The post Can Polygon Rise 500%? A Look at Polygon Price Prediction 2025 appeared first on Coinpedia Fintech News

After months of spending its time in a range, with weak price action, bullish expectations have intensified. As a result, the Polygon price prediction for 2025 is gaining traction, as both on-chain and real-world developments signal that the network may be gearing up for a strong upward move.

Despite not-so-great price action, its increasing adoption, government partnerships, and favorable supply-demand dynamics point toward a promising future. This suggests that the long-term trajectory for the Polygon crypto price could be bullish if things improve further.

Adoption Momentum Strengthens Network Fundamentals

Polygon’s adoption has been accelerating, showing clear signs of strong network usage. The project’s CPO recently noted that October ended with record-breaking growth across several payment categories.

He mentioned that the transfer volume jumped 20% to an all-time high, on/offramp volume surged 35%, card volume rose 30%, and infrastructure project activity climbed 19%.

This consistent uptick reflects the expanding real-world usage of Polygon crypto beyond the DeFi ecosystem.

Moreover, its rising adoption seems to be directly linked with its government ties. As Polygon’s integration into public infrastructure with local government has marked a major milestone.

Per the official X account of Polygon, in India, local governments are moving on-chain through Polygon, starting with Amravati city, home to nearly one million residents. The city is tokenizing land titles, property documents, tax data, and certificates, creating a transparent and immutable record system.

This adoption highlights Polygon’s increasing relevance in real-world applications, enhancing trust and efficiency in governance.

Onchain Data Highlights Bullish Supply-Demand Dynamics

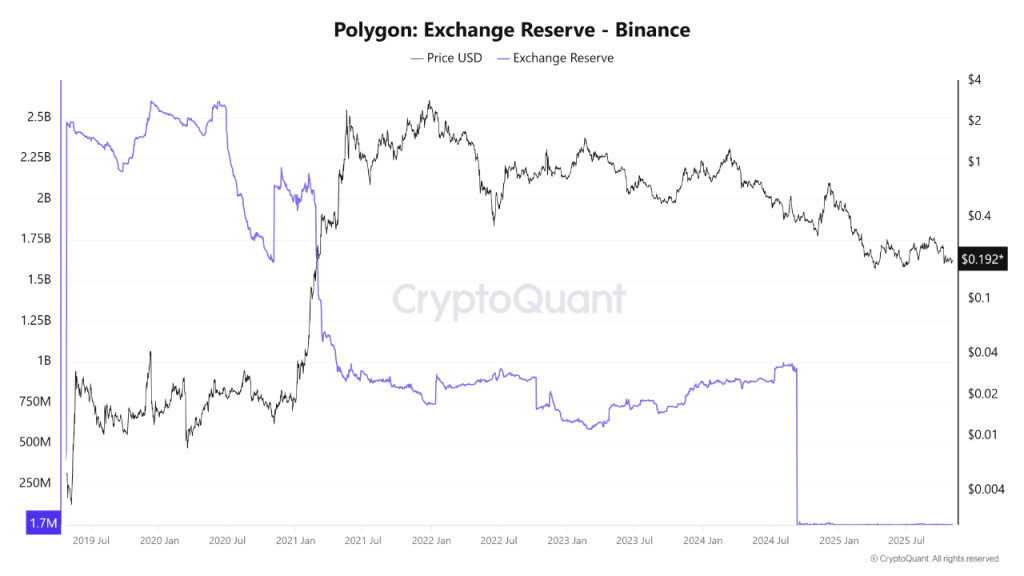

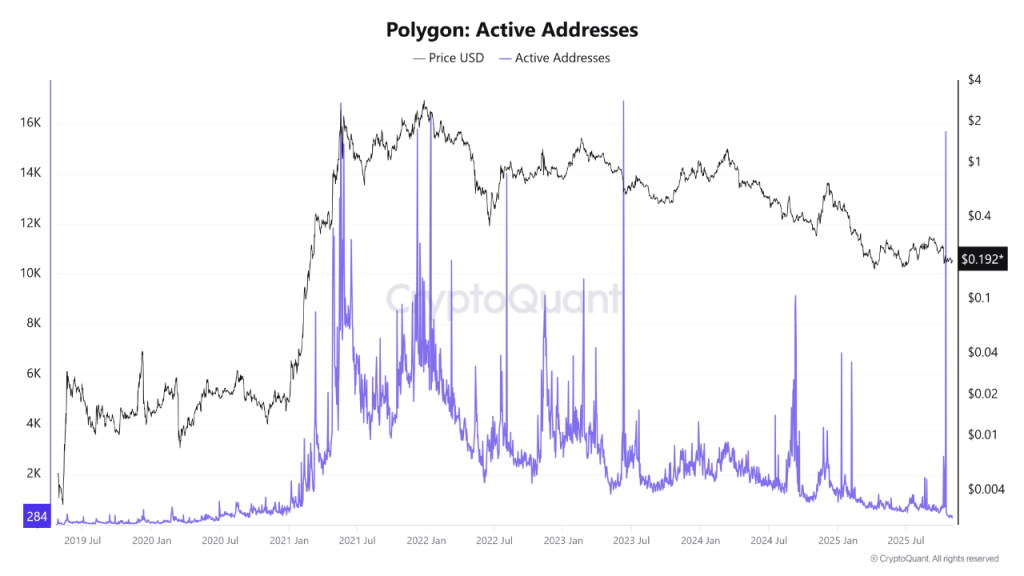

According to Polygon price chart insights shared by CryptoQuant, on-chain metrics reflect favorable market behavior. Exchange reserves of POL tokens on Binance have significantly declined, implying reduced selling pressure and tightening circulating supply.

Meanwhile, active addresses on the Polygon network have spiked, signaling heightened engagement and user participation. This combination of lower exchange reserves (indicating supply contraction) and higher active addresses (indicating demand expansion) presents a bullish backdrop.

If this trend continues, it could support renewed momentum in Polygon price USD for the asset to strongly exit its consolidation phase.

However, the CryptoQuant insights data also warns that sharp surges in active addresses can sometimes coincide with local price tops, signaling overheated short-term sentiment.

Therefore, sustained growth accompanied by gradual increases in user activity could be more structurally supportive of the next rally.

Technical Setup Points to a Potential Breakout Zone

From a Polygon price prediction perspective, technical indicators currently show the token consolidating at the lower end of its trading range, near $0.15. This phase could represent accumulation as the price coils within a tight band. Typically, the longer such consolidation continues, the stronger the subsequent breakout tends to be.

If Polygon price today onwards starts to build its price action, then before the month ends, it could climb from current levels. The odds also suggest that November is a key month, during which it could exit its consolidation range if it closes above $0.40 before the month ends.

The odds are also high that it could even reach near $0.76. A decisive move above this level could open the door to the $1 zone, marking a potential start of a new bullish cycle, which would yield nearly 500% gains.