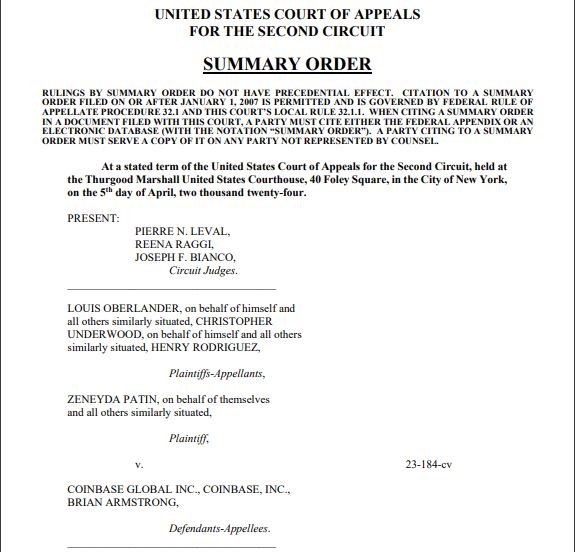

A recent court decision in the United States has offered a mixed verdict for cryptocurrency regulation, with implications for both crypto exchanges like Coinbase and investors nationwide.

The US Court of Appeals for the Second Circuit ruled that secondary sales of cryptocurrencies on Coinbase do not fall under the purview of the Securities Exchange Act of 1934.

This victory for the crypto exchange brings some relief to the crypto industry, but doesn’t eliminate all the legal uncertainties surrounding cryptocurrencies.

Coinbase Wins Appeal On Secondary Sales

The lawsuit centered on whether the cryptocurrencies traded on the exchange qualified as securities. If classified as securities, they would be subject to stricter regulations under the Securities and Exchange Commission (SEC).

A nationwide class of plaintiffs argued that Coinbase facilitated the unregistered sale and offering of securities through its platform, violating various regulations under the Securities Act of 1933 and the Securities Exchange Act.

COINBASE WINS AGAINST THE SEC $COIN

“One of the top crypto exchanges, Coinbase, has achieved a major victory in an ongoing legal battle. The U.S. Court of Appeals for the Second Circuit ruled in favor of Coinbase, confirming that secondary sales of cryptocurrencies on its… pic.twitter.com/EIKs9r5KN9

— amit (@amitisinvesting) April 6, 2024

Coinbase, on the other hand, maintained that secondary crypto sales on their exchange did not meet the legal definition of securities transactions.

The Court of Appeals’ decision provided some vindication for Coinbase. The court agreed that secondary sales on the platform weren’t securities under the Securities Exchange Act.

This is a significant win for Coinbase and crypto enthusiasts who participated in secondary trading on the platform between October 2019 and March 2022.

Unresolved Issues Cloud The Verdict

However, the court’s decision wasn’t a complete victory for Coinbase. The court partially upheld a lower court ruling suggesting that Coinbase could still be liable under Section 12(a)(1) of the Securities Act for selling unregistered securities.

Another point of contention lies with Coinbase’s user agreements. The court acknowledged the changing nature of these agreements, which made it difficult to definitively assess their legal implications. This ambiguity creates uncertainty for both investors and the exchange itself.

Lingering Debate And Need For Clarity

The Court of Appeals’ decision highlights the ongoing debate about how to regulate cryptocurrency in the US. While Coinbase interprets the verdict as confirmation that secondary crypto sales aren’t securities, the plaintiffs see it as a stepping stone towards enforcing securities laws on crypto platforms.

This difference in perspective underscores the need for clear and comprehensive regulations to govern the cryptocurrency market.

Both Coinbase and industry experts agree that a lack of clarity in regulations hinders innovation and growth in the crypto space. Paul Grewal, Coinbase’s Chief Legal Officer, emphasized the need for clear regulations in a recent X post.

He expressed hope that the court’s decision would pave the way for a constructive dialogue with regulators to establish a framework that fosters responsible innovation in the crypto industry.

The court’s decision offers some clarity on the classification of secondary crypto sales on Coinbase, but it doesn’t settle the broader issue of crypto regulation.

Featured image from EveryPixel, chart from TradingView