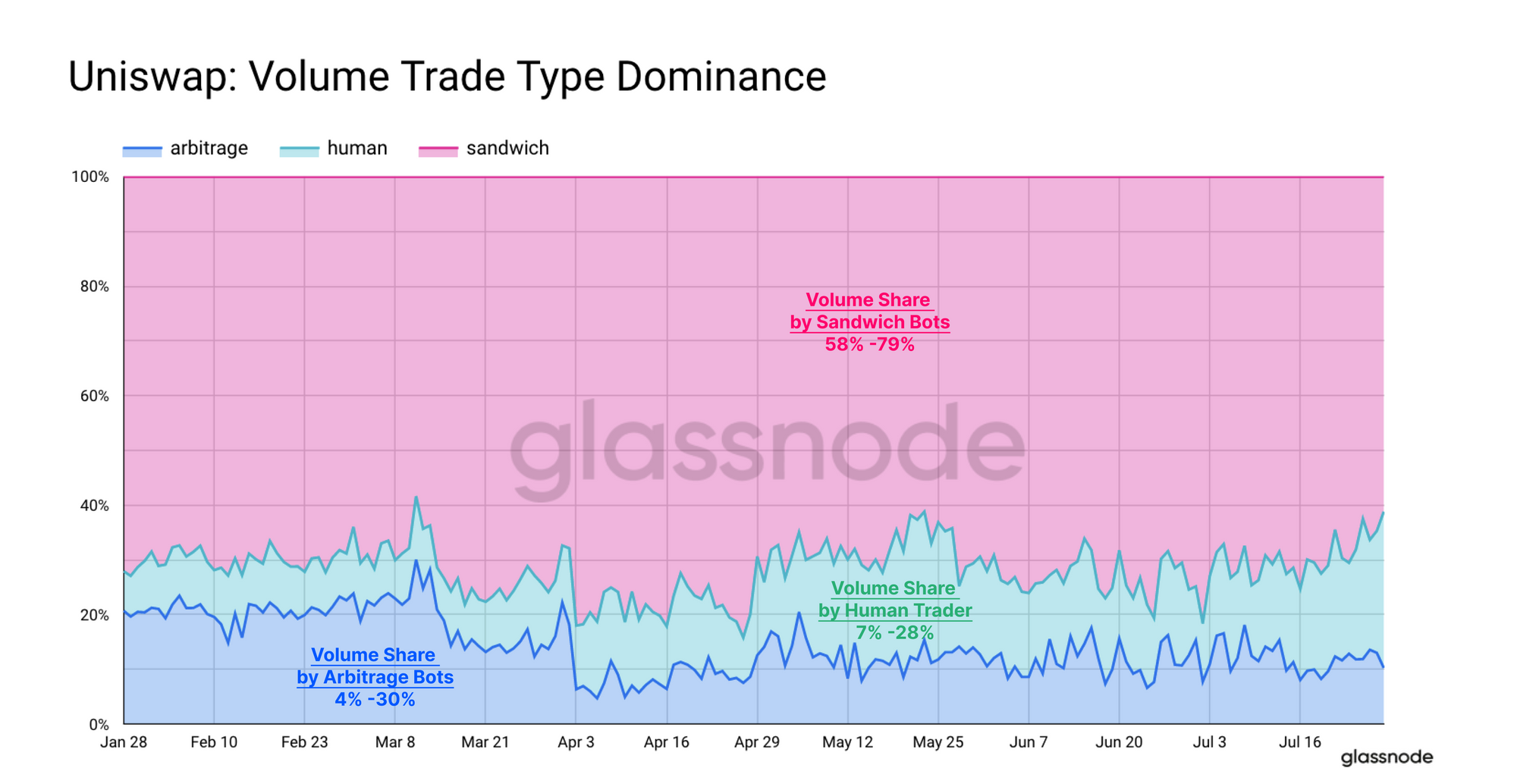

Now, here is a chart that shows the Uniswap volume dominance of these two bots, as well as for human traders, over the last few months:

From the graph, it’s visible that the trading volume share of the Arbitrage bots had been 20% around the start of the year, but today, it has gone down to just 10%. The human trader share, on the other hand, has risen and is currently almost 30%.

The Sandwich bots have been the source of the majority of volume throughout the year, but recently, their share has decreased to about 60% as human traders have expanded their dominance.

Based on this data, around 70% of the volume on the Uniswap DEX is coming from bots alone. The volume, however, may not be the most accurate measure of trading activity, as different types of bots make different numbers of transactions in a single trading action, which can inflate their volume.

