The post Cardano (ADA) Price Prediction For March 29 appeared first on Coinpedia Fintech News

With a price decline of 6% over the past 24 hours, ADA, the native token of the Cardano blockchain, reached a key level and is on the verge of a massive price drop. Over the past week, ADA has been consolidating in a narrow range between $0.69 and $0.75.

Cardano (ADA) Technical Analysis and Upcoming Levels

However, due to a bearish market sentiment and a notable price decline, ADA has reached the lower boundary of the zone and is on the verge of breaking out of this consolidation.

According to expert technical analysis, ADA has turned bearish and weak as it falls below the 200 Exponential Moving Average (EMA) on the daily timeframe. Despite the weak and bearish trend, if the asset price falls below the $0.69 level, there is a strong possibility it could drop by 9% to reach $0.64 in the coming days.

However, historically, whenever ADA’s price reached the lower boundary of consolidation, it experienced an upside move along with buying pressure. However, this time, the sentiment is entirely bearish, and major assets like Bitcoin (BTC) and Ethereum (ETH) are influencing the overall market, increasing the probability of ADA dropping to the $0.64 level in the coming days.

Current Price Momentum

At press time, ADA is trading near $0.695, registering a 6% price decline over the past 24 hours. However, during the same period, the asset’s trading volume jumped by 30%, indicating heightened participation from traders and investors compared to the previous day.

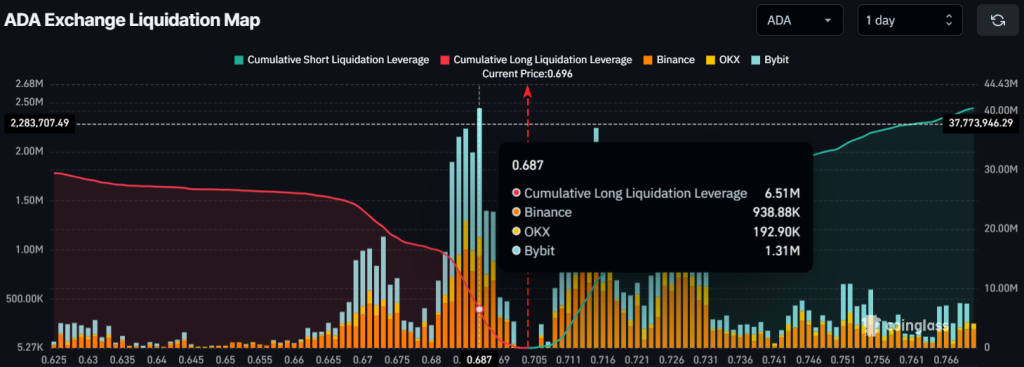

Key Liquidation Levels

Meanwhile, with the bearish market sentiment and ADA trading at a crucial level, traders’ outlook appears to have shifted as they are strongly betting on the short side.

Data from the on-chain analytics firm Coinglass reveals that traders are heavily over-leveraged at $0.715, with $11.15 million worth of short positions. However, bulls are over-leveraged at $0.687, having built $6.51 million worth of long positions, clearly indicating that bears are currently dominating the asset.