While the usual volatility has been absent from the derivatives market, the slight fluctuations seen in the past few days still managed to reveal subtle market trends.

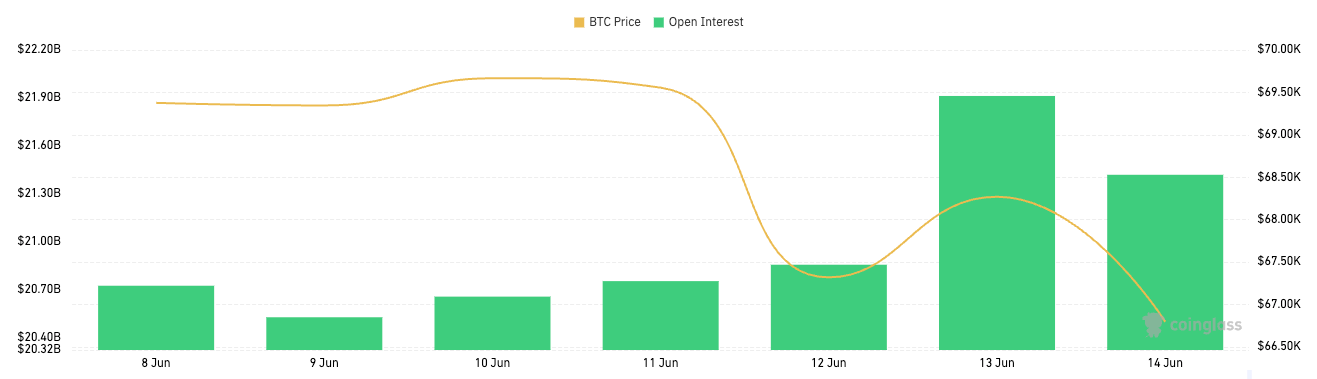

Between June 12 and June 14, Bitcoin options open interest increased $20.85 billion on June 12 to $21.91 billion on June 13, before decreasing to $21.42 billion on June 14.

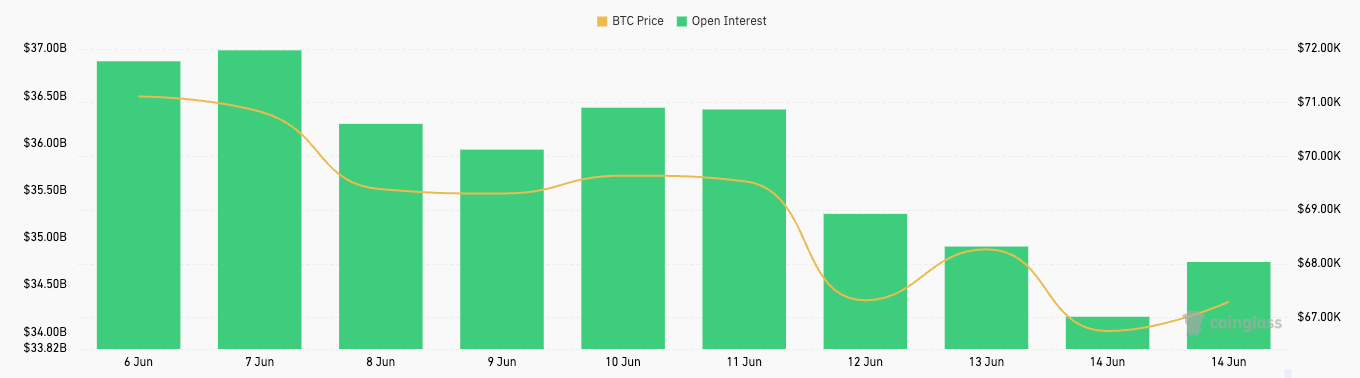

Open interest in Bitcoin futures also slightly declined during the period, falling from $35.25 billion on June 12 to $34.17 billion on June 14.

