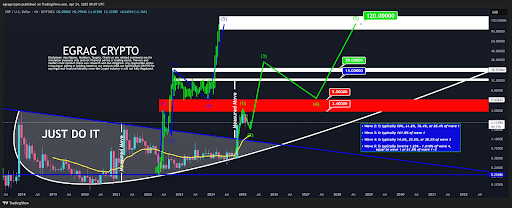

XRP is gearing up for a surge to $120, according to popular crypto analyst EGRAG CRYPTO. Taking to social media platform X, the analyst shared a fresh chart detailing a bullish outlook for XRP, suggesting that the cryptocurrency is retracing a path similar to its explosive 2017 rally. This time, however, the trajectory could be even more dramatic, as the chart accompanying his post outlines a long-term Elliott Wave formation that points first to $27 and eventually to a staggering $120 price tag.

Echoes of 2017: XRP Retracing Cycle That Took Price To All-Time High

The 2017 bull cycle is one of the most iconic periods in XRP’s history. It was during this phase that the price of XRP rallied from under $0.01 to an all-time high of $3.84, driven by a broader crypto market bubble, exchange listings, and speculation surrounding Ripple’s adoption among financial institutions.

The rally followed a classic Elliott Wave impulse structure, with five distinct waves characterized by short consolidations before each major leg upward. By early 2018, the bubble had popped, and XRP, like the rest of the crypto market, entered into a prolonged bear phase.

EGRAG CRYPTO’s post implies that XRP is now following a similar pattern to the one in 2017. Particularly, the analyst noted that XRP is currently in the process of forming its second wave, which is a retracement of the bullish impulse Wave 1. This impulse Wave 1 is characterized by XRP’s surge to $3.4 between Q4 2024 and January 2025. Wave 2, on the other hand, is characterized by the price correction since January, which has sent the XRP price back to trading around $2.

Now, the next step is for wave 3 to begin formation. Based on traditional Elliott Wave ratios, this wave tends to extend aggressively, often measuring 161.8% of Wave 1. According to EGRAG, XRP’s price is expected to end Wave 3 above double digits sometime in summer 2025. It is at this point that the analyst predicted a top out around $27, nearly ten times its current trading price. Following that, his outlook anticipates a lengthy Wave 4 correction lasting several years, setting the stage for a final Wave 5 extension that could see XRP break into triple digits.

The $120 Long-Term Target

In his projection, the $27 level will mark the completion of Wave 3, followed by a Wave 4 correction that could potentially span three years. This correction would be brutal and cause the XRP price to reach a bottom around $5.50.

After this consolidation phase, the ensuing Wave 5 formation will catapult XRP to new highs again and go on the same measured move as Wave 1 or 61.8% of Wave 1 + Wave 3. If this plays out as EGRAG expects, XRP would break into triple-digit territory and ultimately peak around $120.

At the time of writing, XRP is trading at $2.19, up by 2% in the past 24 hours. Reaching the $27 and $120 price targets would translate to 1,132% and 5,380% increases, respectively, from the current price.