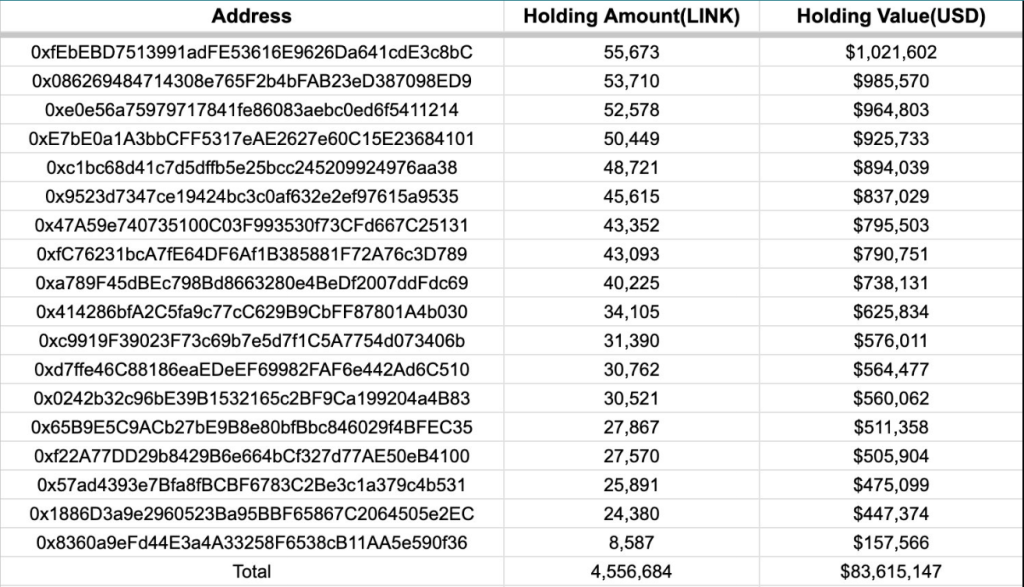

The cryptocurrency market has been abuzz with excitement as a mysterious Chainlink (LINK) whale embarks on a remarkable shopping spree, accumulating an astonishing volume of LINK tokens. Recent data from Lookonchain reveals that this enigmatic whale wallet has acquired more than 4.5 million LINK tokens over the course of just three days. Based on the current LINK price, this accumulation is valued at a staggering $84 million.

Chainlink Whales Surge, Holders Optimistic

This relentless accumulation activity by the Chainlink whale has captured the attention of analysts and investors, generating anticipation for a potential future surge in the LINK price. The market is rife with speculation as traders eagerly await the outcome of this significant accumulation.

This mysterious whale continues to accumulate $LINK!

And has accumulated a total of 4,556,684 $LINK ($83.6M) from #Binance via 55 fresh wallets in the past 5 days.https://t.co/cYgH52rHzxhttps://t.co/B32QIBNNu2 pic.twitter.com/cP7piTmNaT

— Lookonchain (@lookonchain) February 10, 2024

But it’s not just the whale that is showing interest in Chainlink. Santiment’s data indicates a noteworthy increase in the total number of Chainlink holders. Over the past few months, the count of LINK holders has grown by approximately 9,000, reaching a substantial total of 717,000 holders. This surge in holders further fuels the growing optimism surrounding Chainlink’s future prospects.

Adding to the intrigue, Chainlink holders are actively withdrawing their LINK holdings from exchanges. A closer look at the supply on exchanges reveals a recent trend where holders are moving their LINK away from these platforms. Currently, the supply on exchanges represents only about 21.5% of the total supply, indicating a strong belief among holders that a potential future price rally is on the horizon.

Despite experiencing some fluctuations in recent days, the overall price trend for Chainlink remains robust. On the daily timeframe, the LINK price has been oscillating within the $18 price range for several days following a surge into this range on February 1st.

Chainlink Price: Bullish Momentum

As of now, the price sits at around $20.40, reflecting a 12% and 16% increase in the last 24 hours and seven days, with a Relative Strength Index (RSI) remaining above 60, indicating a resilient bullish trend.

These developments within the Chainlink ecosystem have created an atmosphere of eager anticipation among investors and enthusiasts. The whale’s accumulation, the growth in LINK holders, and the withdrawal of LINK from exchanges all contribute to the mounting excitement surrounding a potential future surge in price.

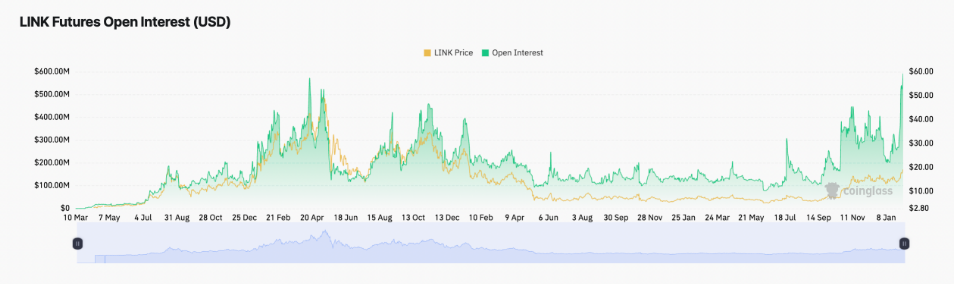

Meanwhile, LINK’s positive funding rate signals a prevailing bullish sentiment, indicating a higher demand for long positions among traders. The simultaneous increase in LINK’s Open Interest further suggests that market participants are leveraging their positions to go long.

This confluence of factors reflects a collective confidence in LINK’s upward potential, with traders expressing optimism through both funding decisions and larger leveraged positions, potentially fueling continued bullish momentum in the market.

Featured image from Adobe Stock, chart from TradingView