The post ChainOpera AI (COAI) Price Surges 85% – But Is the Rally Built to Last? appeared first on Coinpedia Fintech News

After tumbling to a low of $4.4 by Monday, October 20th, the ChainOpera AI (COAI) token staged a stunning rebound, soaring by more than 375% in the last 4days, and within 24 hours, it spiked 80% to $25.50 before settling today at $20.75, which still maintains half the gains of intraday around 40%. The rally pushed one of the most aggressive recoveries among AI-linked cryptocurrencies this month.

At press time, ChainOpera AI COAI price today is favoured by bulls, with both retail and institutional traders eyeing it as a speculative play on the expanding AI-crypto narrative. The momentum was largely fueled by renewed confidence in AI-powered blockchain projects and heavy derivatives market activity.

Speculative Demand Drives the COAI Rally

Futures traders appear to be at the heart of this price explosion. Data from CoinGlass revealed that open interest surged to $171.26 million, while derivatives trading volume climbed over to reach $3.69 billion.

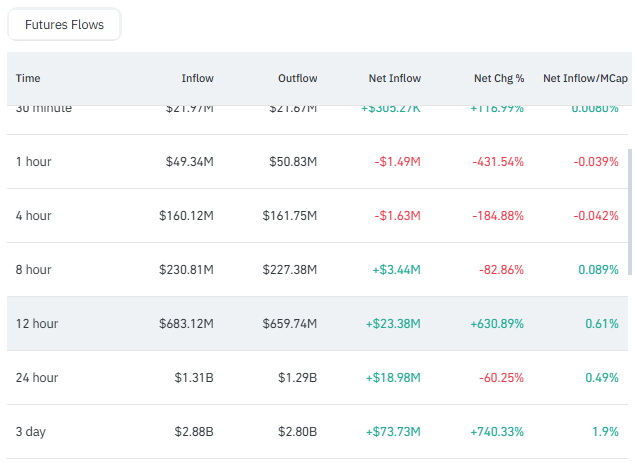

This spike in leveraged exposure shows that investors are betting aggressively on volatility. Since Monday, the COAI price has been rising; it’s reflected in Net Futures inflows data, too. It displays that in the past 3 days, inflows exceeded $70 million, reflecting over 740% growth in fresh long positions. The Long/Short ratio also leaned bullish at 1.01, confirming that market sentiment remains in favor of further upside.

Whales Strengthen the Base – But Risks Loom

On-chain data paints a fascinating picture. Whale accumulation remains dominant, with the top 10 addresses controlling nearly 87.90% of the supply.

Over the past three days alone, whale wallets accumulated massive stash of tokens, signaling strong confidence in COAI crypto despite market volatility.

COAI Price Outlook: Between Momentum and Fragility

Technically, the ChainOpera AI price chart shows strong momentum, supported by a RSI, MACD crossover, and positive CMF hinting at recovery from oversold levels. As long as COAI holds above the $17 zone, it could extend gains toward $30 and potentially $40 in coming weeks.

However, if speculative enthusiasm fades or whales unwind positions, ChainOpera AI (COAI) could retrace back toward $13.5, the last major consolidation level. For now, the market walks a fine line between strong bullish appetite and rising structural risk.

FAQs

ChainOpera AI (COAI) is a cryptocurrency token linked to AI-powered blockchain projects, recently experiencing significant price movement and high trading volume driven by speculative demand.

The rally is primarily fueled by speculative futures trading, renewed confidence in AI-crypto projects, and significant whale accumulation, with over $70 million in fresh capital inflows.

If it holds above $17, COAI could extend gains toward $30. However, if momentum fades, a retrace toward the $13.50 support level is possible, indicating high volatility and risk.

It is a high-risk, speculative asset. While strong momentum and whale support suggest potential, its high volatility and concentration of supply among few holders warrant extreme caution for investors.