Crypto markets head into this week’s Federal Reserve meeting focused less on rate cut and more on whether Jerome Powell quietly declares the start of quantitative easing (QE). The key question on Wednesday for macro-sensitive traders is whether the Fed shifts into a bill-heavy “reserve management” regime that starts rebuilding dollar liquidity, even if it refuses to call it QE.

Futures markets suggest the rate decision itself is largely a foregone conclusion. According to the CME FedWatch Tool, traders are assigning roughly 87.2% odds to a 0.25 percentage point cut, underscoring that the real uncertainty is not about the size of the move, but about what the Fed signals on reserves, T-bill purchases and the future path of its balance sheet.

Former New York Fed repo specialist and current Bank of America strategist Mark Cabana has become the focal point of that debate. His latest client note argues that Powell is poised to announce a program of roughly 45 billion dollars in monthly Treasury bill purchases. For Cabana, the rate move is secondary; the balance-sheet pivot is the real event.

Cabana’s argument is rooted in the Fed’s own “ample reserves” framework. After years of QT, he contends that bank reserves are skirting the bottom of the comfortable range. Bill purchases would be presented as technical “reserve management” to keep funding markets orderly and repo rates anchored, but in practice they would mark a turn from draining to refilling the system. That is why many in crypto describe the prospective move as “stealth QE,” even though the Fed would frame it as plumbing.

What This Means For The Crypto Market

James E. Thorne, Chief Market Strategist at Wellington Altus, sharpened the point in X post. “Will Powell surprise on Wednesday?” he asked, before posing the question that has been echoing across macro desks: “Is Powell about to admit on Wednesday that the Fed has drained the system too far and now has to start refilling the bathtub?” Thorne argues that this FOMC “is not just about another token rate cut; it is about whether Powell is forced to roll out a standing schedule of bill-heavy ‘reserve management’ operations precisely because the Fed has yanked too much liquidity out of the plumbing.”

Thorne ties that directly to New York Fed commentary on funding markets and reserve adequacy. In his reading, “By Powell’s own framework, QT is done, reserves are skirting the bottom of the ‘ample’ range bordering on being too tight, and any new bill buying will be dressed up as a technical tweak rather than a confession of error, even though it will plainly rebuild reserves and patch the funding stress that the Fed’s own over-tightening has triggered.” That framing goes to the heart of what crypto traders care about: the direction of net liquidity rather than the official label.

Macro analysts followed closely by digital-asset investors are already mapping the next phase. Milk Road Macro on X has argued that QE returns in 2026, potentially as early as the first quarter, but in a much weaker form than the crisis-era programs.

They point to expectations of roughly 20 billion dollars a month in balance-sheet growth, “tiny compared to the 800bn per month in 2020,” and stress that the Fed “will be buying treasury bills, not treasury coupons.” Their distinction is blunt: “Buying treasury coupons = real QE. Buying treasury bills = slow QE.” The takeaway, in their words, is that “the overall direct effect on risk asset markets from this QE will be minimal.”

That distinction explains the tension now gripping crypto markets. A bill-only, slow-paced program aimed at stabilizing short-term funding is very different from the broad-based coupon buying that previously compressed long-term yields and turbo-charged the hunt for yield across risk assets. Yet even a modest, technically framed program would mark a clear return to balance-sheet expansion.

For Bitcoin and the broader crypto market, the immediate impact will depend less on Wednesday’s basis-point move and more on Powell’s language around reserves, Treasury bill purchases and future “reserve management” operations. If the Fed signals that QE is effectively starting and the bathtub is starting to be refilled, the liquidity backdrop that crypto trades against in 2026 may already be taking shape this week.

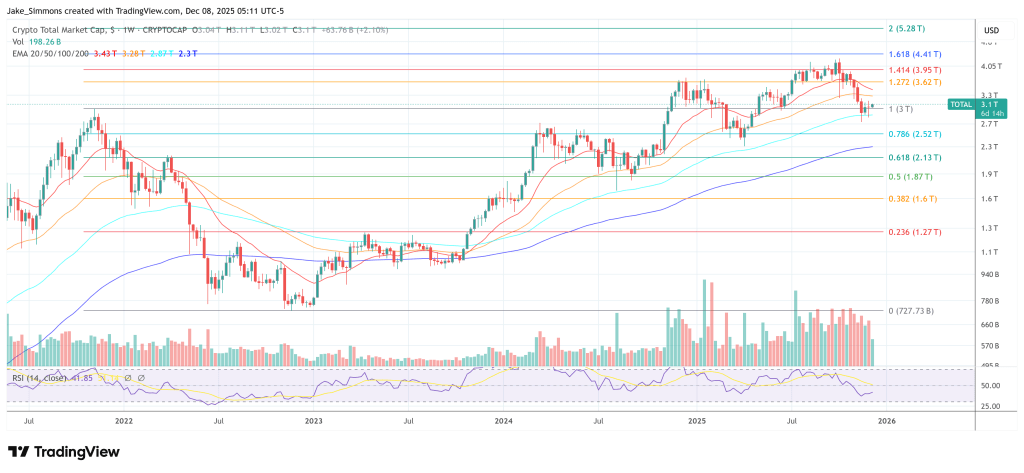

At press time, the total crypto market cap was at $3.1 trillion.