The US government is preparing to bring sweeping anti-money laundering powers from the PATRIOT Act into the crypto sector, in a move that could reshape the boundaries of privacy, compliance, and innovation. According to reporting by The Rage, the Treasury Department is seeking to apply Section 311 of the USA PATRIOT Act—often described as one of the most far-reaching financial surveillance tools—to cryptocurrency activities such as mixers, DeFi protocols, and certain wallet services.

At the center of the initiative is the Financial Crimes Enforcement Network (FinCEN), which is drafting a rule that would formally classify crypto mixing services as a “primary money laundering concern.” Such a designation would give the US Treasury the authority to effectively cut off these services from the US financial system by prohibiting banks, exchanges, and payment processors from transacting with them.

US Revives War On Crypto Privacy

The Rage report notes that this new rule is expected to mirror and expand on the 2022 “mixer rule” FinCEN floated after the sanctioning of Tornado Cash, but with much broader implications. In practice, Section 311 powers allow Treasury to not only blacklist specific entities, but also to ban entire categories of transactions deemed high risk. As the report states: “FinCEN’s proposal would extend the extraordinary powers of the PATRIOT Act into digital assets, placing mixers, DeFi protocols, and even wallet providers squarely in the government’s crosshairs.”

Francis Pouliot, the founder and CEO of Bull Bitcoin, commented via X: “US BUREAUCRATS ATTACK ON BITCOIN USERS PRIVACY. […] The Orwellian scenario may not come to pass entirely, but it’s a signal: if we let them, they will establish that any use of Bitcoin except tracked custodial wallets is ‘suspicious’”.

Lawmakers are also aligning with the Treasury’s push. A group in the House has reintroduced the “Special Measures to Combat Money Laundering Act,” a bill designed to codify Treasury’s use of Section 311 in the context of cryptocurrencies. By placing statutory weight behind this approach, Congress could significantly expand the executive branch’s latitude to act against privacy-focused crypto tools without requiring case-by-case legislative approval.

The implications extend beyond mixers. Observers warn that if Treasury asserts that certain smart contracts or decentralized protocols facilitate illicit finance, those platforms could be designated under Section 311. This would force US intermediaries to block interactions with them, effectively walling them off from the regulated economy.

One policy expert quoted in the report cautioned: “This is not just about Tornado Cash. Once these powers are formally extended, any DeFi protocol that Treasury views as a conduit for money laundering could be placed on the list. That changes the risk calculus for the entire sector.”

Industry reaction is expected to be fierce. Crypto advocates argue that the indiscriminate use of Section 311 would trample due process and innovation by treating open-source code as criminal infrastructure. Civil liberties groups have already challenged the Treasury’s prior actions against mixers, warning that blanket bans erode the constitutional rights of developers and users alike. Exchanges and custodians could face heightened regulatory risk and costs as they adapt to an expanded surveillance perimeter.

The move comes as the US intensifies its focus on financial flows linked to sanctioned entities, cybercriminals, and foreign adversaries. Treasury has repeatedly cited the use of crypto mixing services by North Korean hacking groups, Russian darknet markets, and ransomware operators. Officials argue that without new powers, law enforcement will struggle to prevent digital assets from undermining the integrity of the global financial system.

Whether the proposed rule survives legal and political challenges remains uncertain. The Tornado Cash sanctions are still the subject of ongoing litigation, and expanding PATRIOT Act measures into the decentralized ecosystem is expected to spark fresh constitutional battles. Still, the trajectory is clear: Washington is signaling that the era of light-touch oversight over crypto privacy tools is ending.

As the report concludes: “The PATRIOT Act has long been the government’s nuclear option in financial surveillance. By turning it toward crypto, the Treasury is making clear that no corner of the digital asset industry is beyond its reach.”

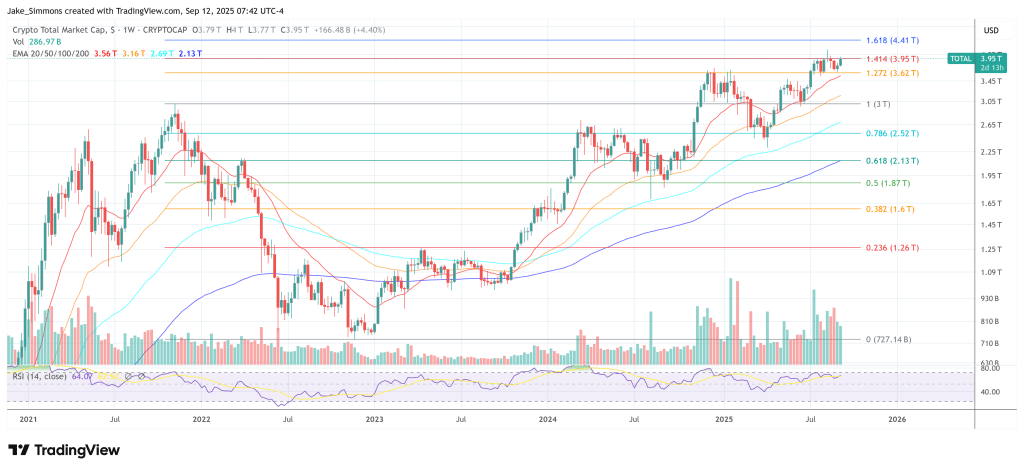

At press time, the total crypto market cap stood at $3.95 trillion.