The post Cardano (ADA) Price Prediction for April 9 appeared first on Coinpedia Fintech News

In the ongoing tariff wars, the cryptocurrency market has already experienced notable downside momentum, but it currently appears to be in recovery. Amid this, the Cardano (ADA) price prediction has become a key topic of discussion, whether the current price rebound is genuine or merely a normal price correction before further downward movement.

Cardano (ADA) Technical Analysis and Price Action

Data from CoinMarketCap reveals that ADA has lost over 24% of its value in the past month. Following this notable price decline, the asset has lost its hold on a key support level at $0.64. This level has a strong history of triggering price reversals and rebounds.

According to Coinpedia’s technical analysis, ADA is poised to continue its downward momentum as it has successfully closed a daily candle below the key support level. Additionally, the asset has also retested that breakdown level. On the smaller time frame (Four-Hour Chart), ADA appears to be moving in an uptrend, taking support from an ascending trendline.

Cardano (ADA) Price Prediction

Based on recent price action and historical momentum, if ADA falls further and closes a four-hour candle below the trendline support, there is a strong possibility it could decline by 20% to reach the $0.43 level in the coming days.

At present, ADA is trading below the 200 Exponential Moving Average (EMA) on both the four-hour and daily time frames. This indicates that the asset is in strong bearish momentum and is showing weak price action. However, in such conditions, investors and traders often look for an upside rally as a shorting opportunity.

Current Price Momentum

ADA is currently trading near $0.575 and has recorded a price decline of over 2% in the past 24 hours. Meanwhile, during the same period, its trading volume dropped by 15%, indicating lower participation from traders and investors compared to the previous day.

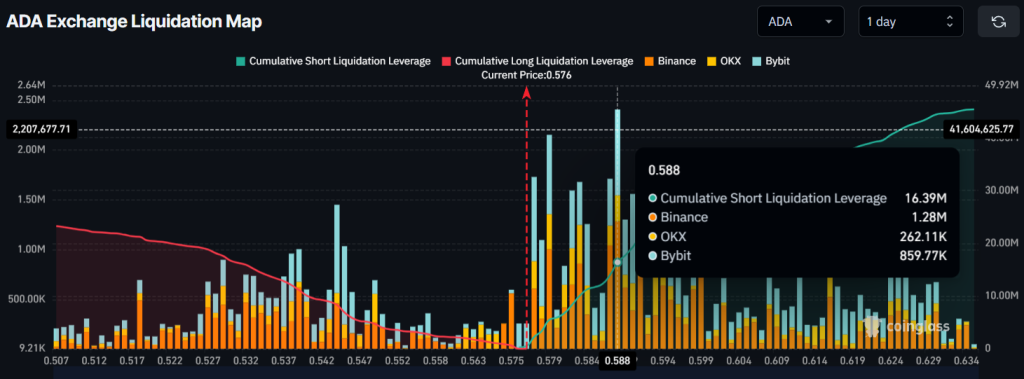

$16.40 Million Worth of Bearish Bet

Looking at the current price momentum and ADA’s bearish outlook, traders seem to be strongly betting on the bearish side, as reported by the on-chain analytics firm Coinglass.

Data further reveals that traders are currently over-leveraged at $0.544 on the lower side (support) and $0.588 on the upper side (resistance). At these levels, traders have built $8.33 million and $16.40 million worth of long and short positions, respectively.

These positions by traders reflect how they currently view ADA, which appears to be bearish. Moreover, with $16.40 million worth of short positions, there is a strong possibility that this could put downward pressure on ADA in the coming days.