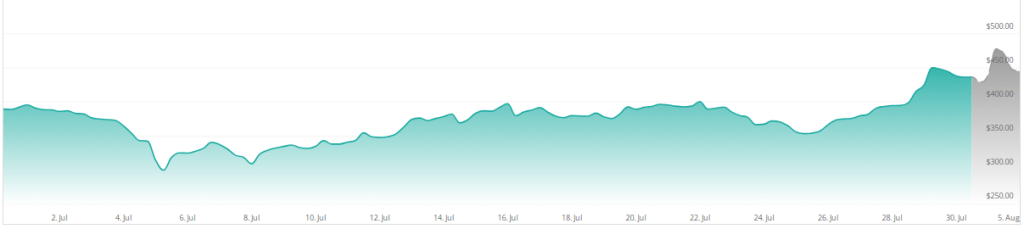

With its recent performance, Bitcoin Cash (BCH) has been generating news and attracting the interest of both experts and investors for its obvious ascent. Reflecting a robust market performance, BCH jumped by around 14% in the last week.

The Bitcoin fork has grown by 12% over the past 30 days, therefore transcending just short-term benefits. At $430 right now, and up 18% in the weekly frame, BCH has a market valuation of $8.60 billion and a 24-hour trading volume of $1.33 billion. With BCH controlling 0.36% of the crypto market, the general trend stays favorable even if the latest 24 hours show a minor decline of 3.50%.

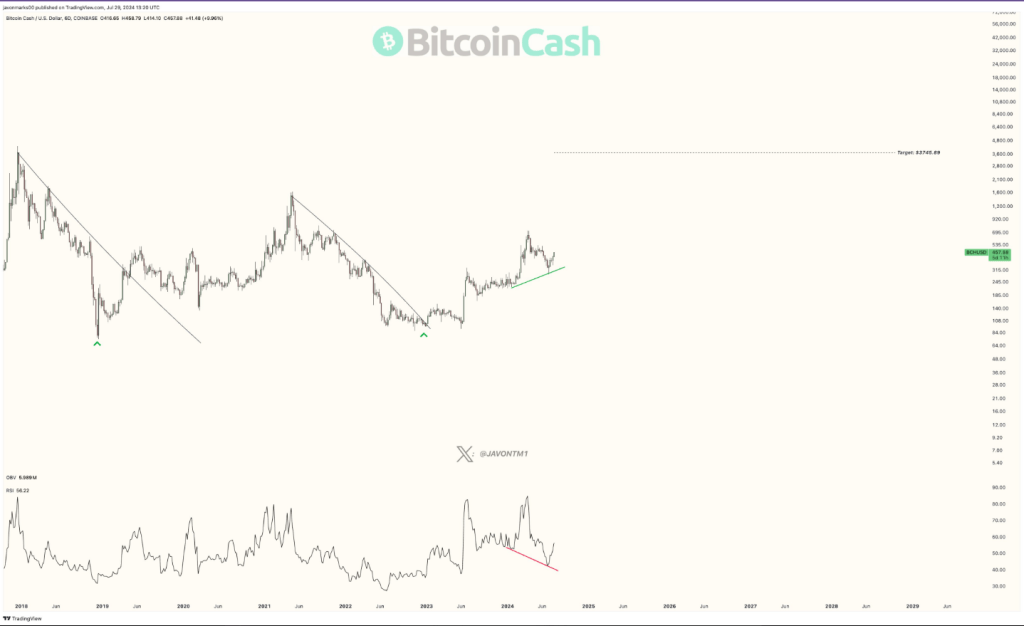

$BCH (Bitcoin Cash) prices confirmed a Hidden Bullish Divergence and has since displayed MAJOR STRENGTH, but there can be much greater coming with a target @ $3,745.89 that’s in play!

With this target, another +683% climb could take place to reach it and this divergence looks to… https://t.co/nh2TFxU29l pic.twitter.com/5JO9J6vNT5

— JAVON

MARKS (@JavonTM1) July 29, 2024

Expert Forecasts Massive Increase

Expert on cryptocurrencies, Javon Marks, has presented a positive view on Bitcoin Cash’s future course. Marks claims BCH has verified a Hidden Bullish Divergence, indicating great upside possibility.

According to his analysis, BCH might reach a goal level of $3,745, a whopping 683% rise from existing levels. Marks underlines that the current price swings are only the start; a significant rise is set by these developments. Investors and traders, who are attentively observing BCH’s future actions through important resistance levels, have been excited by this prognosis.

Historical Context & Market Sentiment

The historical performance of BCH offers important background for both present and future trajectory. On December 20, 2017 BCH peaked at $4,350 and fell to $77.20. Ever since the previous cycle low, $1,620 has been the highest BCH price.

The Fear & Greed Index shows a reading of 61, which corresponds to “Greed,” hence despite the volatility, the present market mood stays positive. This implies that investors are likely to keep supporting BCH’s upward movement as they are enthusiastic about its possibilities.

Bitcoin Cash: Price Forecast

The crypto prediction tool CoinCheckup projects BCH to increase by 4.55% over the next three months. This estimate shows a steady, although slow rise in market confidence and possible investment flow. Rising institutional interest, clear regulations, and wider adoption of cryptocurrencies in many economic sectors are among the elements driving this price action.

With a forecasted increase of 16% over the following six months, BCH’s medium term development is expected to be more noticeable. This projection points to perhaps major adoption benchmarks and a better market vibe. This positive mood is probably driven by technological developments, higher transaction volumes, and better connection into financial systems.

Investor Takeaways

The existing and expected behaviour of Bitcoin Cash offers investors an interesting option. Recent increases, professional forecasts of a significant spike, and favorable market atmosphere point to BCH being ready for significant increase.

Still, one should take into account the possible risks and the natural volatility of the crypto market. Investors and traders will be looking at the next significant movements BCH makes across resistance levels as it keeps displaying strength. Should the optimistic forecasts come true, BCH may be about to climb very spectacularly, offering investors in this coin great prospects.

Featured image from Pexels, chart from TradingView