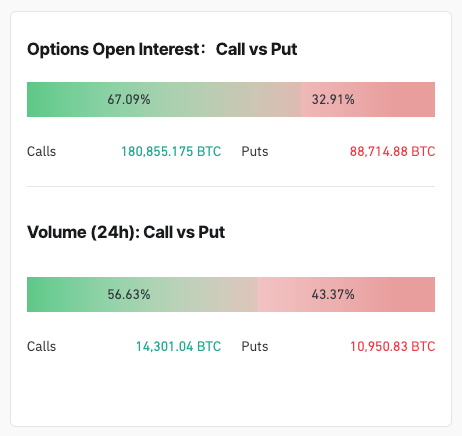

The initial increase in options open interest, followed by a subsequent decline, suggests a complex market sentiment when analyzed alongside price. Bitcoin dropped from $69,555 on June 11 to $66,780 on June 14, after a brief recovery on June 13. The predominance of call options (67.17%) over put options (32.83%) as of June 14 indicates an overall bullish sentiment despite the price drop. The 24-hour volume for options on June 14 also leaned towards calls (59.88%), reinforcing this bullish outlook even in a declining price environment.

These subtle changes in OI were a result of a combination of several factors influencing the broader crypto market. Bitcoin ETFs have experienced mixed inflows and outflows in the past several days. The rebound of Bitcoin ETFs with $100 million in inflows, juxtaposed with a sharp $226 million outflow amid Ethereum ETF news, shows just how big of a hit the market took. This outflow likely contributed to the decreased demand for Bitcoin futures, as evidenced by the declining open interest in futures.

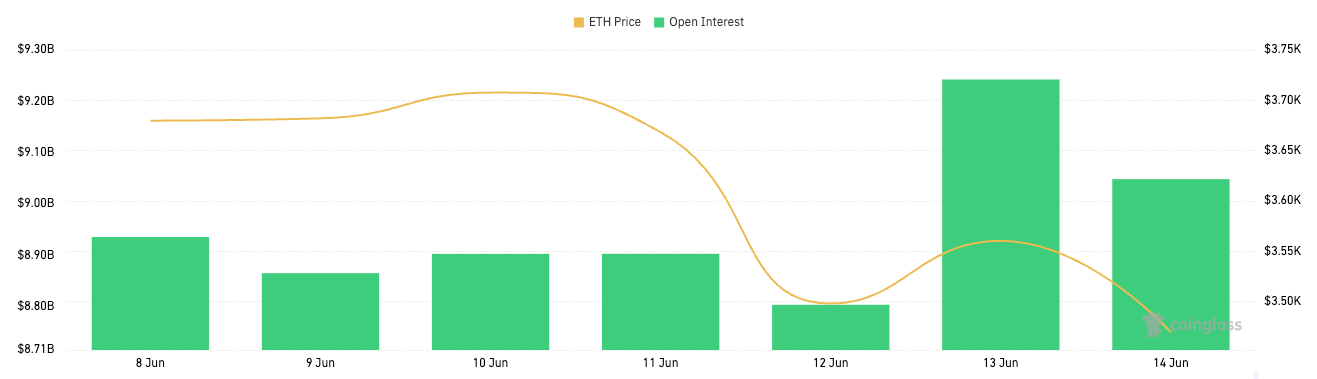

The decisive words from SEC’s Chair Gary Gensler that Ethereum ETFs will be approved this summer likely diverted investor attention and capital towards Ethereum, impacting Bitcoin’s derivatives market. This shift is evident in Ethereum’s future and options market, where open interest increases in the past few days reflect this change in sentiment.

MicroStrategy’s convertible note issuance to purchase more BTC also shaped investor sentiment. Michael Saylor’s latest move demonstrates the company’s unwavering confidence in Bitcoin, which can certainly influence investors participating in the derivatives market. This influence is seen in their ability to maintain and increase bullish positions despite a flat price, as seen in the dominance of call options.

ETF outflows have a direct impact on Bitcoin futures and options markets. Outflows from Bitcoin ETFs can lead to reduced liquidity and demand in the futures market, causing a decrease in open interest. This connection is evident from the data, where we observe a decline in futures open interest following significant ETF outflows. The relationship between ETF flows and futures open interest shows how important institutional participation and sentiment are in driving the market.

Bitcoin’s sideways movement and lack of significant volatility during this period have a dampening effect on open interest. When the price remains relatively stable, traders may find fewer opportunities for profit, leading to reduced trading activity and lower open interest in futures. The stable price range of Bitcoin from June 10 to June 14, with minor fluctuations, suggests a period of market consolidation, contributing to the observed decline in futures open interest.

The post Calls dominate Bitcoin options despite price drop and ETF outflows appeared first on CryptoSlate.