The post Chainlink Whales on the Move: Is LINK Price Set for a Major Price Rally? appeared first on Coinpedia Fintech News

The recent crypto crash has shaken the Chainlink price rally, which appears to have lost its bullish track. The price plunged heavily to a single-digit figure, and despite a rebound, the bears seem to have a strong grip over the rally. Currently, the price continues to face significant upward pressure, and on the other hand, the whales seem to be keeping millions of LINK on the move. With this, the LINK price volatility is expected to rise, dragging the rally back to its initial position, below $10.

LINK Withdrawal Sparks Whale Accumulation Speculation

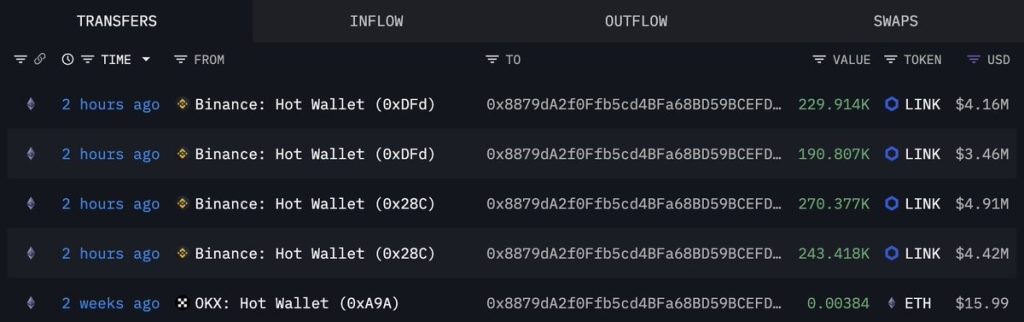

During the latest pullback, the LINK price marked lows around $8.25, which attracted massive whale interest. The whales scooped up over a million LINK in the dip while the retail panic sold, reflecting a classic accumulation by these big players. This kind of accumulation pointed towards a deliberate positioning and conviction. Hence, these tokens were moved recently to a wallet created just a few days before.

The data from Lookonchain suggests a newly created wallet withdrew over 934,516 LINK worth around $16.94 million from Binance. One of the major reasons could be that smart money is moving before the crowd again. These kinds of withdrawals often signal long-term conviction rather than short-term speculation. Moving nearly a million LINK off the exchanges tightens the circulating supply and hints at a strategic accumulation.

What’s Next? Will LINK Price Reclaim $25?

The latest crypto crash had dragged the LINK price out of a bearish pattern, due to which the rally appears to be primed for bearish continuation. The token was trading within a descending channel; however, the bulls failed to push the price within the pattern. This could be a major red flag for the crypto in the short term, but in the long term, the LINK price appears to be primed for a major bullish move.

The weekly price action of Chainlink is extremely bullish; however, to trigger a strong rebound, the token could face a 25% pullback. The token has dropped below the 50-day weekly MA for the first time since July 2025. Moreover, the weekly trade has started below this range, which has fluttered a bearish signal for the crypto. The weekly MACD has turned bearish since July, validating the bearish continuation for the crypto. The LINK price has once broken the support and marked lows, and hence, a continued descending trend could drag the levels back to the same range.

However, in the long run, the Chainlink (LINK) price is forming a massive bullish wave, and after squeezing the selling pressure, the next bullish move could help the token reach $30.