A recent analysis paints a rosy picture of Bitcoin’s future, even with a conservative growth projection. Taking to X, Michael Sullivan predicts that the world’s most valuable coin could reach a staggering $245,000 within just five years if it maintains a mere 30% compound annual growth rate (CAGR).

Bitcoin Projections: From Conservative To Exponential Growth

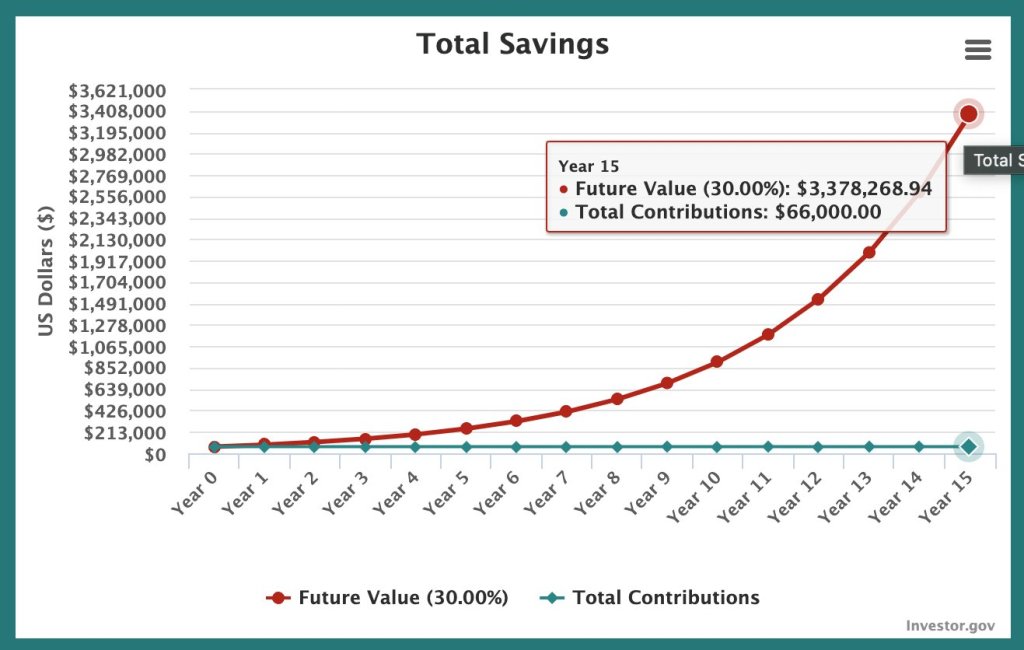

The analysis explores various growth possibilities for Bitcoin. Assuming the coin’s growth rate significantly contracts in the coming years, growing at just 30% CAGR, Sullivan projects the coin to reach $245,000 by 2029.

A decade later, it will be at $909,000; by 2039, each coin in circulation will be trading at a whopping $3.37 million. If, however, the CAGR rises to 40%, Bitcoin would be worth $10.3 million in 15 years and $1.9 million in 10 years.

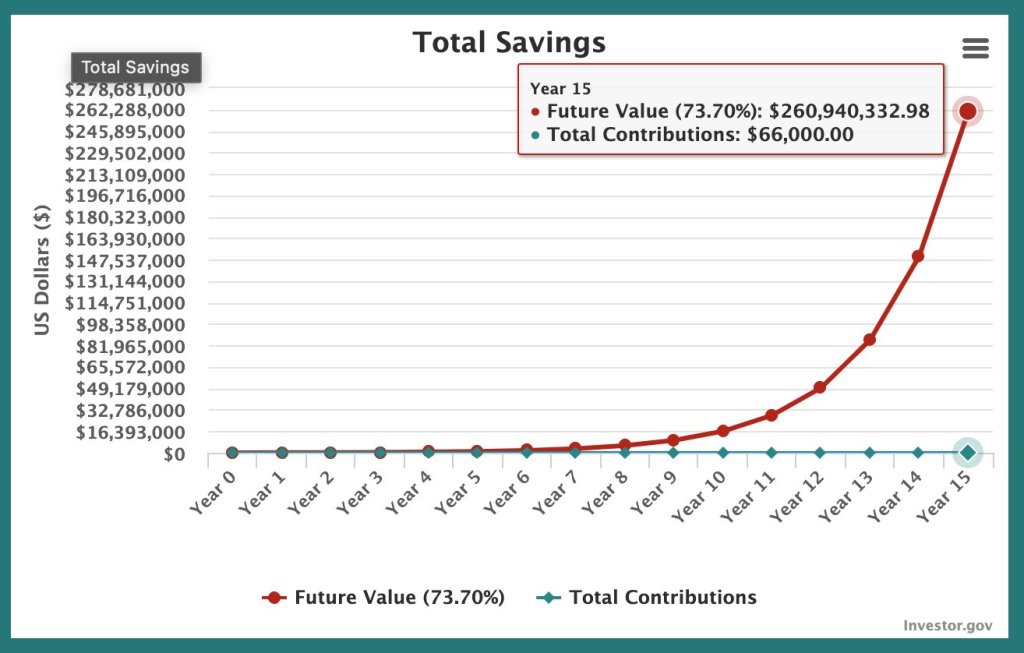

Still, even at these mega valuations, Bitcoin has been soaring at unprecedented rates, outperforming all traditional finance assets since launching. To demonstrate, Bitcoin registered a CAGR of 73.7% over the past four years.

Therefore, if this trend continues, Sullivan says BTC will smash above the $1 million level a year after halving in 2028. However, half a decade later, each coin will change hands at over $16.5 million.

A look back at Bitcoin’s history makes it clear that the coin has been on a tear. Following this historical trend and making projections for the future, BTC could be far more valuable in the next five or ten years.

There Are No Guarantees, Crypto Is Dynamic

While these projections are undoubtedly exciting for Bitcoin holders, it’s crucial to remember that they are just projections. The crypto market, just like any other tradable asset, doesn’t move in straight lines.

As an illustration, after peaking at nearly $70,000 in 2021, prices crashed to as low as $15,600 the following year. In 2017, BTC rose to around $20,000 before tanking to below $4,000 a year later in 2018. This volatility and the dynamic market, influenced by new circumstances, don’t guarantee these lofty projections.

Nonetheless, analysts remain optimistic of what lies ahead, especially after the historic Halving event on April 20. As traditional finance players join in, finding exposure in BTC through spot exchange-traded funds (ETFs), prices might rise, even breaking above the all-time highs of around $74,000.