Crypto-related investment products saw significant inflows last week, totaling $1.84 billion—this year’s second-largest weekly inflows—according to CoinShares’ latest weekly report.

This significant inflow was also matched by a record trading volume of more than $30 billion during the same period, which at times represented 50% of global Bitcoin daily trading volumes on trusted exchanges.

James Butterfill, CoinShares head of research, added:

“The total assets under management [of crypto ETPs], after recent price rises, are now very close to the all-time high at $82.6 billion, just shy of the $86 billion peak set in early November 2021.”

US dominance continues

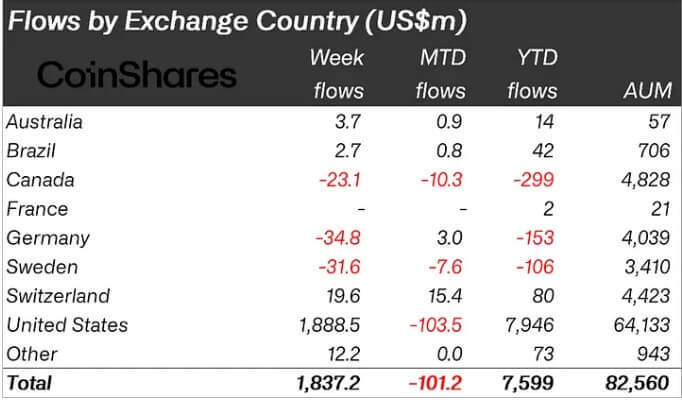

The United States maintains its dominance in crypto investment product flows, continuing to be buoyed by the introduction of Bitcoin ETFs, with the majority of digital asset net inflows reported last week at $1.88 billion.

While the US leads the charge, global responses vary. Switzerland recorded $20 million in inflows, contrasting with outflows from Sweden, Germany, and Canada, amounting to $32 million, $35 million, and $23 million, respectively.

Bitcoin products remain at the forefront across assets, witnessing an inflow of $1.72 billion, representing 94% of total inflows recorded last week.

Notably, CryptoSlate Insight reported that Bitcoin held in global ETPs crossed the one million mark. These ETPs have experienced a significant inflow of 133,000 BTC during the past 90 days, primarily attributed to the success of US spot Bitcoin ETFs.

On the other, investors betting against Bitcoin’s upward price movement allocated $22 million to short-related investment products despite the ongoing market rally.

Ethereum experienced substantial inflows amidst the crypto market surge in tandem with Bitcoin. Ethereum products saw inflows totaling $85 million last week, marking their most significant weekly influx since mid-July 2022. Despite this, ETH products AuM stand at $14.6 billion, down from the peak of $23.7 billion.

Similarly, Polygon, XRP, and Chainlink witnessed inflows totaling $7.6 million, $2.5 million, and $1.6 million, respectively. However, Solana continues its third consecutive week of outflows, totaling $12 million.

The post Crypto investment products near all-time high with $1.84 billion weekly net inflow appeared first on CryptoSlate.