Cardano has declined by 5% during the past week, but on-chain data show that large investors have only continued to buy more.

Cardano Sharks & Whales Now Hold Highest Amount Since September 2022

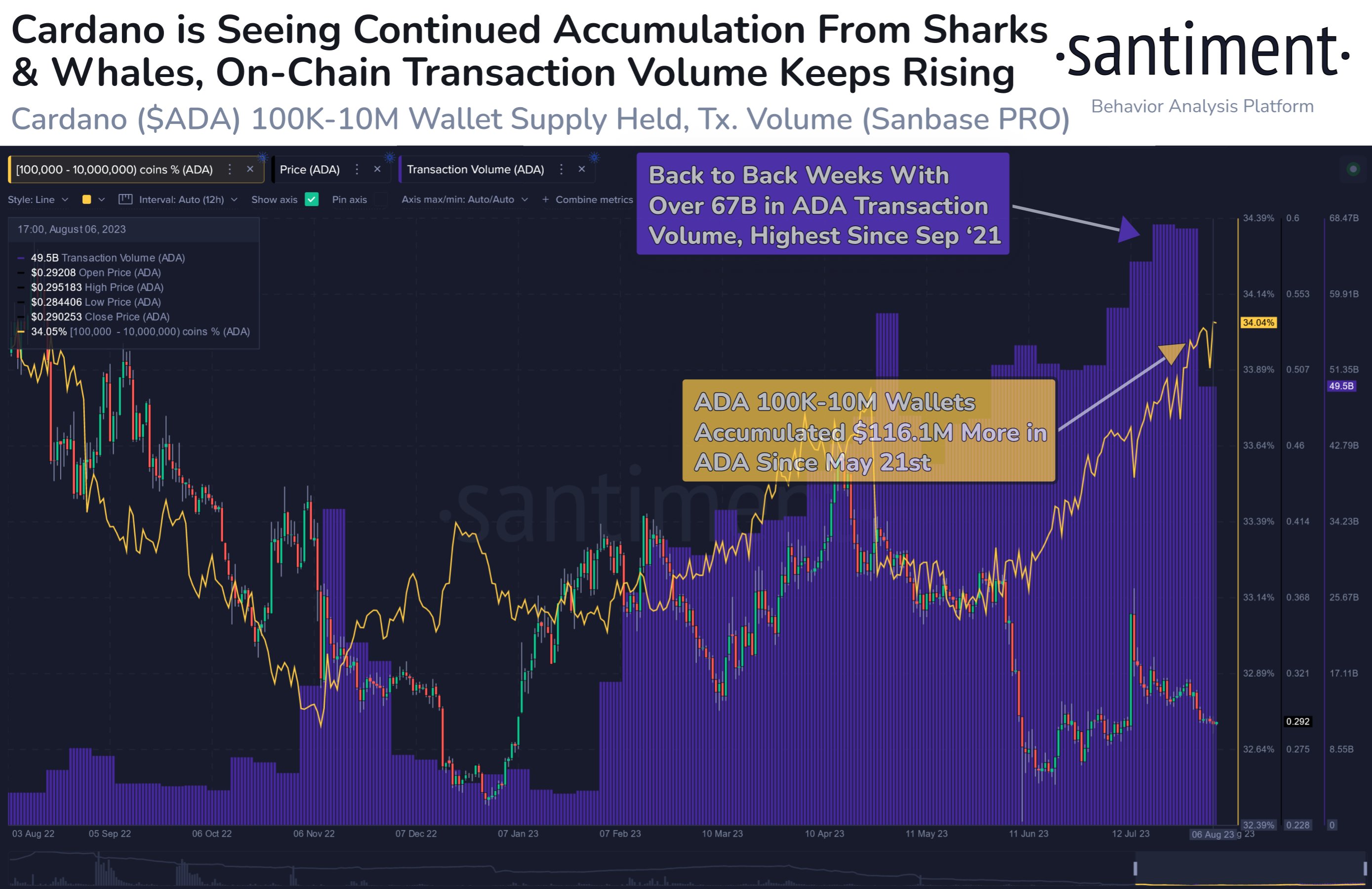

According to data from the on-chain analytics firm Santiment, the ADA sharks and whales have continued to accumulate more of the cryptocurrency recently. The relevant indicator here is the “Supply Distribution,” which keeps track of the total percentage of the supply that each investor group in the market is holding currently.

Related Reading: Litecoin Hashrate Nears ATH Despite Miner Rewards Being Halved

The investors are divided into these cohorts based on the total number of coins that they are carrying in their wallets right now. The 10-100 coins group, for example, includes all wallets or holders who own at least 10 and at most 100 ADA.

Here, the groups of interest are the “sharks” and the “whales.” The investors belonging to these cohorts are some of the largest in the sector and their combined coin range can be defined as 100,000 to 10 million coins.

As these investors have such large holdings, they can potentially move around numbers that may cause visible fluctuations in the market. Due to this reason, it’s often a good idea to keep an eye on what these humongous holders are doing right now.

The below chart shows the trend in the Cardano Supply Distribution for these sharks and whales over the past year.

As displayed in the above graph, the percentage of the Cardano supply held by the sharks and whales has been steadily going up during the last couple of months. This implies that these investors have constantly been adding more tokens to their wallets.

These holders had first ramped up their accumulation after the cryptocurrency had observed a sharp plunge back in June, and they had continued to do so until the asset had seen a rapid surge in July.

In this rally, they had participated in some selling, but the scale wasn’t anything too extraordinary, and without too much wait, these large investors had gone back to buying again, erasing the hit that their supplies had taken in this selloff.

The Cardano price has only gone downhill since then, but these holders haven’t shown any signs of stopping their accumulation. In total, since they started this accumulation spree, they have added a notable $116.1 million to their holdings, which has taken their share of the total circulating supply to 34.04%.

The current level of their holdings is the highest it has been since back in September 2022, almost one year ago now. Naturally, such buying from the sharks and whales is a positive sign for the asset, as it shows that these investors continue to hold a bullish view on Cardano, regardless of how recent price action may have gone.

In the chart, Santiment has also attached the data for another indicator: the trading volume. This indicator has also been at pretty high levels recently, implying that investors have an active interest in trading the asset right now.

ADA Price

At the time of writing, Cardano is trading around $0.29, down 5% in the last week.