One analyst on X notes that Chainlink is facing a tug-of-war between bullish momentum and strong upside resistance from profit-taking traders. For bulls to add to their longs and extend the uptrend, the existing oversupply must be moped, paving the way for more gains above immediate liquidation levels.

Profit Taking Slowing Down LINK Bulls

Looking at the LINK price action in the daily chart, it is clear that buyers have the upper hand. Bulls have been relentless since the token bottomed out in September 2023.

Since then, LINK has doubled, even breaking above the psychological round number at $20. At press time, buyers are still in control, snapping back to trend despite the market-wide cool-off after Bitcoin crashed last week.

LINK is within a broader range, with clear caps at around $17.9 on the lower end and $21.7 on the upper end. After protracted expansion from September, the emergence of a ranging market could suggest that traders are exiting their positions, slowing down the uptrend.

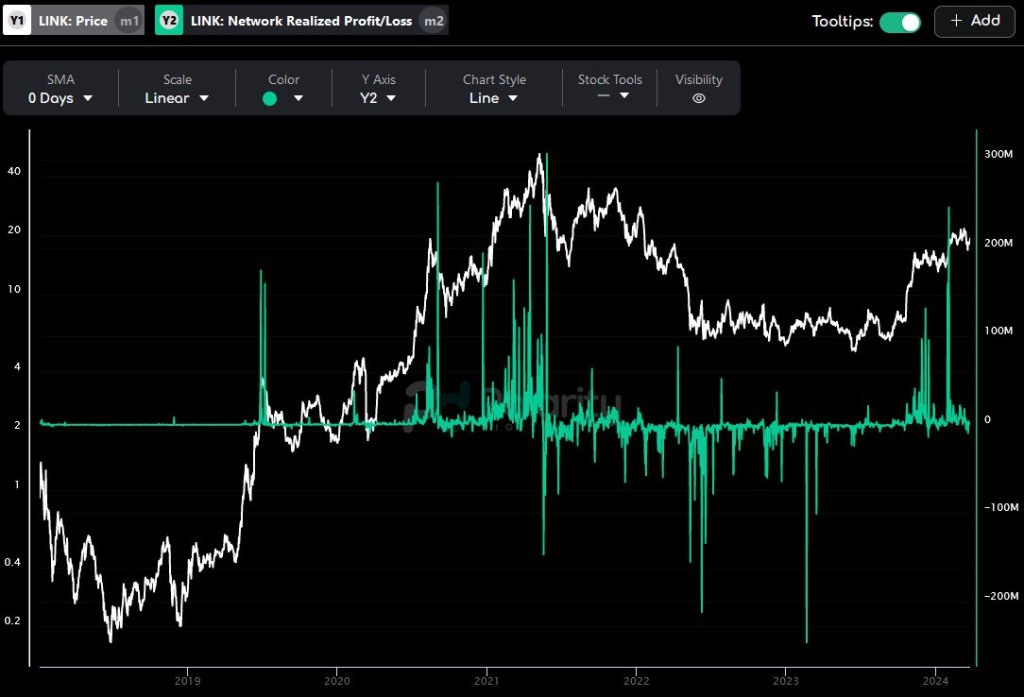

This has been confirmed by on-chain data that the analyst tagged, explaining the recent slowdown. Indeed, on-chain data suggests investors have been cashing in on the recent expansion.

As a result, the excess supply needs to be absorbed by the market before LINK Bulls builds enough momentum to drive the coin to new 2024 highs above $21.8.

Chainlink CCIP Adoption To Recharge Demand?

Despite the short-term headwinds, Chainlink bulls are banking on the widespread adoption of the Chainlink Cross-Chain Interoperability Protocol (CCIP) as a demand catalyst. CCIP is critical for blockchain interoperability. The solution allows secure communication between smart contracts of linked blockchains and external data sources.

CCIP has been adopted by, among others, Metis, a layer-2 scaling solution for Ethereum. Circle, the issuer of USDC, a stablecoin, is also leveraging the platform to enhance interoperability.

Recent data shows a surge in CCIP revenue, pointing towards increased adoption of this multichain bridging platform. As of March 26, Dune Analytics data shows that the CCIP has generated over $484,000 in revenue. This figure will likely increase as CCIP finds adoption and Chainlink integrates with even more protocols, businesses, and blockchains.

Still, the pace at which LINK breaks above March highs and registers fresh 2024 highs will also demand the performance of other coins, including Bitcoin and Ethereum. A resurgent BTC could draw more capital, lifting altcoins, including LINK, in the process.