Quick Take

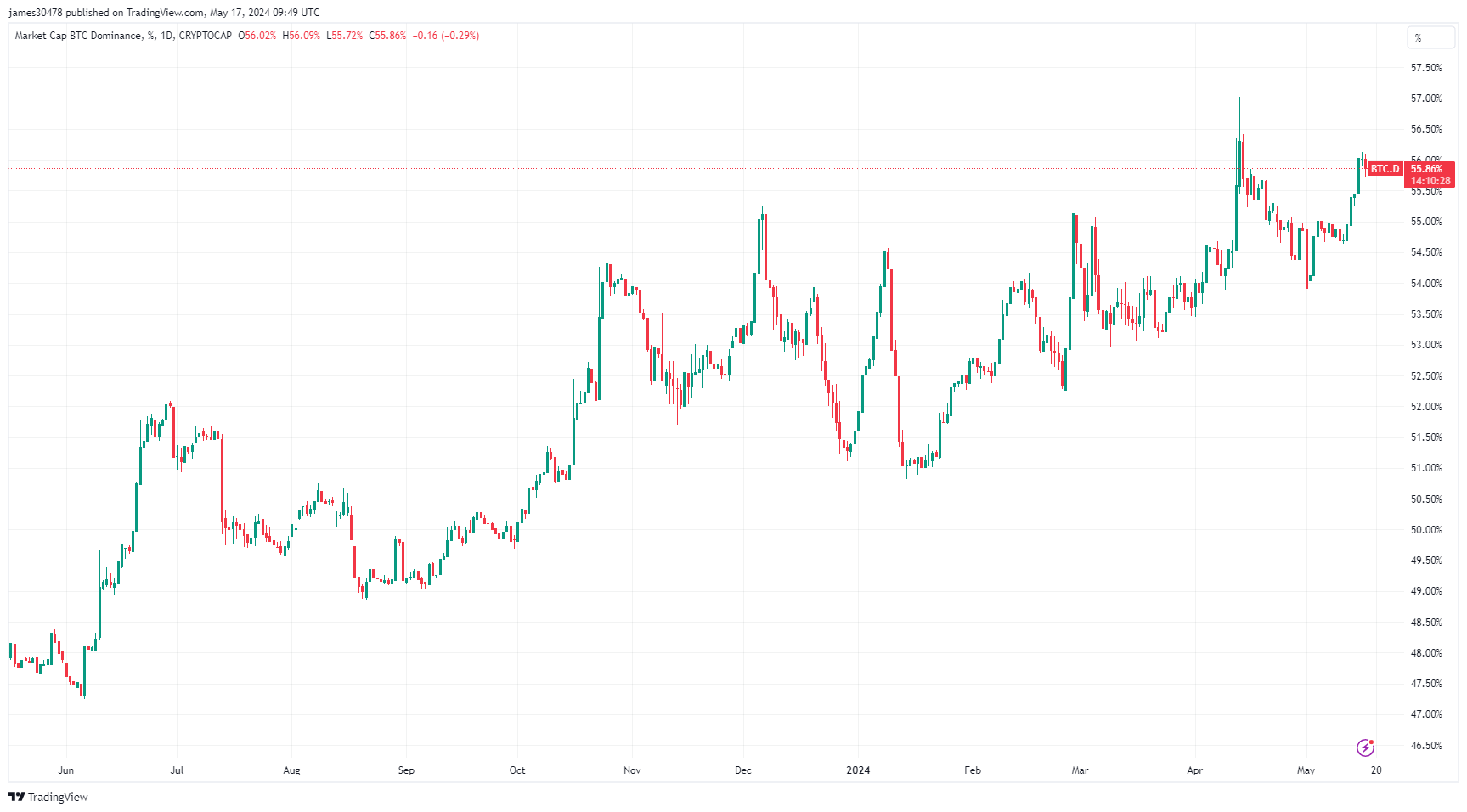

Between Q4 2023 and 2024, a significant divergence emerged between the narratives of Bitcoin and the broader digital assets market. This divergence was evident in the performance of the ETH/BTC ratio and Bitcoin’s market dominance, which is currently flirting with 56%, approaching a one-year high.

2024 witnessed a remarkable surge in the adoption of Bitcoin as an institutional asset class, as evidenced by the substantial investments in the Bitcoin ETFs.

Furthermore, the Chicago Mercantile Exchange (CME) is gearing up to launch spot Bitcoin trading, further solidifying Bitcoin’s mainstream acceptance.