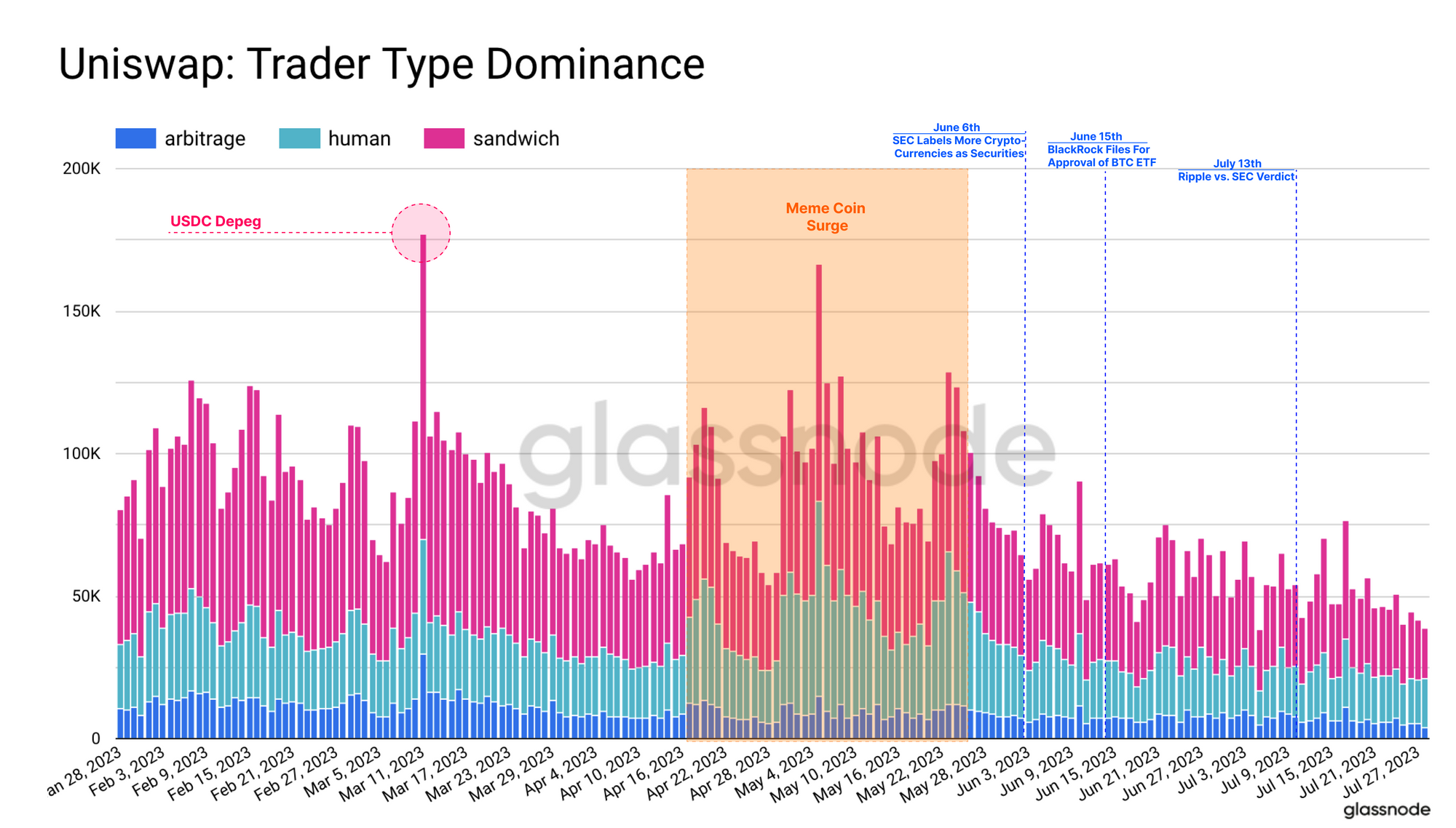

So, to get another perspective on the activity, Glassnode has also looked at the pure number of trades that are coming from each of these types:

The two types of bots combined still appear to outweigh the human traders in this comparison, although the difference in their dominances is clearly a lot lesser.

Uniswap is a decentralized cryptocurrency exchange, meaning that there is no central entity in control of the platform. Trades on the exchange happen using smart contracts, computer programs that automatically run when certain conditions are met.

For governance-related purposes, a special governance token called UNI exists, which any user can choose to hold and be able to participate in decision-making on the platform.

The exchange’s code is also open source, but the latest version of the platform, Uniswap V4, has a license attached to it that makes it so that although anyone can see and copy the code, no one is allowed to use it for commercial or production purposes before the four-year period is up. This has been something that has attracted complaints from the open-source community.

UNI Price

At the time of writing, the Uniswap governance token is trading around $6.4, up 12% in the past week.