The crypto sector continues to exhibit strong growth and resilience, as evidenced by the consistent influx of venture capital (VC), surpassing the $1 billion mark for the second consecutive month.

This sustained flow of investment highlights the market’s ongoing expansion and the increasing confidence of investors in the potential of blockchain technologies and digital assets.

Investment Trends and Sector Highlights in April’s Crypto Funding

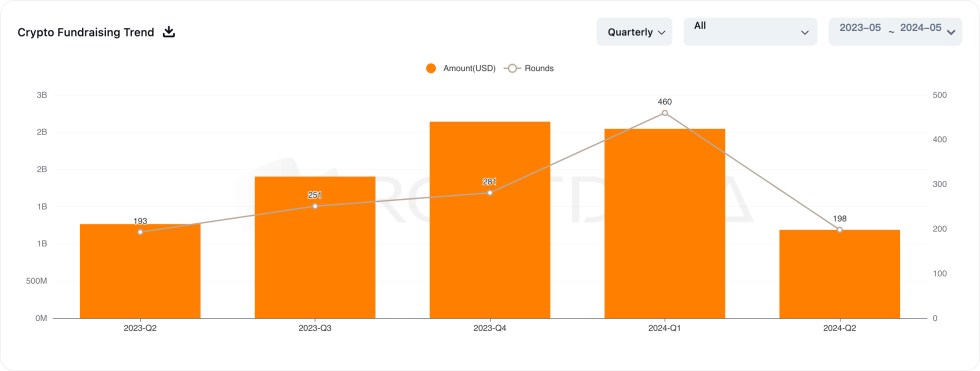

In April alone, the crypto sector saw $1.02 billion raised across 161 investment rounds, closely following the $1.09 billion from 186 deals in March. These figures maintain momentum since the latter part of 2022, suggesting a stable and growing interest in the crypto space.

Significant contributions to this total include notable investments in various blockchain-related ventures. For instance, Securitize, a platform specializing in tokenizing real-world assets, secured a $47 million investment led by BlackRock.

Meanwhile, Monad, often called the “Solana killer,” attracted a substantial $225 million from Paradigm and Coinbase Ventures.

Other significant fundraises include Auradine and Berachain, which received $80 million and $100 million, respectively. These raises demonstrate the wide array of sectors within the crypto market, drawing investor interest.

Notably, investment trends within the digital currency market show a clear preference for certain sectors. Blockchain infrastructure firms have emerged as the top recipients of VC funding, amassing $1.7 billion in 2024.

This sector’s attractiveness is likely due to its foundational role in supporting the broader digital currency ecosystem’s functionality and scalability.

Following closely are decentralized finance (DeFi) protocols, which have garnered $626 million, underscoring their pivotal role in reshaping financial services through blockchain technology. Additionally, decentralized autonomous organizations (DAOs) received a relatively modest $3 million.

Major VC Firms Next Move

According to the report, leading venture capital firms Pantera Capital and Paradigm are vigorously seeking substantial funds for fresh digital currency ventures.

Pantera Capital aims to secure $1 billion, potentially setting a record for the largest crypto fund raised since May 2022.

In contrast, having gathered $7.2 billion for multiple technology sectors, Andreessen Horowitz has decided against increasing investments in its dedicated cryptocurrency fund, demonstrating a selective strategy in its financial commitments to the digital asset landscape.

Speaking of major VC firms, Vance Spencer, co-founder of Framework Ventures, recently shared his perspective on the cryptocurrency market. Despite maintaining a bullish outlook on crypto, Spencer anticipates a turbulent two years ahead. The co-founder of Framework Ventures advised:

You should be prepared for at least 24 months of roller coaster crypto as we cut rates from 5.5% back to 2-3%.

Featured image from Unsplash, Chart from TradingView