Crypto analyst Pejman has warned that the Bitcoin price could witness a further crash in the short term. He revealed the level the flagship crypto needs to hold to avoid these “heavy declines.”

Bitcoin Price Could Witness Further Crash If It Falls Below This Level

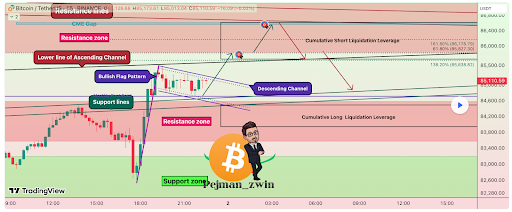

In a TradingView post, Pejman stated that the Bitcoin price could record heavy declines if it falls below $83,500. This warning came following a bullish analysis in which he remarked that BTC seems to be completing the bullish flag pattern. The analyst added that he expects the flagship crypto to rally to the upside as it looks to fill the CME gap at the $86,000 range.

This eventually happened as the Bitcoin price rallied to as high as $88,000 amid the massive volatility that occurred following Trump’s reciprocal tariffs announcement. However, Pejman suggested that the rally to $88,000 is likely the local top for BTC, stating that there is a possibility that Bitcoin will fall again following this price surge.

Moreover, the Bitcoin price has since corrected following the rally to $88,000. This price crash occurred as Trump unveiled the customized tariff rates for countries such as China, the European Union, the United Kingdom, and Japan. This move from the US president is expected to trigger a trade war, with these countries retaliating with counter-tariffs, which is bearish for BTC and the broader crypto market.

BTC Could Still Drop To As Low As $78,000

Based on crypto analyst Kevin Capital’s analysis, the Bitcoin price could soon drop to as low as $78,000. The analyst noted that there is a little bit of long liquidity at the $78,000 to $80,000 level, but there is also a lot of liquidity in the $87,000 to $90,000 range.

He further remarked that market makers could look to transact in that $87,000 to $90,000 range just before Trump’s tariff announcement, which happened as predicted. With the Bitcoin price sucking up the liquidty at the $87,000 to $90,000 range, it looks likely to drop to the $78,000 to $80,000 range to also suck up the liquidity at that range.

Despite the Bitcoin price’s downtrend over the past two months, crypto analyst Rekt Capital is still bullish on the flagship crypto’s trajectory. He noted that BTC experienced a 32% downtrend from mid-March 2024 to early September 2024, a pullback that lasted almost six months before its price broke to new all-time highs (ATHs). As such, the analyst suggested this downtrend is nothing to worry about as BTC could still rally to new highs in a flash.

At the time of writing, the Bitcoin price is trading at around $83,000, down over 1% in the last 24 hours, according to data from CoinMarketCap.