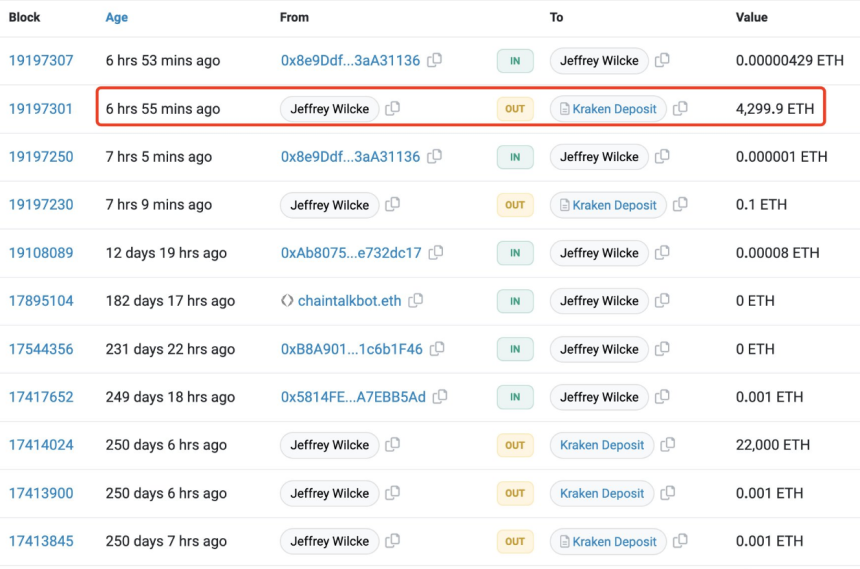

In a recent development, Ethereum [ETH] co-founder Jeffrey Wilcke’s wallet has made a notable deposit of 4,300 ETH to a cryptocurrency exchange.

The deposit made by Wilcke amounts to 22,000 ETH, valued at approximately $41.1 million at the time. With Ethereum’s current price standing at $2,500, this deposit has injected renewed interest and excitement into the market.

Ethereum Co-Founder Transfers 22K ETH: Impact On Price

Despite this substantial deposit, the overall trend of Ethereum’s netflow remains unaffected. This deposit comes after a considerable hiatus, with the last recorded transaction from this wallet dating back to June 2023.

Jeffrey Wilcke, the Co-founder of #Ethereum, deposited 4,300 $ETH($10.7M) to #Kraken 7 hours ago.https://t.co/STceT5cQmT pic.twitter.com/ROG0evjirh

— Lookonchain (@lookonchain) February 10, 2024

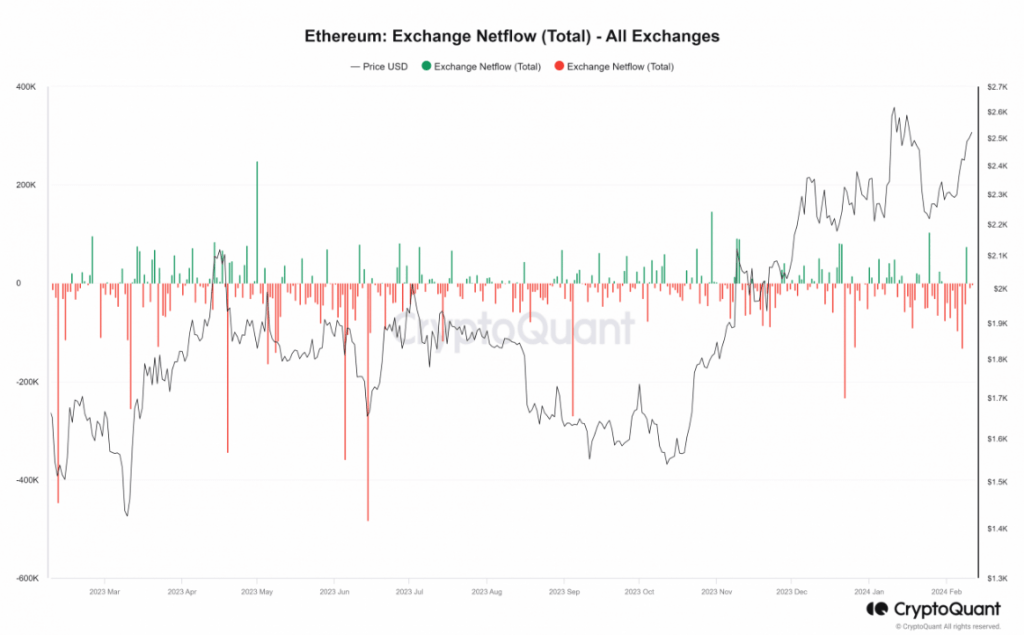

According to an analysis of the Netflow metric on CryptoQuant conducted by NewsBTC, there has been a continued outflow of ETH from exchanges. In fact, more than 9,800 ETH left the exchanges at the end of trade on February 10th. However, it is worth noting that the previous day witnessed a significant inflow of over 75,000 ETH.

In the midst of these market movements, Ethereum’s price has been on an upward trajectory over the past three days. As of the time of this report, ETH is trading at over $2,500, indicating a strong positive trend.

Ethereum Bulls Gain Momentum: $3,000 Milestone?

The Short Moving Average and Relative Strength Index (RSI) further validate this bullish sentiment. The RSI has crossed the 60 mark and is moving towards the overbought zone, while the price remains above the yellow line, acting as a support level.

Furthermore, Ethereum has been making waves in the crypto world, surpassing even Bitcoin and signaling a robust bullish trend. All eyes are now on ETH, with growing expectations that it may soon hit the $3,000 milestone.

Speculation is also building about a potential climb to $5,000, with rumors circulating about an upcoming upgrade referred to as “Dencun” next week. However, it is important to note that information regarding this specific upgrade is limited, and further research is required to verify its impact on Ethereum’s potential price surge.

As the market eagerly anticipates the future trajectory of Ethereum, investors and enthusiasts are advised to exercise caution and stay informed. Tracking official Ethereum community channels, developer blogs, and reputable cryptocurrency news sources will provide valuable insights into the latest developments and upgrades affecting ETH’s price movements.

Wilcke’s recent deposit, combined with Ethereum’s positive trend and the anticipation surrounding the rumored Dencun upgrade, has created an atmosphere of excitement and speculation within the cryptocurrency market. With ETH surpassing Bitcoin and eyeing new all-time highs, the future of Ethereum holds immense potential for investors and traders alike.

Featured image from Adobe Stock, chart from TradingView