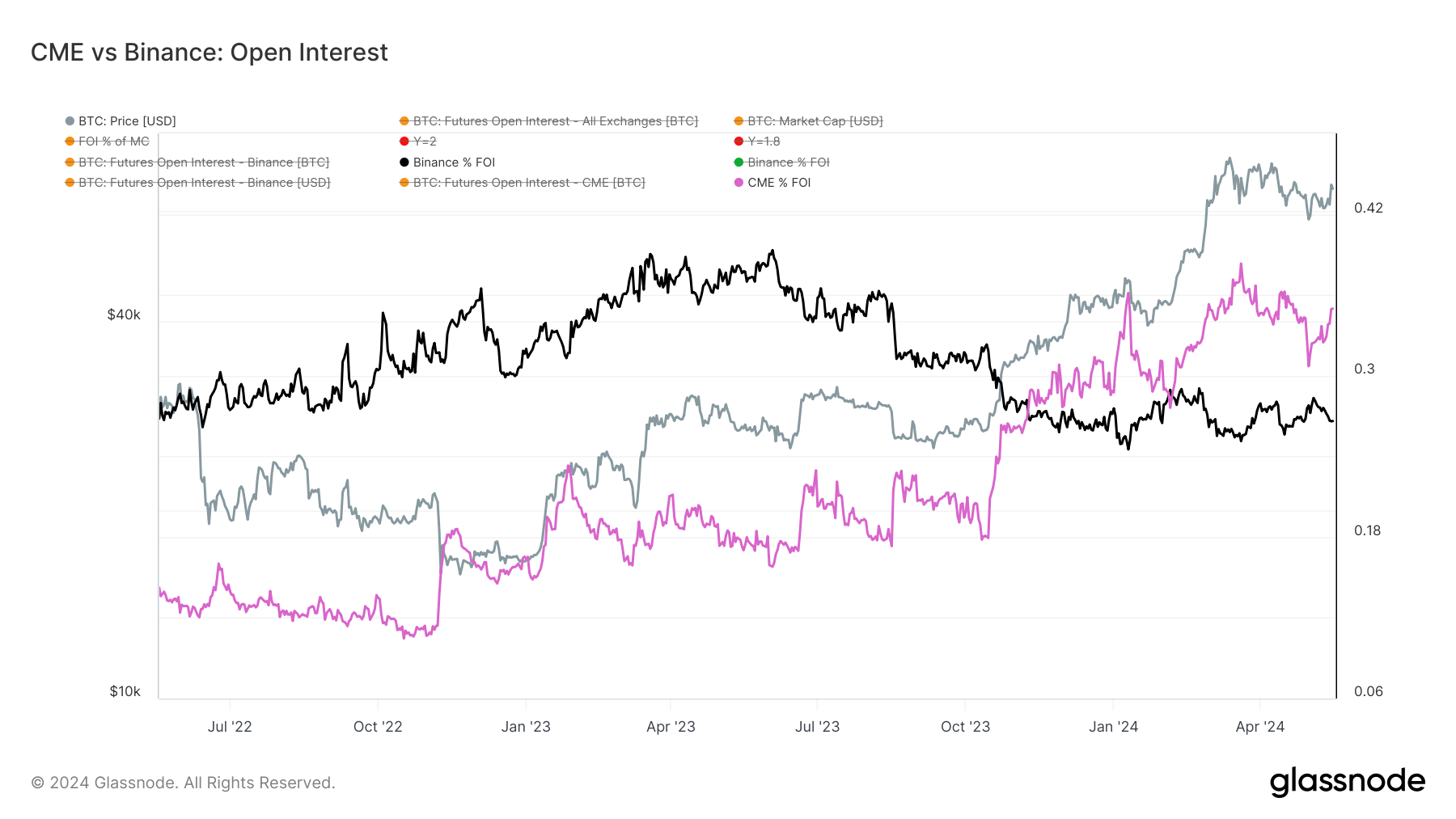

Over the past 12 months, a notable trend has emerged in the futures market, which is defined as the total funds (USD value) allocated in open futures contracts. CME open interest (OI) has taken the lead and has become the dominant player since November 2023. During this period, Binance’s OI has stagnated at around 26%, and CME’s OI has continued to rise.

Interestingly, when Bitcoin bottomed out on May 1, dipping below $57,000, the CME OI also reached one of its lowest points of 2024. However, as Bitcoin rebounded from $56,000 to $66,000, a $10,000 increase, the CME OI experienced a corresponding uptick, while the Binance OI declined. The CME OI reached an all-time high around Bitcoin’s high in March.

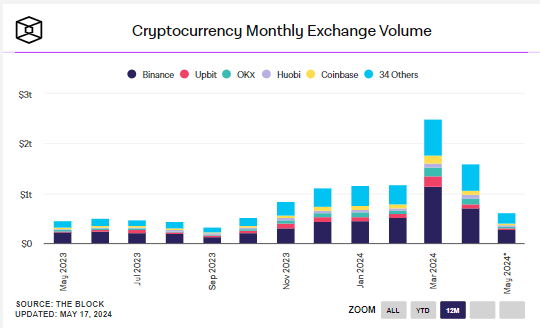

As Bitcoin continues its bull run, I expect the CME futures OI to capture an even larger share of the market. The same trend is anticipated for spot volume over the long term, which is also dominated by Binance.

The post CME futures dominance aligns with rising institutional investment in Bitcoin appeared first on CryptoSlate.